Which stocks will continue to benefit from public investment?

Stocks in the materials and infrastructure construction sectors holds high growth potential, benefiting from policies aimed at boosting public investment.

The group of stocks in the materials and infrastructure construction sectors holds high growth potential, benefiting from policies aimed at boosting public investment.

Accelerating Public Investment

According to a report by the Ministry of Finance, disbursed state budget capital from previous years carried forward into 2024, as of December 31, 2024, amounted to over VND 38.605 trillion, reaching 67.38% of the plan. The estimated disbursement of capital for the 2024 plan is over VND 529.632 trillion, achieving 70.24% of the plan and 77.55% of the target set by the Prime Minister.

In 2024, 37 provinces and 16 of 46 ministries and central agencies had distribution rates higher than the national average. Vietnam Television (100%), Social Policy Bank (100%), Union of Literature and Arts Associations (98.22%), Central Office of the Communist Party (93.65%), Voice of Vietnam (88.34%), State Bank of Vietnam (84.83%), Ministry of Transport (83.3%), and Ministry of Public Security (81.88%) were among the organizations with the best disbursement rates. Notable at the local level were Vinh Phuc (90.54%), Hoa Binh (89.47%), Ha Nam (89.25%), Nghe An (90.59%), Binh Dinh (91.19%), and Bac Kan (91.32%).

However, 30 ministries and central agencies and 26 provinces reported disbursement rates below the national average. Notably, the Ministry of Finance highlighted that Ho Chi Minh City, with a significant allocation of VND 79.26378 trillion (11.8% of the national target), had only disbursed 51.08%, heavily impacting the overall national disbursement rate.

Based on these figures, the Ministry of Finance noted that central government budget disbursement rates were higher than in the same period in 2023, while local government disbursement remained low.

Challenges in Public Investment Disbursement

The Ministry of Finance report identified several obstacles affecting project disbursement progress. While the Government has proposed new laws to the National Assembly to streamline public investment project management, these laws will not take effect until 2025. Therefore, challenges in public investment disbursement for 2024 remain unresolved.

Additional persistent issues include complications in land clearance, land use planning, material supply, investment procedures, and disbursement processes for ODA-funded projects.

ACBS's Analysis of Infrastructure Construction

Public investment disbursement in 2024 was comparatively slow, according to a recent analysis by ACBS Securities on the infrastructure construction industry. But according to ACBS, the government is allocating money to clearing up legal issues while also accelerating the completion of important projects including the North-South railway, Long Thanh International Airport, and the North-South Expressway Phase 2.

The 10th Central Committee Conference Resolution, XIII tenure, states that the government's goal for GDP growth in 2026–2030 is 7.5%–8.5% each year. According to ACBS, rapid public investment distribution will be crucial to reaching this ambitious growth target.

"Therefore, we expect public investment to gain momentum in early 2025, once the new laws take effect. Additionally, during 2026-2030, the Government will continue to vigorously implement major projects such as the North-South high-speed railway," said Mr. Do Tiet Dat, ACBS analyst.

Infrastructure construction stocks will benefit.

Benefiting Sectors and Companies

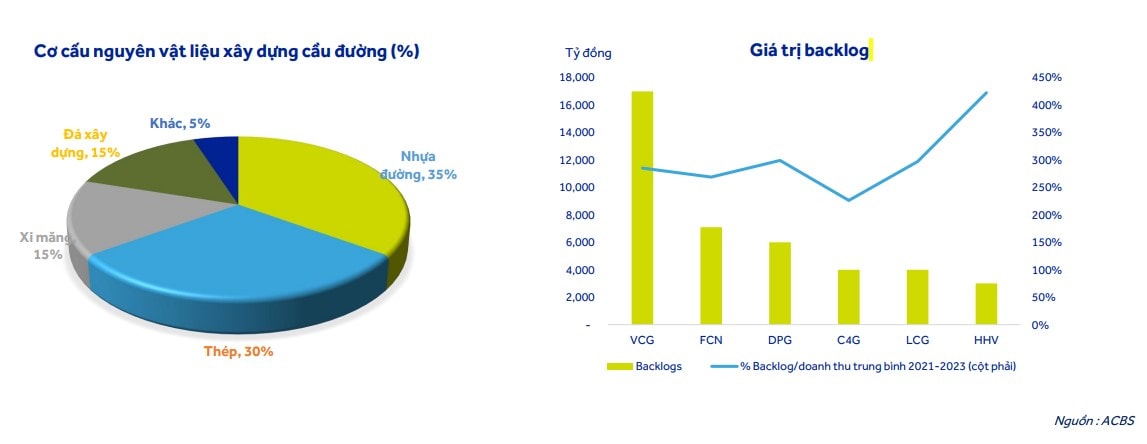

ACBS identified sectors such as steel, cement, asphalt, infrastructure construction, logistics, residential real estate, and industrial parks as potential beneficiaries. Stocks in materials and infrastructure construction stand out with high growth potential due to the advantages of public investment policies and the likelihood of winning numerous future contracts.

HPG

ACBS predicts that the demand for construction steel will continue to rise in 2025 as the Government accelerates investments in major infrastructure projects like Long Thanh Airport and the North-South high-speed railway. HPG, with its comprehensive steel industry value chain, maintains its leading market position domestically, accounting for approximately 38% of total construction steel consumption. Public investment-driven demand for construction steel is expected to help HPG maximize capacity, with a projected 10% production increase compared to 2024. Moreover, stable demand will help maintain steel prices and ensure HPG's profit margins remain steady.

VLB

According to ACBS, VLB possesses five quarries (Thanh Phu 1, Thien Tan 2, Tan Cang 1, Soklu 2, Soklu 5) that are ideally situated to serve important projects in the Southeast and Southwest, including Ho Chi Minh City Ring Road 3, Long Thanh International Airport, and the North-South Expressway Phase 2. Between 2024 and 2030, 37.3 billion cubic meters of construction stone are expected to be needed for large-scale projects in southern Vietnam, with a 10% yearly increase in consumption. VLB was positioned to profit from growing demand by the end of 2023, with roughly 90 million cubic meters of remaining stone deposits and an approved 5.7 million cubic meter annual extraction capability.

PLC

ACBS assessed that PLC, the largest asphalt supplier in Vietnam with a national market share of approximately 30%, is well-positioned to benefit from the demand for highway construction. With storage and port infrastructure capable of handling 400,000 tons annually across the country, PLC is set to capitalize on the Government's goal of completing 3,000 km of highways by 2025 and 5,000 km by 2030.

HHV

Large building contracts have been acquired for HHV as a result of the government's public investment push for 2021–2025, according to ACBS. The backlog at HHV is currently above VND 2.9 trillion, which is roughly three times its construction income for 2023. With a compound annual growth rate (CAGR) of 16%, ACBS estimates that HHV will increase revenue recognition in the construction segment between 2024 and 2026, coinciding with the completion phase of important projects.