Re-rating opportunity for leading bank stocks

The current valuation of the banking sector does not fully reflect the long-term economic growth prospects, potential improvement in asset quality, and the anticipated upgrade of Vietnam’s stock market.

The current sector valuation still does not fully reflect long-term economic growth potential, asset quality improvement, and Vietnam’s market upgrade prospects.

This is the view of analysts at Rong Viet Securities (VDSC), who assessed the potential of bank stocks— a group that has reclaimed its “king” status and contributed significantly to the recent historic peak of Vietnam’s stock market after 25 years of development.

Opportunity from Bad Debt Resolution

Although the market is undergoing a correction after the unprecedented distribution session on July 29, banking stocks still hold promising potential, according to experts.

With the government and the State Bank of Vietnam continuing to prioritize economic growth, current monetary policy is leaning toward selective easing, focusing on priority sectors and supporting recovery. This creates favorable conditions for credit expansion—a core driver in Vietnam’s current growth model.

Additionally, the credit quota allocation mechanism has become more flexible, based on each bank’s risk management and capital efficiency. Therefore, in the upcoming growth cycle, banks with strong capital buffers, higher risk appetite, cost advantages, technological capabilities, and diversified ecosystems are expected to take the lead, gaining competitive edges and attracting capital inflows, VDSC noted.

The recently revised Law on Credit Institutions, which officially “legalizes” Resolution 42, is seen as a legal breakthrough to address bad debt bottlenecks.

According to VDSC, bad debt—once a major hindrance to credit growth—is being brought under control and effectively resolved, thus creating favorable conditions for recovery. Low interest rates are helping improve debt repayment capacity for both businesses and retail investors. Meanwhile, a gradually recovering real estate market—traditionally a large share of total loans—is easing pressure on banks.

On the legal front, the regulatory framework for bad debt resolution is also being strengthened. Resolution 68 and the upcoming legalization of asset seizure mechanisms from Resolution 42 are expected to be key legal drivers, improving debt recovery efficiency starting 2026. Once bad debt pressure eases, banks’ financial strength will recover, paving the way for credit growth and improved profit margins in the second half of 2025.

As bad debt risks subside, banks with stable asset quality, sound risk management, and proactive debt resolution strategies will lead the credit recovery cycle. These banks are also expected to post strong profit growth in the second half of the year. VDSC highlights VPB, MBB, VIB, and OCB as promising candidates.

Attractive Valuations

The current sector valuation still does not fully reflect long-term economic growth potential, asset quality improvement, and Vietnam’s market upgrade prospects.

Specifically, the sector’s average P/B ratio remains around 1.5x—relatively low over the past three years—despite improvements in operational efficiency and risk management.

