Abundant liquidity and stable deposit rates will support lending rate cuts

Short-term deposit interest rates, with a slight upward trend, may be reined in to remain stable in the near future, amid continued capital flows pushing liquidity into the market.

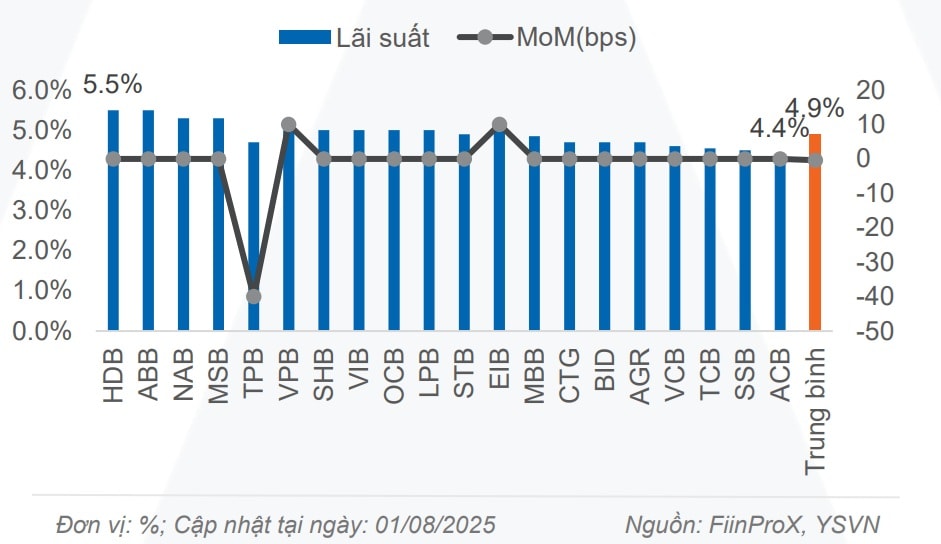

12-month personal deposit interest rates at several commercial banks

To ensure that deposit rates do not have strong momentum to rise, banks must maintain ample liquidity and be ready for a period of credit acceleration, especially among the 23 commercial banks recently granted higher credit growth limits by the State Bank of Vietnam (SBV).

Last week, the SBV continued to suspend the issuance of treasury bills and also reduced operations via the open market operations (OMO) channel, as system liquidity returned after several weeks of shortage, according to a monetary report from Yuanta Securities Vietnam (YSVN).

By week’s end, only around VND 68.8 trillion (-69.4% WoW) was issued via reverse repo operations at a 4% interest rate, focused on 14-day (VND 33.5 trillion), 7-day (VND 18.2 trillion), and 28-day (VND 15.7 trillion) tenors.

Additionally, about VND 70.6 trillion matured from the reverse repo channel and was withdrawn from the system. As a result, the SBV conducted a net withdrawal of nearly VND 1.8 trillion from the banking system after five consecutive weeks of net injection. Outstanding value in the reverse repo channel fell to VND 209.1 trillion by the end of the week.

“System liquidity has cooled again after several weeks of stress. Interbank interest rates declined sharply from Monday through Thursday and rebounded on Friday. By the end of the week, the overnight rate dropped 114 basis points (bps) to 5.36%, 1-week dropped 112 bps to 5.35%, 2-week dropped 138 bps to 5.07%, 1-month dropped 88 bps to 4.51%, and 3-month dropped 11 bps to 5.46%. The VND-USD overnight interest rate spread narrowed to 97 bps,” said Mr. Nguyễn Thế Minh, Head of Personal Client Research at YSVN.

The expert emphasized that, alongside the SBV’s decision on July 31 to raise credit growth quotas and the slight increases in deposit interest rates at some banks recently, this supports YSVN’s view that deposit rates could rise modestly in the second half of 2025, while lending rates are expected to remain low to support economic growth in line with the Prime Minister's directive.

This view aligns with the recent SBV directive urging credit institutions to implement measures to stabilize and strive to reduce deposit interest rates, contributing to monetary market stability and creating room to lower lending rates. This is part of the key tasks assigned to the banking sector in 2025 to stabilize the macroeconomy, control inflation, and achieve the growth target of 8% or more.

