Vietnam boosts private sector with financial and tax incentives

According to Brian Lee Shun Rong, an economist from Maybank Group, Vietnam is rolling out a series of ambitious policy reforms to accelerate the growth of its private sector, with a particular focus on small and medium-sized enterprises (SMEs) and household businesses.

These reforms aim to help the country escape the middle-income trap and foster stronger, more sustainable economic growth.

Resolution 68-NQ/TW, the latest directive guiding national policy, outlines a comprehensive set of financial, tax, and institutional measures to expand the SME sector and formalize millions of informal household businesses.

Cutting Taxes, Expanding Credit Access for SMEs

One major bottleneck in Vietnam’s FDI-driven growth model is the shallow integration of domestic firms into global supply chains. Most foreign-invested firms focus on downstream assembly, with limited participation from local suppliers. Many domestic companies are too small or lack the capacity to meet multinational quality standards.

Resolution 68 introduces a wide range of tax incentives, including a three-year corporate income tax (CIT) exemption for newly registered SMEs. Innovative startups and venture funds receive full CIT exemptions for two years and a 50% reduction for the following four years.

The revised Corporate Income Tax Law (July 2025) applies preferential rates of 15% for companies with annual revenue under VND 3 billion and 17% for those between VND 3–50 billion, compared to the standard 20% rate.

Additionally, professionals working in startups and R&D centers will receive full personal income tax (PIT) exemptions for two years and 50% reductions for the next four years. High-tech firms and innovative startups are also entitled to at least a 30% discount on land lease fees in industrial parks, clusters, and incubators.

From January 2026, Vietnam will abolish the annual business license tax (ranging from VND 1 to 3 million), removing another burden on micro and small enterprises.

To address land and credit access—two major hurdles for SMEs—the resolution mandates that new industrial zones established after May 17, 2025, reserve at least 20 hectares or 5% of their land for SMEs and startups. Banks are encouraged to accept intangible assets (such as brand value and intellectual property) as collateral and to expand unsecured credit based on e-invoicing and tax filings.

Currently, SMEs rely on three main credit channels: the SME Development Fund, Credit Guarantee Fund, and commercial bank lending. However, strict requirements on financial health and hard asset collateral limit access.

Banks such as BIDV, Techcombank, and MB Bank have launched rapid, flexible loan solutions through the MISA Lending platform. SMEs using MISA accounting software can apply for loans via an automated system that compiles financial data from the past three years, utilizes AI-based credit scoring, and completes approvals efficiently. New businesses also benefit from waived membership fees during the first 12 months.

Promoting Technology Transfer from FDI to Domestic Firms

The government is also pushing for stronger technology transfer from foreign investors to local partners. Finance Minister Nguyen Van Thang recently indicated that future investment incentives may require technology-sharing commitments, workforce training, and collaboration with local supply chains.

The Ministry of Finance is drafting regulations to establish specialized industrial zones aimed at deepening local technical capacity and fostering spillover benefits. This may include industrial clusters in priority sectors like AI, where foreign multinationals and local suppliers are co-located to encourage close cooperation.

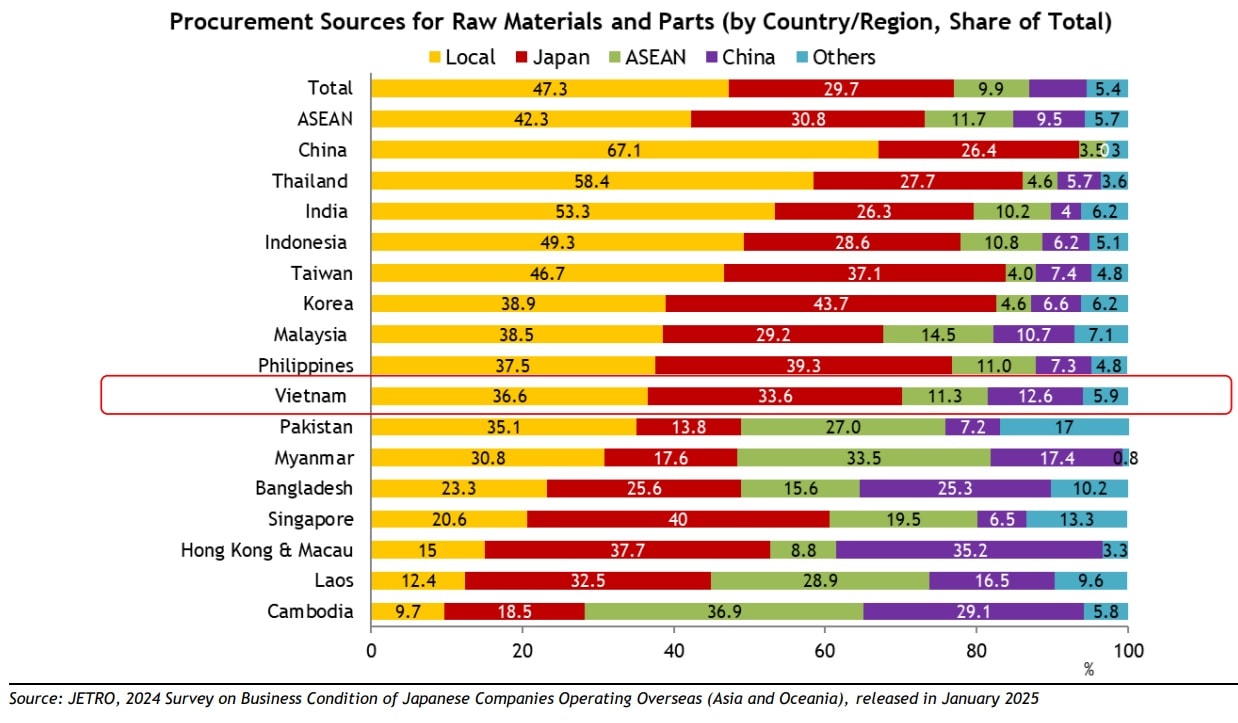

Despite these efforts, 43% of FDI firms currently lack staff training plans. Vietnam’s local procurement rate in manufacturing stood at 36.6% in 2024—below Malaysia (38.5%), Indonesia (49.3%), Thailand (58.4%), China (67.1%), and India (53.3%).

Vietnam has around 5.2 million household businesses—over five times the number of registered private enterprises. Yet, despite their size, they contribute just 22% of GDP, compared to 28% from the formal private sector. These businesses typically employ fewer than five workers and face constraints in capital spending and technology adoption.

As of June 1, 2025, the fixed tax regime (flat-rate tax) has been abolished for households earning over VND 1 billion annually. Businesses in retail, food and beverage, transport, and entertainment must now issue e-invoices via cash registers connected to the tax authorities. The flat-rate tax system will be fully phased out by January 1, 2026, and replaced with a revenue-based tax model to improve transparency and help newly formalized businesses scale up.

To incentivize the transition, the revised 2025 Corporate Income Tax Law grants a two-year CIT exemption and a 50% reduction for four more years to household businesses that successfully formalize. E-invoicing also improves credit profiles, making it easier for these firms to access formal bank loans.

Although initial compliance and equipment costs (e.g., cash registers) may weigh on earnings, the government is providing transitional support, including free shared accounting tools, subsidized e-invoice services, and software.

Early results are promising: over 1,500 household businesses converted to registered companies in the first half of 2025, with 910 conversions in June alone. By June 30, more than 47,000 household businesses had adopted e-invoicing—exceeding the government’s 37,000 target by 125%.