Will gold prices rise on a slower FED tightening cycle?

Following the Federal Reserve's meeting in November, the markets strengthened their bets on a slower tightening cycle, which helped gold mount a strong rally on Friday.

Fed might discuss the extent of upcoming rate hikes after its widely anticipated 75-basis-point increase in November

>> Did gold prices bottom out?

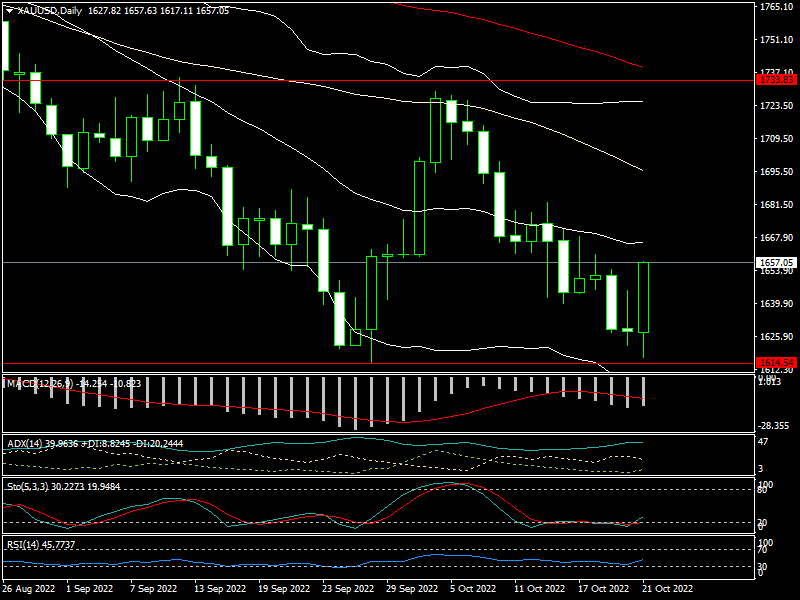

After falling to a fresh two-year bottom and nearly breaching the crucial support level of $1,620 earlier in the week, December gold futures recovered more than $20 on the day and last traded at $1,657.80 an ounce.

Low trading volume was observed in the Vietnam gold market as SJC gold bar prices ranged from 66,7 million dong to 67,2 million dong.

The Wall Street Journal's revelation that the Fed might discuss the extent of upcoming rate hikes after its widely anticipated 75-basis-point increase in November caused the market to reevaluate its expectations for rate hikes, which led to the price increase.

This article also discusses how some government representatives have started to indicate their "want both to cut down the pace of rises soon and to cease raising rates early next year to examine how their actions this year are affecting the economy." The aim to lessen the possibility of inducing an unnecessarily abrupt recession in the economy is what worries the Federal Reserve officials who are more on the dove side. It is too soon for these debates, according to those opposed to any shift in the Fed's current hawkish pace of rate hikes, because inflation is still very entrenched and persistent.

In addition, the FedWatch tool predicts a 46.3% chance that by the end of 2022, the Fed funds rate will be between 450 and 475 basis points. This is a significant departure from yesterday's forecast, which gave a likelihood of 75.4%. New conjecture among Federal Reserve officials about whether or not to start reducing the magnitude of the rate hike in December as well as hikes next year is what led to the significant shift in Fed Funds futures contract pricing over the previous 24 hours.

The possibility of witnessing the Fed argue whether or not to downshift into a slower pace of tightening, according to senior market analyst Edward Moya of OANDA, particularly intrigued investors.

>> Gold prices will rise sharply as FED’s tightening cycle could end sooner

"Markets were anticipating a 75 bps increase in November and a further 75 bps increase in December before Friday's news. Now, if the Fed does debate, it could easily defend a change of half a point in December instead. Additionally, Mr. Moya noted that the effects of the initial rate hikes may already be being felt by the American economy.

Gold prices will be impacted by the US third-quarter GDP, which is due on Thursday of next week

On worries of a worldwide economic recession, gold prices may go sideways in the short term but will rise over the long run.

How much turmoil there is in the world economy is demonstrated by the enormous uncertainty in the British bond market, which was followed by the Truss government's fall from power after just 44 days in office. In order to shield its economy from the unparalleled strength of the US dollar, the Bank of Japan has started to regularly intervene in currency markets.

Even some prominent experts have started to issue warnings about the impending danger of a severe recession. The United States could experience a recession before the end of the year, according to Mr. Nouriel Roubini, CEO of Roubini Macro Associate and professor at the NYU Stern School of Business. He forewarned investors that the globe might see a stagflationary debt crisis beyond anything we've ever seen in the upcoming ten years.

Consumers need to make investments in this environment that will shield them from inflation, geopolitical risk, and environmental harm. According to Mr. Roubini, these include short-term government bonds, inflation-indexed bonds, gold, other precious metals, and weather-resistant real estate.

The US third-quarter GDP, which are due on Thursday of next week, are of particular interest to gold speculators. After two quarters of contraction, 2.3% growth is anticipated according to market consensus calls.

"The GDP data is a significant unknown. After a run of two poor quarters, we are supposed to turn the corner. Numerous factors could make what occurs here more complicated. Currently, the risk is that the economy may have a breakdown, "Moya made a note.

Technically speaking, gold is still in a downtrend, and the downside risk is more pronounced. "Technically, we should maintain our position because prices might drop another 5% to $1,560 and subsequently to $1,470-80. Technically, that's how things are developing "Sean Lusk, co-director of Mr. Walsh Trading, told Kitco News that gold experienced a washout period of six months after reaching a top of more than $2,000 per ounce in March. When will it be over? How much is required before things start to stabilize?