At the recent conference on solutions to stabilize deposit rates and reduce lending rates, chaired by Deputy Governor Phạm Thanh Hà, banks also expressed their commitment to maintaining stable deposit rates and striving to lower lending rates to support businesses and individuals in accessing credit at reasonable costs.

Mr. Phạm Toàn Vượng, General Director of the Vietnam Bank for Agriculture and Rural Development (Agribank), said that under the direction of the Government and SBV to support people and businesses in accessing credit and promoting economic growth, Agribank—as a state-owned commercial bank—has actively controlled and reduced input costs to create room for lowering lending rates to meet credit demand.

From the beginning of 2025, credit demand has remained high in pursuit of planned credit growth targets, keeping market liquidity demands elevated. However, Agribank did not increase deposit interest rates, and even reduced short-term deposit rates in April 2025. In the first 7 months of 2025, Agribank continued to restructure capital sources and control input interest rates to create room for lending rate cuts. As a result, its average lending rate as of July 31, 2025, decreased by 0.37% compared to the beginning of the year.

Agribank’s leadership also pledged to continue seriously implementing Government and SBV directives on stabilizing interest rates, creating favorable conditions for people and businesses to access bank capital to support production and economic growth. Mr. Vượng also proposed that the SBV continue to implement measures to control deposit interest rate levels to ensure a healthy competitive environment and enhance competitiveness in capital mobilization among state-owned banks, including Agribank.

Mr. Lê Ngọc Lâm, General Director of the Bank for Investment and Development of Vietnam (BIDV), noted that in the first 7 months of the year, BIDV reduced income by about VND 3 trillion to support lending rate reductions. The bank also adjusted its deposit interest rates downward.

The BIDV CEO suggested the SBV raise the borrowing limit via electronic channels from the current VND 100 million to a higher level to meet actual demand and reduce credit costs, thereby helping lower lending interest rates.

The risk management capacity, credit quality assurance, and rational capital allocation by commercial banks play a crucial role in maintaining medium-term interest rate stability. (Illustrative photo: Quốc Tuấn)

Mr. Lê Quang Vinh, General Director of Vietcombank, shared that the bank has fully complied with SBV directives on stabilizing deposit interest rates and has launched preferential credit packages. He also affirmed that the bank will continue maintaining reasonable deposit interest rates.

Vietcombank’s CEO also proposed that the SBV consider lowering the deposit rate ceiling to help banks secure lower capital costs, thereby supporting businesses. He also recommended increasing the ratio of Treasury deposits counted as short-term capital sources, helping banks boost their credit supply to the economy.

In the first half of 2025, credit institutions actively supported businesses and individuals in recovery and production development by reducing interest rate levels and launching numerous lending rate reduction programs. According to Mr. Phạm Chí Quang, Head of the SBV’s Monetary Policy Department, listed deposit rates at commercial banks have remained stable since the end of 2024. As of July 20, 2025, the average deposit rate for new transactions stood at 4.18% per annum, stable compared to the end of 2024; while the average lending rate for new transactions was 6.53% per annum, down by about 0.4% from end-2024.

Abundant liquidity, together with the SBV's flexible management of capital for banks—particularly smaller ones with greater capital mobilisation costs—and the banks' collective commitment, pave the way for deposit rates to stay steady throughout the remainder of 2025. As a result of the requirement for monthly average rate disclosures, loan rates may remain low, even falling even further, and competitive pricing may emerge, providing borrowers with access to more inexpensive rates. Furthermore, if the US Federal Reserve decreases interest rates in September as predicted, it will relieve exchange rate pressures and boost Vietnam's monetary easing measures.

However, some experts believe that even if the Fed does cut rates, it may not significantly impact domestic interest rate trends. The key lies in the regulatory role of the SBV, the credit institutions' efforts in capital injection, maintaining credit quality, effective risk management, and reasonable capital allocation—together with effective coordination of fiscal and public investment policies—as the foundation for maintaining stable interest rates that support positive growth.