Gold prices will be subdued by bets on more FED rate hikes

This week, the FED has continued to raise interest rates, causing gold prices to decline even further.

The FED will hike rates by 0.75% this week since the US core inflation rate is still high and Q3 GDP growth was positive.

>> Will gold prices rise on a slower FED tightening cycle?

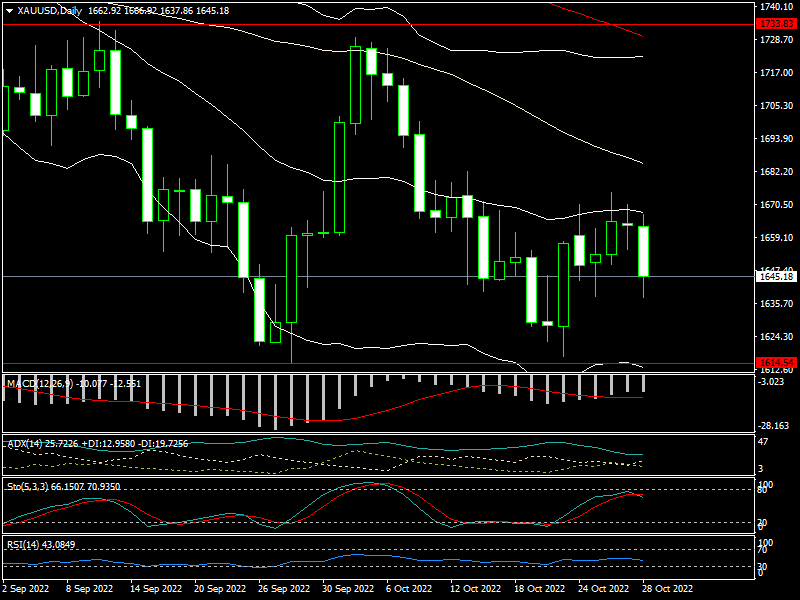

The price of gold on the world market increased from USD 1,638/oz to USD 1,674/oz at the start of this week, but it subsequently declined to USD 1,638/oz by the end of the week.

The price of SJC gold bars quoted by DOJI in the Vietnamese gold market decreased from 67.6 million dong per tael to 66.9 million dong per tael, with a relatively low trading volume.

Due to the US economy's recovery in the third quarter following two straight quarters of negative growth, gold prices fell back in the final two sessions of this week. As a result, after declining by 0.6% in the second quarter and 1.6% in the first, the US GDP climbed by 2.6% year over year in the third quarter.

The US GDP growth came in large part due to a narrowing trade deficit, which economists expected and consider to be a one-off occurrence that won’t be repeated in future quarters.

Consumer spending, nonresidential fixed investment, and government spending all saw rises in GDP. The study showed a continuing trend in consumer expenditure toward services as opposed to products, with services spending up 2.8% and goods spending declining 1.2%.

The FED will hike rates by 0.75% this week since the US core inflation rate is still high and Q3 GDP growth was positive. As a result, the Fed increased interest rates this year by 375 basis points, pushing them to 3.75%–4% this week.

Technical analysis indicates that a double bottom pattern at $1,614/oz is still in place in the near future.

At its most recent meeting, the Fed declared that interest rates would increase to 4.4% this year and 4.6% the following year. However, a lot of economists claim that there is no evidence that the Fed would stop raising rates before they reach 5%. In order to avoid "breaking" the US economic recovery, the Fed may scale back the rate hike after its meeting this week.

The Fed's decision to keep raising interest rates this week will still have a negative effect on gold prices, even though it has lately been priced in to gold prices.

>> Did gold prices bottom out?

The Fed rate hike this week, according to Mr. Colin, a foreign exchange expert, will have a negative effect on gold prices and cause them to continue falling. "The support levels for the gold price have gradually fallen to $1,614/oz. And so far, despite a stronger US currency and higher Treasury yields, that level has been maintained. However, there is a possibility of a dip below $1,600/oz, with $1,540/oz as important support, if gold prices fail to remain above $1,614/oz", said Mr. Colin.

Although the FED's repeated rate hikes are putting downward pressure on gold prices in the near term, in Mr. Colin’s opinion, gold prices will continue to rise over the long run because the FED is poised to raise interest rates to their maximum level while inflation is still high. For long-term gold investments, investors should take advantage of the short-term correction in the price of gold, particularly when it is between USD 1,540 and USD 1,600/oz.

Technical analysis indicates that a double bottom pattern at $1,614/oz is still in place in the near future. If the price of gold remains above this level, it will likely rebound back to the $1,675–1,700/oz region. However, the short-term downturn in gold prices will continue if this level is broken.