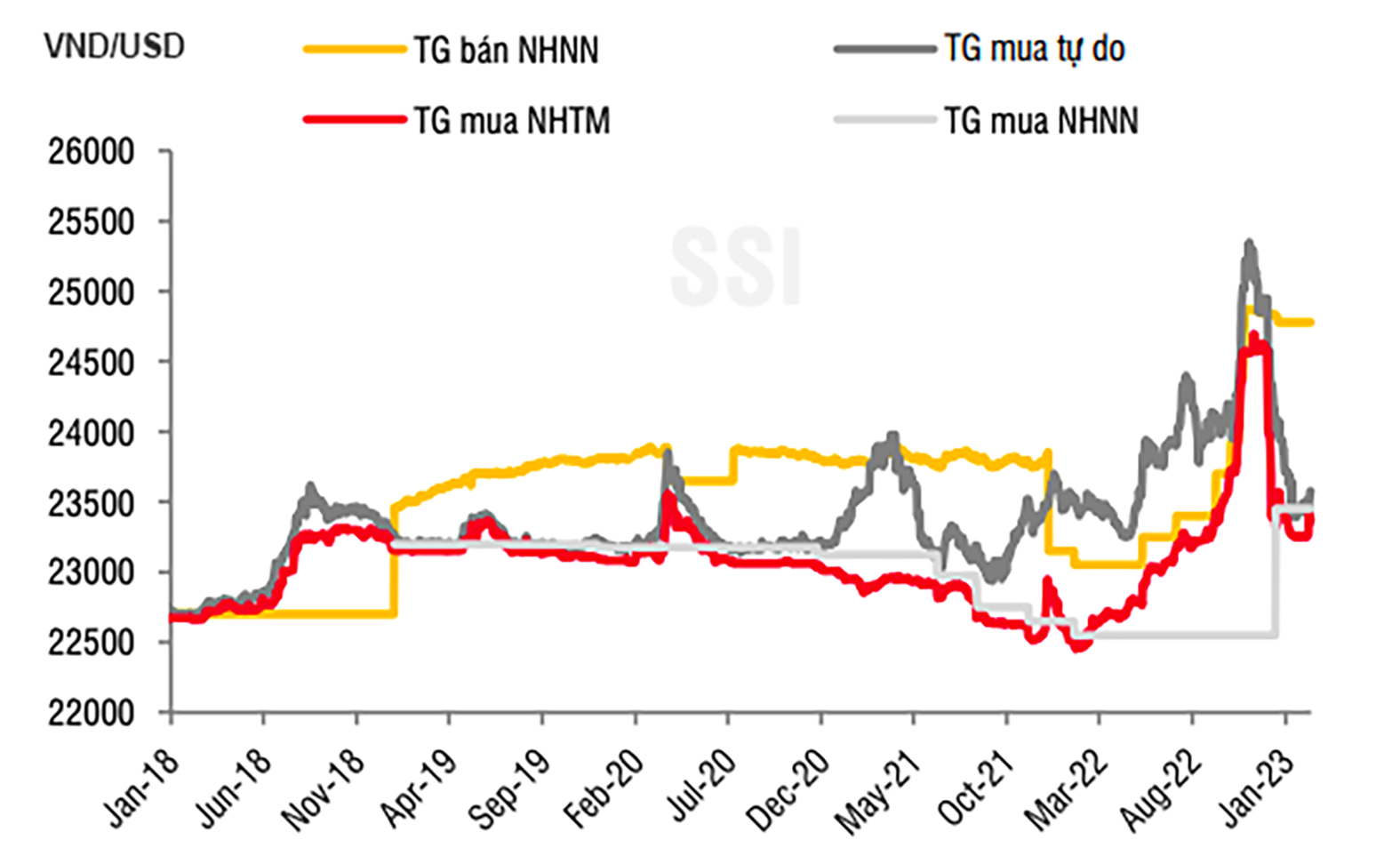

Exchange rate to remain stable

According to many experts, the reduction of interest rates by the central bank will not have much impact on the exchange rate, and the exchange rate will remain stable this year.

In just half a month, the State Bank of Vietnam (SBV) has twice reduced the operating interest rates to create conditions for Credit Institutions (CIs) to lower lending rates to promote growth.

Abundant foreign currency supply

This move by the SBV took place at a time when many large central banks, especially FED, are continuing to raise interest rates, causing some concerns that there will be significant pressure on the exchange rate.

However, according to many experts, the reduction of interest rates by the SBV will not have much impact on the exchange rate as the supply of foreign currency in the country is currently abundant, while the exchange rate pressure from outside has decreased significantly as the FED and other large central banks are expected to end the current interest rate hike cycle soon.

Dr. Can Van Luc and a group of authors from the BIDV Research and Training Institute have identified the main reasons for the stability and downward trend of the exchange rate in the first quarter, including the decrease of the USD in the international market, low demand for foreign currency due to reduced imports, a trade surplus of 4.1 billion USD, and the recovery of international tourism.

Stability in exchange rates

Forecasting the exchange rate movement in 2023, most experts predict that the exchange rate will remain stable this year due to the abundant supply of foreign currency from the large trade surplus, optimistic disbursement of FDI capital, stable remittances, and tourism recovery, while the exchange rate pressure from outside will decrease.

BVSC believes that the biggest pressure on the exchange rate in 2022 comes from the FED's continuous interest rate hike, causing the USD to have a high upward trend. However, in 2023, when the FED has a plan to stop raising interest rates and the US economy faces difficulties, the USD has shown signs of weakness, thereby reducing pressure on the VND.

"We maintain the forecast that the VND will have stable movement in 2023, fluctuating around ±2%," BVSC said.

Dr. Nguyen Tri Hieu - financial expert believes that flexible adjustment of interest rates at an appropriate level will be extremely important, helping to control inflation, stabilize exchange rates and create stability and sustainability for the entire economy. "Although the exchange rate is forecasted to be stable, businesses need to apply derivative tools to prevent exchange rate risks in case the FED continues to raise interest rates in the near future," emphasized Mr. Nguyen Tri Hieu.