Outlook for the 2025 Vietnamese stock market

Many organizations anticipate 2025 to be a thriving year for Vietnam's stock market, according to securities analyst Mr. Huynh Hoang Phuong.

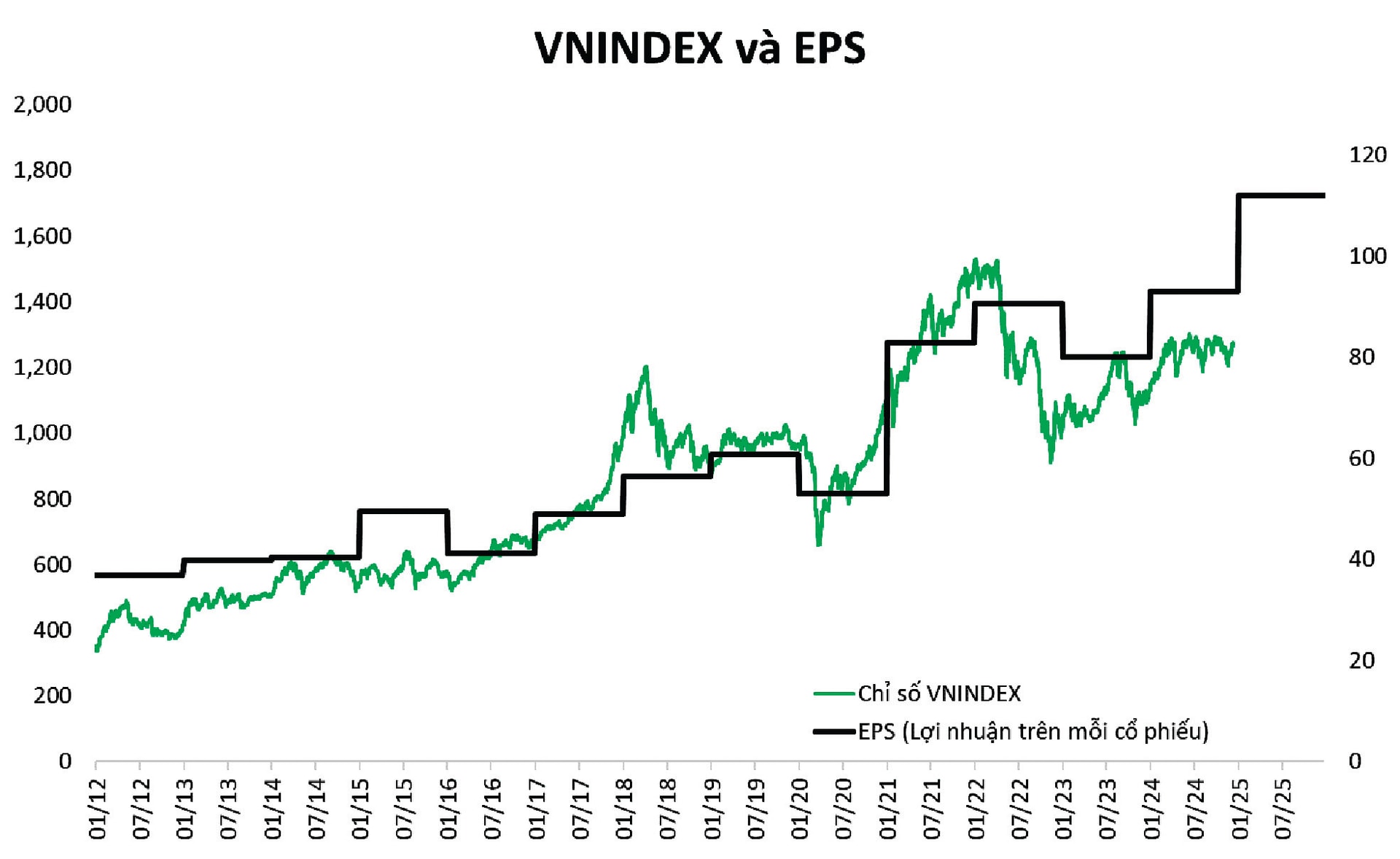

VN-INDEX and EPS

However, both professional stock investors and those practicing tactical asset allocation need to distinguish clearly between short-term drivers and mid- to long-term potential to craft suitable strategies.

Is this merely a story of transient liquidity in certain periods of 2025, or does it mark the beginning of a sustainable growth cycle for the VN-Index?

A Pivotal Year for Mid-Term Prospects

The profit growth (EPS) of listed firms is the primary factor driving the stock market's medium- and long-term growth. According to Fidelity, EPS growth can account for up to 95% of the medium-term variations in the S&P 500, demonstrating a strong link between EPS growth and stock index performance. In a similar vein, company profitability has been directly linked to the VN-Index's increase since 2012.

Based on projections that place VN-Index EPS growth at roughly 20% in 2025 and similar pace anticipated for 2026 (sources: Bloomberg, HSC, Vietcap, DC, Vinacapital), the country's institutional and regulatory reforms are supporting a healthy mid-term market outlook. As a result, 2024 is probably going to be a year of recuperation, setting the stage for the mid-term development phase that will begin in 2025.

Upgrades and “Turnaround”: Short-Term Drivers

At the moment, the VN-Index is trading below its EPS benchmark, with a P/E ratio at 13.22 times on December 24, 2024 (10% lower than its average since 2012). This primarily stems from net foreign outflows and potential risks in the two major sectors—banking and real estate—throughout 2024.

To achieve robust economic growth in 2025, the government must prioritize the recovery of domestic consumption and investment to compensate for slower growth drivers such as manufacturing, exports, and tourism. This domestic recovery directly affects most sectors on the VN-Index. Consequently, the turnaround from low valuations in banking, real estate, and retail is anticipated to attract significant capital inflows.

The expected September 2025 FTSE elevation of Vietnam's stock market to developing market classification is another short-term consideration. Upgrades have historically caused markets to react favorably three to six months in advance, followed by a drop if valuations became "overstretched." The market usually resumes growing based on its fundamentals after that time. As a result, the VN-Index may experience a spike in speculative capital, especially starting in Q2 2025, but this influence might progressively fade by the end of the year.

The VN-Index is currently trading below the EPS line, evidenced by a P/E ratio of 13.22 times on December 24, 2024—about 10% below its average since 2012. This is mainly due to net foreign selling pressure and latent risks from the banking and real estate sectors in 2024.

Capitalizing on Short-Term Liquidity

On the whole, Vietnam’s stock market in 2025 can benefit from both mid-term prospects and short-term drivers. Short-term catalysts—like the rebound from low valuations—can help restore valuations to their historical averages, while the upgrade narrative could generate strong short-term returns (potentially pushing the VN-Index toward or above the projected EPS line in the corresponding chart).

Investors should, however, view EPS growth as the "north star" for long-term allocation and modify their plans when the upgrade effect subsides, particularly after the official announcement of the upgrade.

Importantly, these projections are dependent on the FTSE upgrade and the recovery of important domestic economic factors including consumption and both public and private investment, including the real estate market. Therefore, investors should keep a careful eye on pertinent developments and prepare for unfavorable outcomes, especially when it comes to external issues like President Trump's second-term policies that impact Vietnam's exports and the Fed's interest rate-cutting trajectory.