Does debt restructuring affect bank asset quality?

Circular 02/2023/TT-NHNN on debt restructuring officially expires at the end of 2024. For restructured loans, financial institutions will be required to account for all credit costs.

SBV does not extend Circular 02/2023 and issued Circular 53/2024 in late December for restructuring debts affected by the typhoon

Problem Loans Have Stabilized

As 2024 came to an end, the Vietnam banking industry witnessed the issuance of Circular 53/2024, a debt restructuring circular that ran through the end of 2025. It regulates the modification of debt payments for clients impacted by the floods, landslides, and devastation caused by Typhoon No. 3.

Two noteworthy aspects of the circular are that (1) financial institutions may modify repayment terms from the date of implementation until December 31, 2025, with no cap on the number of restructures; and (2) the final repayment deadline for restructured loans may be modified in accordance with the challenges faced by the customers, but not after December 31, 2027.

This means that loans from customers affected by the historic storm in 2024 will receive support for repayment restructuring, including multiple restructures if desired and extensions up to three years. This provides financial institutions relief in debt recovery pressure while giving customers time to recover.

Meanwhile, Circular 02/2023 for restructuring loans affected by COVID-19 officially expired on December 31, 2024, as per a mid-2024 amendment and extension. This mandates banks to account for all credit costs related to restructured loans.

Prior to this, some claimed that companies had only just started to recover and that their financial stability was still precarious, anticipating this circular to be extended for at least six months, till June 2025.

Many banks, however, stated that the proportion of loans impacted by COVID-19 was negligible, as many clients recovered and made their repayments. The banks complied with the regulations' provisioning requirements for loans that were still restructured and uncollected at the end of the year.

Problem loans

According to Phan Thi Van Anh, MSc, Senior Analysis Director of VIS Rating, Circular 02, introduced in May 2023, acted as a policy tool to assist customers in overcoming financial and business challenges during a period of slowed economic growth. This policy allowed banks to restructure repayment terms, enabling customers more flexibility and time to reorganize business operations and manage cash flow. Circular 02 also postponed recognizing credit costs associated with restructured loans until the end of 2024.

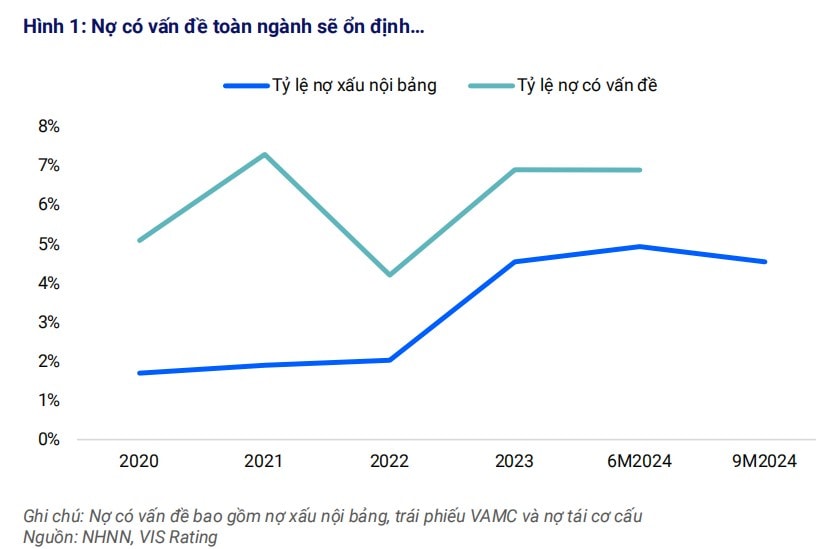

VIS Rating cited SBV data showing that the total problem loans in the banking sector—comprising non-performing loans (NPLs), restructured loans, and VAMC bonds—stabilized at 6.9% of the total credit system by June 2024. "This ratio stabilized over the past year after a sharp 2.7 percentage point increase in 2022-2023. The restructured loan principal in the sector decreased to 0.9% of total credit, down from 1.2% at the end of 2023," VIS Rating emphasized.

"In the first three quarters of 2024, the overdue loan formation rate among banks generally slowed. Most banks expressed confidence in customer repayment cash flow recovering due to improved domestic business conditions. Additionally, the scale of restructured loans has significantly reduced in some state-owned and private banks (e.g., TCB, ACB, HDB, VIB)," Van Anh noted.

For loans under Circular 02/2023/TT-NHNN, after its expiration, banks must account for all credit costs related to restructured loans. The impact on business results can be manageable for large banks with limited restructured loan volumes. However, a few banks, such as VPB—with significant restructured loans tied to large clients and low NPL coverage ratios—face the highest asset risk, according to VIS Rating. These banks also deal with unresolved issues in the real estate sector, including legal troubles or low demand in new projects.

"Furthermore, these banks face difficulties improving profitability to meet higher credit costs. Capital costs are also rising amidst heightened competition among banks to drive credit growth. Smaller banks, such as ABB, have planned to reduce lending risks to address asset quality issues, which could pressure their net interest margins", VIS Rating highlighted.

Positive Profits and Financial Readiness for Risk Management

According to SBV Deputy Governor Dao Minh Tu's preliminary estimations, system-wide non-performing loans (NPLs) were still being addressed by the end of 2024, even though business and economic difficulties had an impact on repayment capability.

Some banks have made insinuations about better performance based on unofficial and unaudited business outcomes. This shows that financial institutions have enough resources to manage risks, such as other outstanding debts and restructured loans under Circular 02.

Among the "Big 4" banks with billion-dollar profits:

- BIDV reported profits of VND 30,006 billion (over $1.1 billion) and tightly managed credit quality, with an NPL ratio of 1.3% and a 133% NPL coverage ratio.

- VietinBank estimated parent bank pre-tax profits of VND 26,300 billion (over $1 billion) without detailed asset quality information.

- Agribank achieved record profits exceeding VND 27,500 billion, reducing on-balance-sheet NPLs to 1.56%, aiming for sub-1% by 2025.

- Vietcombank projected profits exceeding VND 43,000 billion with consistently low NPL ratios and the highest risk provisioning coverage in the system.

The Big 4's record-high profits, combined with recent capital movements, reinforce their financial capacity to lead system competition and expand credit to support economic growth. Among private commercial banks:

- TPBank surpassed VND 7,000 billion in profits in 11 months, projecting a 34% annual growth.

- HDBank targeted a 25% growth in 2025, with record profits reaching VND 20,000 billion.

- Sacombank estimated Q4 profits at over VND 4,600 billion, up 68%, with annual profits exceeding VND 12,700 billion.

For smaller banks with thin capital or restructuring plans, higher capital costs and provisioning needs may erode profits, such as NCB, ABB, and KienlongBank.

Experts from VCBS highlight that NPL pressures persist for banks with customers unable to recover under Circular 02. Institutions with high restructured loan ratios and low NPL coverage may face increased provisioning costs in late 2024 and 2025, affecting profitability.