FED and exchange rate pressure with Vietnam

While Vietnam isn't suffering inflationary pressures like other countries, the exchange rate requires caution.

Expectations for the Fed to Halt Rate Hikes

According to Mr. Tran Duc Anh, Director of Macroeconomics and Market Strategy at KB Vietnam Securities, the macroeconomic data from the US that's published always greatly influences market developments. This data reflects the health of the economy and impacts the trajectory of interest rate hikes by the US Federal Reserve (Fed).

The first concern is that of inflation. Notably, global inflation rose from 3% in June to 3.2% in July, following a period of strong decline from mid-2022 till now. This rising trend, although still falling short of projections, has piqued the interest of investors.

Mr. Duc Anh explained that inflation in the United States surged dramatically on a monthly basis in the first half of 2022 as a result of the Russia-Ukraine conflict. Inflation has climbed by about 1.2 - 1.3% by June 2022. Due to the low comparison base throughout this era, US inflation began to fall below 0.1% in July 2022. As a consequence, while inflation in the United States increased by 0.17% on a monthly basis in July 2023, when viewed on an annual basis, total inflation in July was still greater than in June.

"The fact that July's inflation is higher than June's inflation is only indicative of statistical issues and does not necessarily indicate a significant rise in US prices." However, investors should be aware that these signals also suggest that the inflation trend in the United States, which benefitted from a large comparative base in 2022, would not likely see fast declines in the last six months of 2023, as we have observed," Mr. Duc Anh stated.

This gives a foundation for determining that, while the inflationary tendency will continue, the speed will be slow, and the decreasing tendencies will have a sawtooth pattern of rise and decline. To see a significant fall in inflation, the Fed's aim of lowering US inflation back to 2% will take a long time, maybe until the second half of 2024 or even later in the beginning of 2025.

"For core inflation (excluding energy and food prices), there's still a stable decreasing trend, specifically 4.8% compared to the same period last month and 4.77% this month, which is a positive signal," Mr. Tran Duc Anh explained.

Fed policymakers will meet next month to decide whether to raise interest rates for the 12th time to slow the economy or to preserve stability. Some officials feel the Fed has raised rates sufficiently to restrain inflation, while others say it is still too early to "hit the brakes" on rates.

The US Federal Reserve is clearly split. However, the financial market believes that the Fed will agree to suspend rate rises next month, according to the CME FedWatch tool.

Fed Governor Michelle Bowman noted in early August at an event in Atlanta, "Inflation remains significantly above the Fed's 2% target." Given these developments, I backed the Federal Reserve's decision to contemplate increasing interest rates in July. Additional rate hikes may be required to bring inflation back down to the FOMC's objective."

Meanwhile, Carol Schleif, Chief Investment Officer at BMO Family Office, believes the Fed will keep rates unchanged in September, but the strength of the labor market may allow the Fed to hike rates again.

"Over the past year, investors have sought a convincing story about deflation, but we haven't seen the labor market soften sufficiently," she added.

How Does This Impact Vietnam?

The Fed and investors are currently watching to see if inflation continues to slow without severely worsening the labor market, which might lead to a "soft landing." While some economists feel that raising the unemployment rate is necessary to remove excess demand from the economy and lower inflation, others argue that it is still too early to hike rates at this time.

In terms of its influence on Vietnam, Mr. Tran Ngoc Bau, CEO of WiGroup, observes that, despite continuing inflation, the US and EU economies are exhibiting indications of weakness. However, given the current circumstances, stability is gradually returning. Thus, the Fed and the EU are reaching the end of their rate rise cycle, and if they do raise rates, the increase will be little. As a result, the current debate is how long the Fed will keep interest rates high.

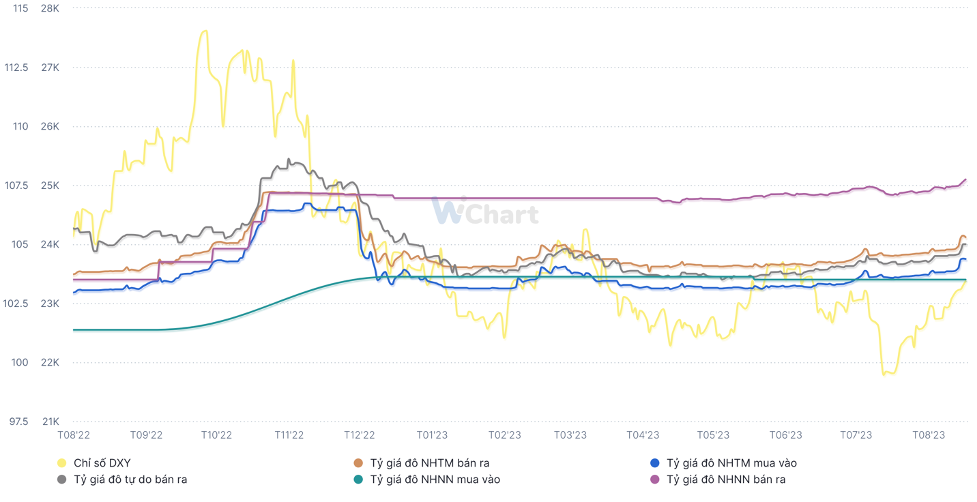

The CEO remarks that the State Bank of Vietnam (SBV) is currently lucky in that it does not suffer inflationary pressures like major central banks. However, at this time, the currency rate is the most serious concern that authorities must address in Vietnam.

At the moment, USD capital inflows into Vietnam are strong due to equities sales and huge trade surpluses. This is the "weapon" that monetary policy can deploy to deviate from main economic patterns. Both of these causes, however, cannot be sustained in the long run, therefore exchange rate pressure is constantly present. The repercussions of losing control of the exchange rate are expected to be similar to what happened in late 2022.

"I believe that the current situation necessitates a race against time for everyone to use monetary policies to quickly restore the economy before Vietnam's monetary policy loses its independence." In terms of operational interest rate cuts, the SBV still has some freedom, and as far as I know, the general consensus is to keep cutting rates. However, policymakers should be careful and prioritize employing other measures, in my opinion, because Vietnam's policy rate primarily influences short-term and ultra-short-term interest rates and liquidity. "It hasn't had a truly effective impact on longer-term rates," said WiGroup's CEO.