What outlook for VCG?

Vietnam Construction And Import-Export JSC (HoSE: VCG) stands as a leading enterprise in the public investment sector, distinguished by its proven construction expertise and a substantially higher bid-winning rate compared to industry peers.

Leverage from public investment

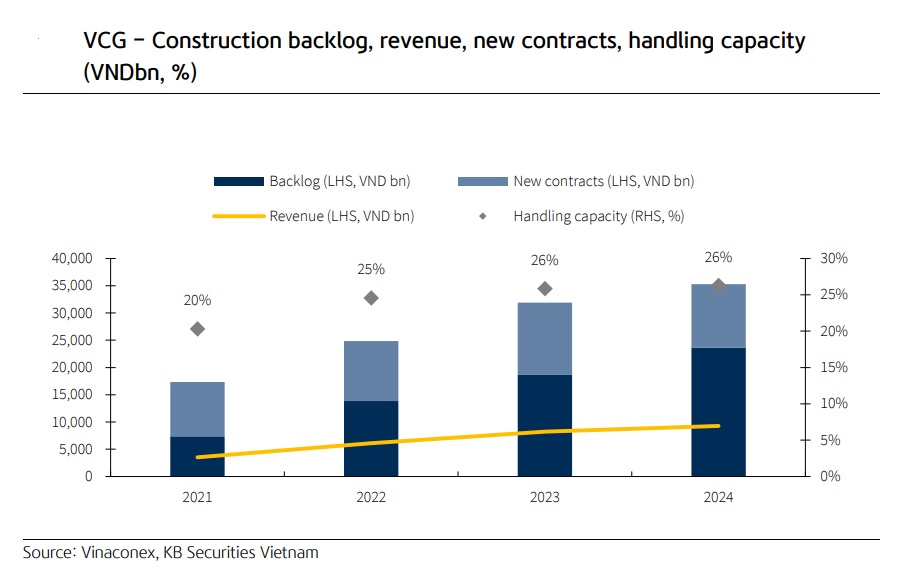

The construction backlog of VCG is predominantly composed of public investment contracts, constituting 97% of the total. This backlog represents 2.8 times VCG’s 2024 construction revenue, underscoring substantial growth potential in construction revenue for 2025–2026. KBSV forecasts VCG’s construction revenue to reach VND10,220 billion in 2025 (10% YoY), with 45% of its construction contracts anticipated for completion and handover within the year.

Since the start of 2025, the Vietnamese Government has set an ambitious public investment disbursement target of over VND790.7 trillion (17% YoY), with the aim of supporting the targeted 8% GDP growth 8 for the year. However, data from the Ministry of Finance indicates that public investment disbursement in the first four months of 2025 reached VND129 trillion, achieving only 14% of the annual target (compared to over 15% during the corresponding period in 2024). Notably, disbursement progress has demonstrated month-over-month improvement.

Nguyen Duong Nguyen, Analyst at KBSV anticipates an acceleration in public investment disbursement from 2Q2025 onward, as over 93% of the allocated capital had been detailed and assigned by the end of March 2025. In addition, the amended Public Investment Law is expected to streamline the documentation process and expedite site clearance and capital arrangement in the near term.

Looking back at its track record, we note that VCG has consistently participated in key bidding packages, most notably in the Long Thanh Airport megaproject, where VCG’s consortium won the largest contract (Package 5.10). The company demonstrates strong bidding capabilities in the public investment sector, supported by an impressive portfolio in large-scale projects and a sound financial structure.

Promising indicators from real estate projects

At the General Shareholders’ Meeting, management disclosed that Vinaconex – ITC (UPCOM: VCR, 51% owned by VCG) is currently in negotiations with a partner to bulk-sell a portion of the Cat Ba Amatina resort project (total investment of VND10.9 trillion) to secure cash flow and funding for future developments. “We consider this a prudent decision given the absence of a clear recovery in the resort real estate market. However, VCG will require additional time to finalize a sale price and select a suitable partner. The transaction is expected to close in 2025 and is anticipated to generate a substantial one-off profit for the year. As of 1Q2025, the book value of the Cat Ba Amatina project stood at VND5,587 billion, representing 19% of VCG’s total assets”, said Nguyen Duong Nguyen.

In 2025, VCG’s management estimates that 70% of the company’s profit will come from the real estate segment. Notably, the Green Diamond project recognized 80% of its revenue in 2024, with the remaining 20% scheduled for recognition in 2025. This year, profits are expected to be driven mainly by Vinaconex Diamond Tower and Hoa Binh Avenue Urban Area, contributing VND200 billion and VND500 billion, respectively.

However, Nguyen Duong Nguyen said VCG would face some challenges. Given its frequent involvement in large-scale bidding packages, VCG may encounter implementation delays, which could postpone project acceptance, handover, and revenue recognition—particularly as public investment projects face pressure to accelerate timelines while resources are dispersed across multiple sites. Besides, as the Cat Ba Amatina project accounts for 19% of VCG’s total assets, the bulk sale of a portion of it would unlock capital and provide momentum to fuel growth in other Vinaconex projects. However, if the transfer does not proceed as initially planned, the stock price could come under pressure, as the market has already partially priced in the transaction based on recent trading activity.