Gold price may continue to upswing on SVB’s collapse

The gold price rose unexpectedly this week as a result of potential contagion risks from the Silicon Valley Bank (SVB) meltdown.

State regulators in California seized Silicon Valley Bank and appointed the Federal Deposit Insurance Corp. as receiver.

>> Gold price next week: Beware of Powell’s "hawkish" testimony

State regulators in California seized Silicon Valley Bank and appointed the Federal Deposit Insurance Corp. as receiver. The bank, known for investing in tech startups and supporting cryptocurrencies, experienced a deposit run after announcing plans to sell shares to raise capital. After selling loss-making assets, mostly US government bonds, it needed to raise funds to cover a $1.8 billion deficit.

The bank's bond and mortgage-backed securities holdings have taken a significant hit as the Federal Reserve has aggressively raised interest rates to cool inflation. According to analysts, SVB was one of the leading technology financiers, and its failure demonstrates the potential unintended consequences of the Federal Reserve's aggressive hiking cycle in its fight against inflation. The concern is that the startup-focused lender's problems will spread to the rest of the global markets.

Many analysts believe that this is just a taste of what's to come, as the economy has yet to fully absorb the effects of the Federal Reserve's rate hikes. The central bank isn't finished yet, which adds fuel to the fire.

Of course, with a potential banking crisis looming, the question now is whether the Federal Reserve has room to raise interest rates further.

According to Chantelle Schieven, head of research at Capitalight Research, the Fed continues to jeopardize the economy by underestimating the lag in US monetary policy.

>> Gold prices could remain sideways on FED rate hike

"A potential Fed-induced banking crisis will push gold prices to $2,000 per ounce by the end of the year," said Schieven, adding that with that target in mind, she sees gold prices as a good buy.

Gold price may continue to upswing on SVB’s collapse

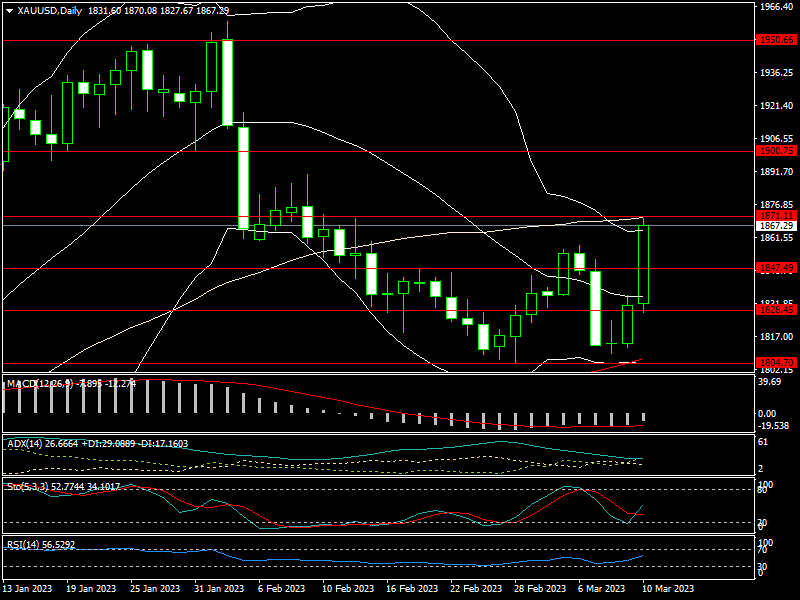

The NFP report had a strong headline beat, but the rest of the report backed up the notion that the labor market is cooling. Wage pressures were much lower than expected, and the unemployment rate increased from 3.4% to 3.6%. Gold is rising as Fed rate hike bets are reduced and SVB contagion risks prompt some safe-haven buying. The bond market is now pricing in rate cuts by the end of the year, which is causing yields to plummet dramatically.

Only the coming week will reveal whether gold can maintain these levels, particularly in light of Tuesday's inflation report. Inflation is expected to slow to 6% from 6.4% in February, according to market consensus.

According to Mr. Colin, an FX analyst, the CPI print is not as important as the reaction to it. There has frequently been some debate over whether certain data or Fed comments are dovish or hawkish. The Fed will also keep an eye on how markets react to and digest the CPI.

"I don't think gold bottomed yet, and [prices] might have further to fall during the first half of this year. I wouldn't be surprised if gold remained stuck between $1,800 and $1,900. However, the collapse of SVB could push gold prices above $1,900”, said Mr.Colin.