Gold prices will rise sharply as FED’s tightening cycle could end sooner

The FED will likely stop raising rates earlier than expected, according to many analysts. This will raise gold prices.

SJC gold bar prices increased in Vietnam as well, going from VND 65.3 million per teal to VND 66.8 million per teal.

>> Did gold prices bottom out in the short term?

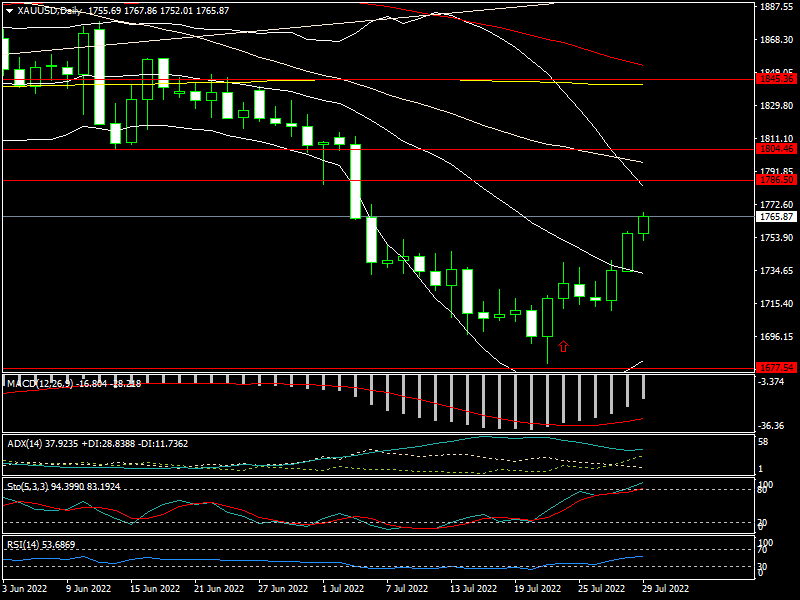

In response to the repricing of Federal Reserve rate hike expectations following the July FOMC meeting, gold increased to $1.767 per ounce and closed at $1,765 per ounce.

SJC gold bar prices increased in Vietnam as well, going from VND 65.3 million per teal to VND 66.8 million per teal. The price of SJC gold bar is VND 16 million more than the price of gold on the international market.

Fed Chair Jerome Powell predicted another excessively large super boost would be feasible in September after hiking rates by 75 basis points on Wednesday. However, everything is dependent on the most recent macrodata rounds. Additionally, there will be two rounds of employment and inflation data prints to consider prior to the September meeting.

Since the Fed is currently in neutral territory, the tightening cycle may soon come to an end as the Fed begins to scale down the rate hikes.

The U.S. second quarter GDP growth also decreased by 0.9 percent, marking the second consecutive quarter of decline and matching the criteria for an official economic recession.

Fed Chair Jerome Powell predicted another excessively large super boost would be feasible in September after hiking rates by 75 basis points on Wednesday. However, everything is dependent on the most recent macrodata rounds. Additionally, there will be two rounds of employment and inflation data prints to consider prior to the September meeting.

Since the Fed is currently in neutral territory, the tightening cycle may soon come to an end as the Fed begins to scale down the rate hikes.

The U.S. second quarter GDP growth also decreased by 0.9 percent, marking the second consecutive quarter of decline and matching the criteria for an official economic recession.

The day after the Federal Reserve's announcement of its monetary policy, Mr. George Milling-Stanley, chief market strategist at State Street Global Advisors, stated that he is not surprised that gold prices have increased by 2%. He pointed out that the FED could have been much more hawkish but that further aggressive rate hikes will rely on data. Federal Reserve Chair Jerome Powell struck a strong tone.

>> US. inflation has peaked, how will gold price move?

The consensus appears to be that we will only be looking for a 50-basis point rise in September, and it may drop lower in October. As of today, the markets have determined that there are two more months until the next meeting, and that is time for a lot of data to be provided.

Gold prices will rise sharply as FED could stop raising rates sooner than expected.

According to Mr. George Milling-Stanley, markets are now more concerned about the potential for a recession than they are about the Fed raising interest rates, which might devalue the dollar and limit bond yields. Meanwhile, he continued, it is unclear that the Federal Reserve will be able to completely control inflation, even if the economy slows.

"The U.S. economy is going to get a lot worse before it gets better than that is positive for gold", Mr. George Milling-Stanley emphasized. "People's fear of recessions will resurface and I'm sure it will on several occasions over the next two months, then I think that gold will do well as investors seek safe-haven assets."

According to Mr. Milling-Stanley, his base case forecast for gold prices this year is that they will fluctuate between $1,800 and $2,000 per ounce. The possibility that gold may end the year above $2,000 per ounce is also still present, he continued.

Given the growing number of significant macroeconomic and geopolitical risks, he said, it's difficult to imagine why gold would remain where it is through the remainder of the year. The gold prices would increase sooner rather than later.

Milling-Stanley stated that he is confident that the physical demand in China will increase given the bullish macro climate. Despite the fact that COVID-19's effects are still being felt across the nation, Milling-Stanley stated that he doesn't believe the country will go into complete lockdown.