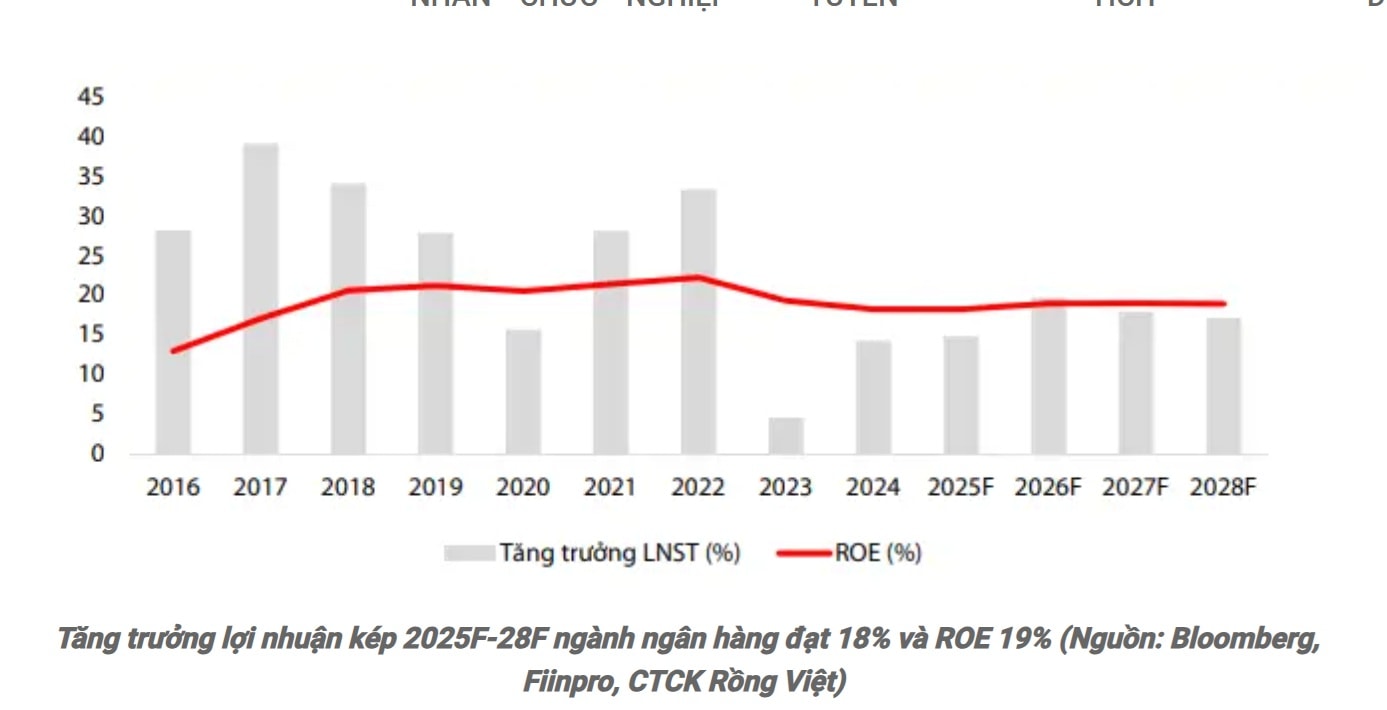

During the 2016–2019 growth cycle, the banking sector posted a compound annual growth rate (CAGR) of 36% in profits, reduced on-book NPLs (including VAMC bonds) from 4.8% to 2.6%, and traded at a P/B range of 1.6x–1.9x.

Given a positive mid-term economic outlook, profits, ROE, and asset quality are expected to see structural improvements, allowing valuations to return to the 1.7x–1.8x range in the new growth cycle, according to VDSC.

Moreover, one factor increasingly mentioned in outlooks across all sectors is the potential upgrade of Vietnam’s stock market—an important catalyst. For banking stocks in particular, this is even more significant due to their heavy weightings in indices like FTSE and available room for increased foreign ownership. Stocks like VCB and VPB could become “strategic targets” for international capital as Vietnam nears an upgrade.

Bank Earnings Updates

Several banks have released Q2 and H1/2025 earnings. MBBank (MBB) impressed with Q2 pre-tax profit of VND 7,503 billion, down 1.7% YoY, but H1 profit hit nearly VND 15,900 billion, up 18.3% YoY—surpassing BIDV and leading among banks reporting so far.

BIDV (BID) reported outstanding loans of VND 2.14 quadrillion (6.1% YTD), deposits at VND 2.29 quadrillion (7.2%), and service revenue of VND 2,802 billion. Pre-tax profit reached VND 15,200 billion, achieving 46% of its annual target.

ACB posted Q2 pre-tax profit of VND 6,100 billion, up 33% QoQ, mainly due to a 68% increase in non-interest income and 26% drop in provisioning. H1 profit reached VND 10,700 billion (2% YoY).

VIB’s H1 total operating income exceeded VND 9,700 billion, with pre-tax profit over VND 5,000 billion (9% YoY). Asset quality improved, with NPLs down to 2.54%, 0.14 percentage points lower than Q1.

VPBank (VPB) ended H1 as the largest private bank by assets, exceeding VND 1.1 quadrillion. Consolidated pre-tax profit reached VND 11,229 billion (30% YoY), with Q2 profit alone at VND 6,215 billion.

Techcombank (TCB) surpassed VND 1 quadrillion in assets (6% YTD), with H1 pre-tax profit at VND 15,135 billion.

BVBank (BVB) posted total income over VND 1,200 billion, with net interest income near VND 1,150 billion (12% YoY). H1 pre-tax profit was VND 93 billion.

LPBank reported H1 pre-tax profit of VND 6,164 billion (4.1% YoY)—its highest 6-month figure to date. Q2 profit declined 1.5% YoY.

PGBank’s Q2 pre-tax profit reached VND 188 billion (98.3% YoY), with H1 profit at VND 284 billion (35% YoY).

VietA Bank (VAB) recorded H1 pre-tax profit of VND 714 billion (27% YoY), achieving over 55% of its 2025 target.

TPBank (TPB) estimated H1 pre-tax profit above VND 4,100 billion (12% YoY).

NCB (NVB) posted strong results: Q2 after-tax profit estimated at VND 311 billion; H1 profit reached VND 462 billion—77 times higher than H1/2024.

Nam A Bank (NAB) reported H1 pre-tax profit of over VND 2,500 billion (14% YoY).

On UPCoM, Kienlongbank (KLB) attracted attention with a 60% dividend and Q2 profit of VND 565 billion (67.2% YoY)—its highest quarterly profit since Q1/2021. H1 profit totaled VND 921 billion (67% YoY), meeting 67% of its 2025 plan.

Eximbank (EIB) posted H1 pre-tax profit of VND 1,488.5 billion (0.97% YoY), with Q2 profit at VND 656.9 billion.

Among the Big 4, VietinBank (CTG) reported 10% loan growth and 9% deposit growth YTD. Pre-provision profit grew YoY.

Vietcombank (VCB) estimated total assets above VND 2.1 quadrillion (1.8% YTD), with credit growth over 5.0% YTD. Credit structure continued shifting toward higher quality and sustainability.

Agribank, the wholly state-owned bank, reported the highest H1 performance since its 2021–2025 restructuring plan began. Total deposits surpassed VND 2.1 quadrillion (6.4% YTD), with rural lending accounting for 61% of total loans. Total outstanding credit reached over VND 1.85 quadrillion (7.6% YTD).

CEO Pham Toan Vuong noted that agricultural lending alone exceeded VND 1.13 quadrillion.