Gold prices need a new catalyst from the FED

Investors are still hesitant to enter the market, despite the FED's indication that it may slow the rate of rate increases in December.

SJC gold bar prices increased in the Vietnamese gold market from VND 67,1 million per teal to VND 67,6 million per teal in this week.

>> Gold prices will be subdued by bets on more FED rate hikes

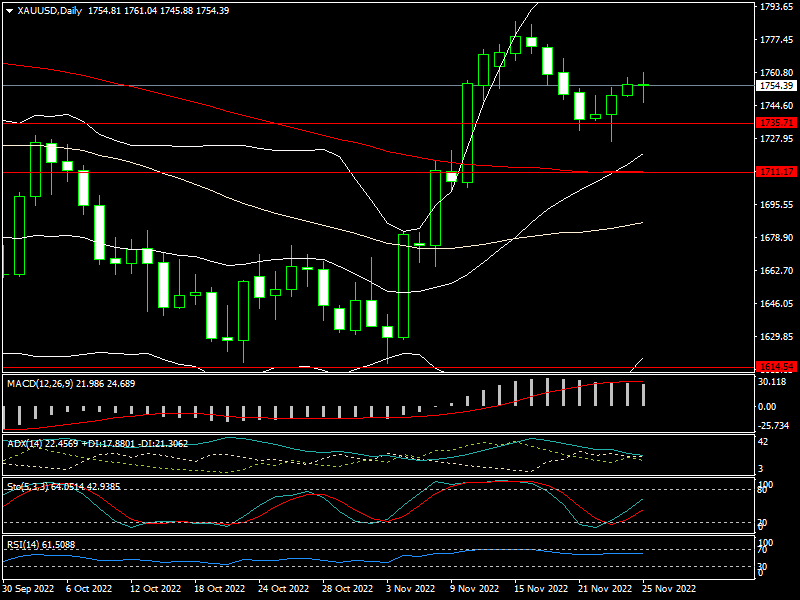

The price of gold increased this week on the international market to $1.761 per ounce after falling to $1,726 per ounce and closing at $1,754 per ounce.

SJC gold bar prices increased in the Vietnamese gold market from VND 67,1 million per teal to VND 67,6 million per teal despite little trading activity.

Mr. Nicholas Frappell, general manager at ABC Bullion, observed that the majority of the short covering, or speculators buying gold to cover their short transactions, that has been driving the gold rise since the beginning of the month. Investors are also not purchasing exchange-traded instruments that are backed by gold.

"In the futures or ETF space, new purchasers are not motivated "said he. "The Fed has also stated that rates will likely remain high for a longer period of time, which will benefit the USD and rates. Gold looks to have climbed on a slower road toward high and long rates", said Mr. Nicholas Frappell.

When he speaks next week at a gathering at the Brookings Institution in Washington, DC, Federal Reserve Chair Jerome Powell will have the opportunity to address the gold market directly.

Markets anticipate the FED to slow the rate hikes to 50 basis points next month, but some analysts claim it is still too early to predict a shift in the direction of the economy.

Gold prices will see a "catalyst" next week if Mr. Powell indicates in the next meetings that the pace of rate hikes would be slowed down. As a result, the price of gold may move toward 1,800 USD/oz the following week. But because the Fed has merely slowed down the rate climb, not halted boosting interest rates, investors must also be wary of the selling pressure at this price level. Therefore, an immediate substantial decline in USD bond yields is not possible.

>> Will gold prices rise on a slower FED tightening cycle?

Along with Powell's remarks, a busier week of economic data is anticipated to increase market volatility. According to economists, market expectations for the Federal Reserve's monetary policy may be impacted by the employment data released the following week.

Gold prices may continue sideway in the short term.

Powell has acknowledged that the labor market has been too tight and that before the Fed starts to ease back on its aggressive approach, it needs to see more slack.

Remember that the FED Chairman started to voice concerns about the labor market in recent remarks when the US unemployment rate started to rise again (the unemployment rate rose to 3.7% in October) and NFP gradually declined. Therefore, the Fed will be obliged to pause down the rate hike if the unemployment rate increases over 3.7% and the NFP is lower than anticipated (200,000 jobs). The gold price will benefit from this the next week.

Technical analysis predicts that the gold price will continue to move towards the $1,800/oz region if it stays over $1,711/oz (MA100) next week, especially when it crosses $1,798/oz (MA200). However, a dip below $1,700/oz is probable if gold prices fell below $1,711/oz the next week.