FED scales back its rate hike, gold price will break out?

In a speech, Fed Chairman Jerome Powell declared that the central bank would "slow the pace" of rate hike. Will this lead to an increase in gold prices the following week?

FED may scale back its rate hike at the upcoming meetings

>> Gold prices need a new catalyst from the FED

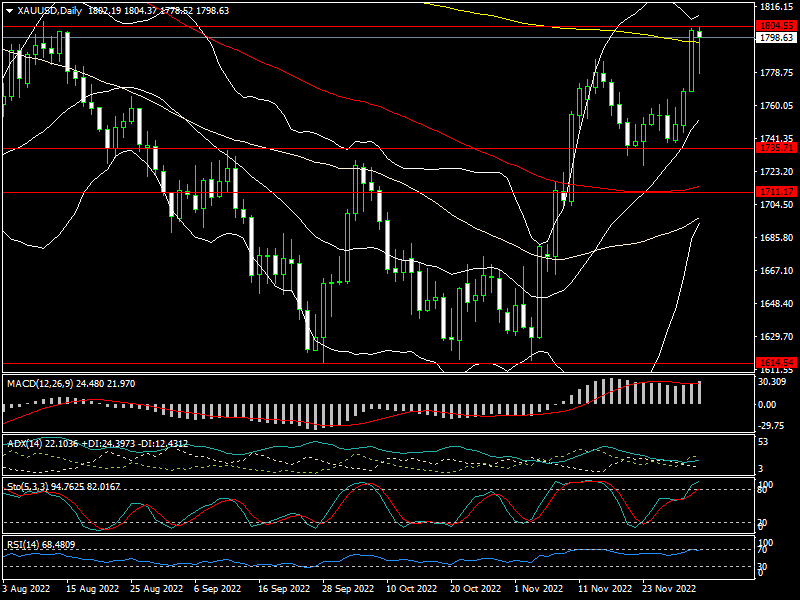

The gold price increased this week, from 1,739 USD/oz to 1,804 USD/oz before closing at 1,798 USD/oz.

SJC gold bars price posted by DOJI has increased from 67.1 million dong per tael to 67.6 million dong per tael on the Vietnamese gold market.

This week's sharp rise in gold prices was caused by the market's persistent expectation that the FED will scale back its rate hike at its upcoming meetings. And this week, Fed Chairman Powell stated that the Fed will probably pull back its rate hikes from this December meeting at a conference at the Brookings Institution in Washington, DC.

Notably, the US added 263,000 jobs in November. Despite being the lowest number since December 2020, it is still significantly higher than the predicted 200,000 jobs. While the unemployment rate is only 3.7%, the US jobs report for November revealed that the labor market remained tight, in part as a result of the FED raising interest rates too quickly and sharply.

Mr. Will Rhind, founder and CEO of GraniteShares, said the US unemployment rate is still low, at 3.7%, but the US economy has weakened, and rate hike will cause an economic slump.

"Once those layoffs actually commence, we're going to experience a real recession, which is most likely to occur somewhere in the following year. Because consumption accounts for 70% of US GDP, as unemployment rises, consumption would decline significantly, putting a detrimental effect on US economic growth”, said Mr. Will Rhind.

>> Gold prices will be subdued by bets on more FED rate hikes

There is an 80% likelihood, per the CME Fed Watch Tool, that the Fed will only increase interest rates by 50 basis points by the end of this month, as opposed to the 75 basis points that it has in the past. The market still anticipates that the Fed will increase interest rates to between 5% and 5.25% before ending the current cycle of monetary tightening. As a result, neither the USD nor the yields on US government bonds have been able to drop significantly, even after each rate increase by the Fed.

Gold prices may continue uptrend next week

The aforementioned anticipation can have a short-term negative effect on gold prices. This is another factor keeping many individuals from actively investing in the gold market.

However, a lot of experts think that the US economy in particular and the world economy in general are not in a recession when the Fed slows the rate of interest rate increase to stop the cycle of monetary tightening. various problems and difficulties. Gold has traditionally been a safe-haven asset in the context of a volatile global economy. As a result, investors should buy long-term investments during price corrections of gold below $1,700/oz, preferably near $1,600/oz.

According to Mr. Colin, a freelance FX specialist, the price of gold could still rise the following week if it decisively crosses 1,805 USD/oz. As a result, the price of gold may reach 1,847–1,878 USD/oz next week. However, the short-term increase in the price of gold must be handled carefully because many investors still do not really anticipate a significant increase in the price of gold in the near future, and they may sell off to take profits at the price range above 1,800 USD/oz.