US. inflation has peaked, how will gold price move?

Inflation in the United States appears to have peaked, prompting the Federal Reserve to be cautious in raising interest rates, easing downward pressure on gold prices next week.

The FED may need to be more careful in raising interest rates in the coming meetings.

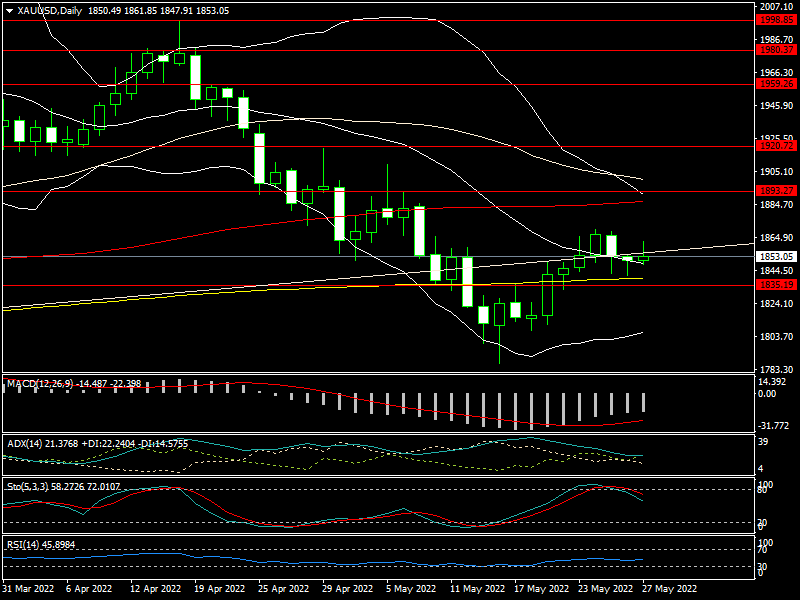

The price of gold on the international market hasn't moved as much this week as it has in recent weeks. As a result, gold prices climbed to 1,869 USD/oz at one time, then fell to 1,840 USD/oz before rising to 1,860 USD/oz again. The gold price ended the week at $1,853 per ounce.

The price of SJC gold bars in the Vietnamese gold market fluctuated in line with the international gold price trend, falling from 69.9 million dong/tael to 68.8 million dong/tael before rising to 69.5 million VND/tael. According to the figures of certain large-scale gold trading firms, the market's trading volume did not alter dramatically.

Gold price experienced a strong recovery in several sessions on weak US dollar. From a 20-year high, the USD index has declined nearly 3% to 102 points. Furthermore, the 10-year US government bond yield fell to 2.74 percent from a high of nearly 3%. Furthermore, the US stock market's impressive comeback after 7 weeks of loss has created a positive feeling for gold investors.

In addition, the US Department of Commerce announced that the core Personal Consumption Expenditures Index, the Federal Reserve's favored inflation index, climbed 4.9 percent yearly in April, down from 5.2 percent in March and 5.3 percent in February. This is one of the reasons for gold's recent gains. As a result, investors believe US inflation has peaked and is declining, meaning that the Fed would be more cautious in raising interest rates in the coming months.

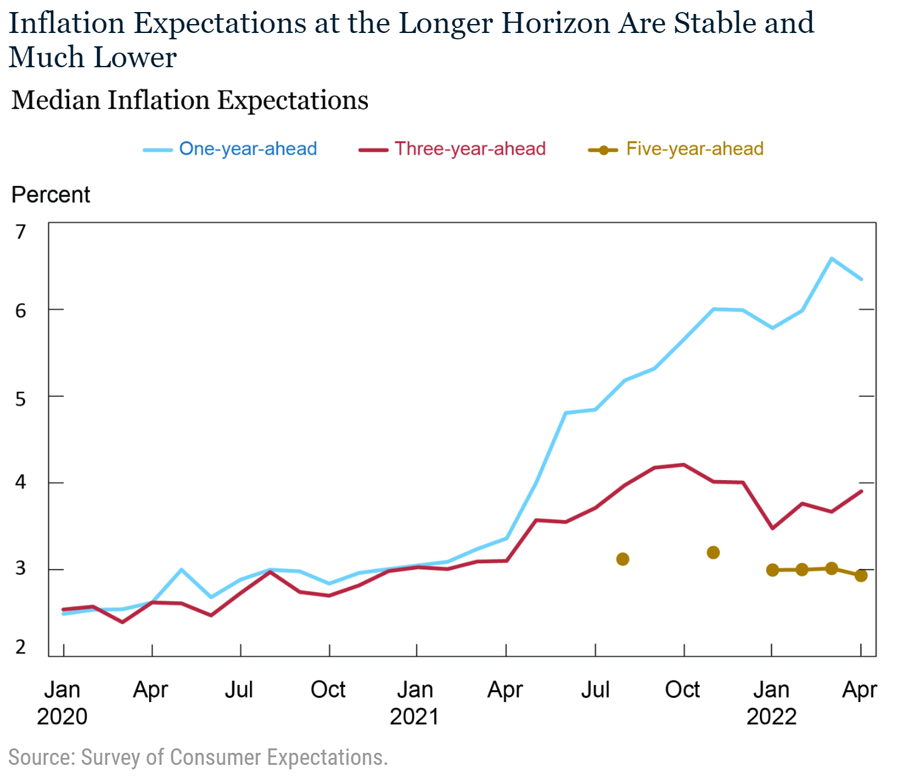

However, US. consumers expect inflation to remain elevated this year and possibly for the next three to five years, according to the latest data from the New York Federal Reserve. According to the report, consumers expect inflation pressure to hold above 6% this year. At the same time, inflation in the next three years is expected to moderate to 4%. Finally, consumers see inflation holding steady at 3%.

The poll results also appear plausible, given food and energy prices make up a significant component of the basket of commodities used to create the US PCE index. While energy prices and food quantities continue to rise as the Russia-Ukraine conflict progresses, US and Western sanctions on Russia may be increased. Not to mention China's unwavering commitment to its zero-Covid policy.

Because consumers in the United States expect inflation to remain high this year, they will likely continue to curtail spending, harming US economic growth, which fell to 1.4 percent in the first quarter of this year. If the FED continues to raise interest rates as projected to keep inflation at bay, the US economy may be pushed into stagflation, as many analysts have predicted. As a result, the FED may need to be more careful in raising interest rates in the coming meetings. Gold prices could be less pressured next week as a result of this.

In the short-term, gold price might move with $1,785/oz as a key support

According to Mr. Edward Moya, a senior analyst at OANDA Group, the gold market would wait to see what happens with inflation in the coming months. In the short-term, gold price might move with $1,785/oz as a key support and $1,870/oz as an initial resistance. If this barrier is breached, gold's price might quickly rise above $1,900/oz.

The US will release its May jobs report next week, which will include the unemployment rate and non-farm employment (NFP) data. According to projections, the NFP will create 325,000 jobs, compared to 428,000 jobs in March. If the projection is true, gold prices will likely continue to rise next week. On the other hand, it is expected to correct marginally next week, to 1,839 USD/oz. The gold price will recover next week if it stays above this level. If this barrier is breached, gold prices could fall to the 1,810-1,830 USD/oz range next week.