Why are interbank rates remaining low?

The State Bank of Vietnam (SBV) has stated that it has continuously maintained low interest rates to support economic growth.

According to the SBV, maintaining low interest rates involves trade-offs—exchange rates being one of them. (Illustrative photo: Quốc Tuấn)

According to the SBV, interest rates have been steadily declining since the end of 2022. In just the first half of this year, the average lending rate has dropped an additional 0.6 percentage points per year.

To keep interest rates low, the SBV has provided liquidity support and maintained low interbank interest rates while also directing commercial banks to cut operational costs and apply technology to lower lending rates.

A timely issuance of a green taxonomy is deemed essential to channel green credit flows.

The banking sector has also rolled out preferential credit programs with lower-than-average rates, such as a VND 100 trillion loan package for agriculture, forestry, and aquaculture with rates reduced by at least 1–2 percentage points, and the social housing loan policy recently cut by 0.2 percentage points to 5.9% per annum.

These policies help individuals and businesses access cheaper loans and recover business operations, contributing to an impressive nearly 10% credit growth in the first half of 2025—marking the highest rate since 2023.

“To maintain such low interest rates, we have to make certain trade-offs—exchange rate stability being one. We consistently conduct monetary policy in a way that ensures ample liquidity for financial institutions, giving them access to low-cost capital from the SBV. This has allowed the VND interbank market interest rates to stay low, ensuring that institutions have sufficient liquidity and low capital costs, enabling competitive loan pricing in line with the directives of the Government and the Prime Minister,” said Mr. Phạm Chí Quang, Head of the SBV’s Monetary Policy Department.

SBV leaders also acknowledged that, despite Vietnam’s overall stable balance of payments and a trade surplus, the rapid movement of foreign capital—particularly persistent outflows from the stock market since 2024—has exerted considerable pressure on the foreign exchange market.

Looking ahead, Vietnam is expected to remain vulnerable to global financial market factors, especially U.S. tariff policies. Due to Vietnam’s high trade openness—its export-to-GDP ratio has exceeded 200% at times—U.S. tariff policy will heavily influence not only investment and exports but also Vietnam’s major trading partners.

The U.S. Federal Reserve's (Fed) future actions will also have significant effects on interest and exchange rates, according to Mr. Quang. Since the beginning of this year, the Fed has delayed cutting interest rates twice due to Trump administration tax policies. While inflation in Europe and Japan is easing, U.S. inflation remains volatile. The Fed’s interest rate decisions hinge on data—especially employment figures—which are currently full of uncertainties.

Deputy Governor of the SBV Phạm Thanh Hà emphasized that the SBV’s policy direction in the coming period will remain proactive, flexible, timely, effective, and in close coordination with fiscal and other macroeconomic policies. The goal is to prioritize economic growth while maintaining macroeconomic stability and controlling inflation. Key priorities include:

First, continuing to instruct credit institutions to reduce operating costs, enhance IT and digital transformation, and implement other measures to reduce lending rates.

Second, closely monitoring international and domestic markets to manage exchange rates flexibly, in line with market conditions, while using monetary policy tools to stabilize the forex market and control inflation.

Third, adjusting credit management in accordance with macroeconomic conditions, inflation trends, and the economy’s capital absorption capacity. This includes encouraging credit growth toward production, priority sectors, and key growth drivers as directed by the Government and the Prime Minister, while strictly controlling credit to high-risk areas.

Fourth, advancing the 2021–2025 banking system restructuring project, including bad debt resolution and measures to prevent the emergence of new bad debts.

In terms of interest rates, the Deputy Governor highlighted that in July and the second half of the year, the SBV will continue supporting liquidity through open market operations to ensure that commercial banks have access to low-cost capital to expand credit and keep interest rates low, aiming to meet the 16% credit growth target.

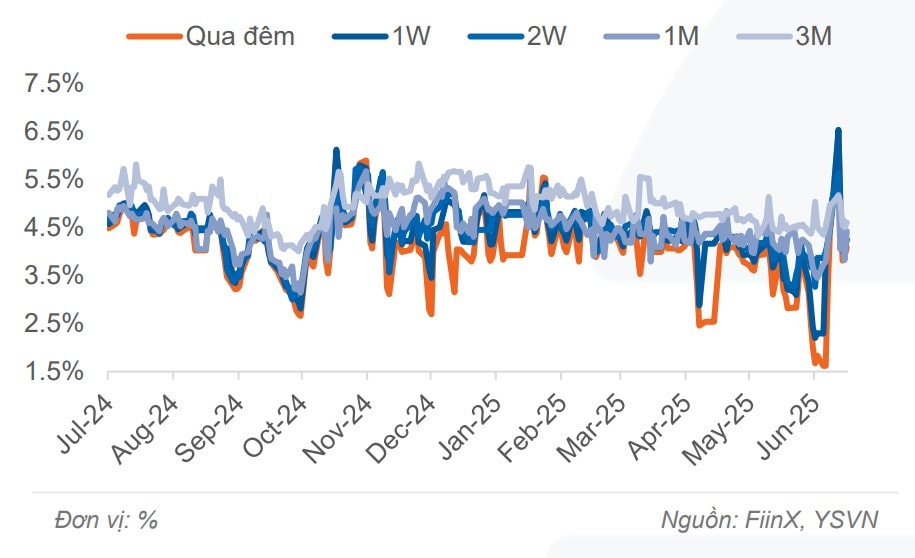

Interbank interest rate trends

Recent actions by the SBV reflect efforts to support liquidity and maintain low interest rates amid lingering market concerns about exchange rate and inflation volatility.

According to data from Yuanta Vietnam, in the first week of July, the SBV continued to operate through both T-bill and term-purchase channels in the interbank market. It issued VND 17.4 trillion in 7-day T-bills at a 3.5% interest rate and injected an additional VND 62.4 trillion via term purchases at 4% interest for terms ranging from 7 to 91 days. With VND 22.5 trillion of T-bills and VND 58.1 trillion of term purchases maturing, the SBV had a net injection of VND 9.4 trillion—down 76.6% from the previous week. The outstanding value stood at VND 94.6 trillion for term purchases and VND 17.4 trillion for T-bills by the end of the week.

Liquidity conditions stabilized after quarter-end. Interbank interest rates spiked at the beginning of the week on June 30, with overnight rates peaking at 6.45% and 1-week rates at 6.53%. However, rates gradually declined by week’s end: overnight rates dropped 78 basis points to 4.9%, 1-week rates fell 60 points to 4.3%, 2-week rates dropped 83 points to 4.3%, and 1-month rates decreased 50 points to 4.4%. Consequently, the VND-USD overnight interest rate spread narrowed to -0.3%.

According to Official Dispatch No. 104, the Prime Minister has continued to request the SBV to instruct credit institutions to reduce costs, simplify administrative procedures, and enhance digital transformation to further lower lending rates and support production and business activities.

Given these policies and market developments, Mr. Nguyễn Thế Minh, Head of Analysis at Yuanta Securities Vietnam, believes that deposit rates remain low while credit demand is expected to surge in the second half of the year. As a result, he anticipates that not only will the credit growth target of 16% be met, but it might also be exceeded. However, maintaining low interest rates will be challenging for commercial banks.

“We believe deposit rates may stay flat or inch up slightly in the near future, while lending rates will likely remain low to support economic growth,” said Mr. Minh.