Gold price for next week: wary of the Fed's fresh move

The trend of gold prices next week may be significantly influenced by the Fed's interest rate stance at the next meeting.

The FED may cut rates next week

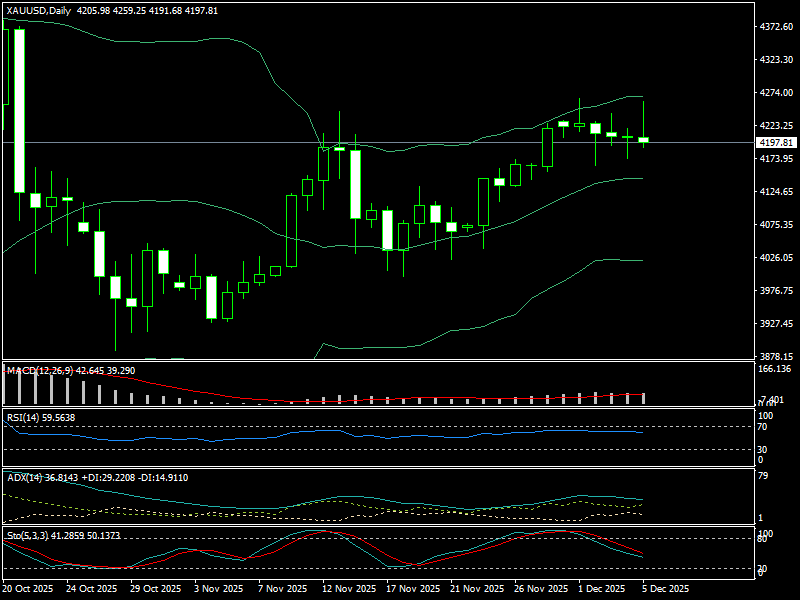

The price of gold fell from $4,264/oz to $4,164/oz earlier this week, then rose to $4,259/oz before declining again and ending this week at $4,197/oz.

The price of SJC gold bars posted by DOJI on the Vietnamese gold market rose to VND 155.2 million/tael during the week's opening session, then dropped to VND 153.8 million/tael before rising to VND 154.2 million/tael.

Due to statistics indicating a notable slowdown in the US labor sector and steady US inflation, gold prices increased to above $4,200/oz. Ahead of the FOMC meeting, this has rekindled anticipation of rate decreases. The market is once again projecting a nearly 90% probability that the Fed will lower rates at the meeting next week, according to CME's FedWatch tool.

Gold prices may not be much affected by the Fed's rate reduction at next week's meeting since they have already been factored in during previous trading sessions. However, there will be a greater impetus for gold prices to rise next week if the Fed decides to lower interest rates more in 2026 than the forecast given at the September meeting.

Due to the uncertainties surrounding the direction of the Federal Reserve's monetary policy, Mr. Lukman Otunuga, Senior Analyst at FXTM, believes that gold prices may be extremely volatile next week. The Fed's interest rate projection for 2026 is less clear, although it is anticipated that interest rates will be lowered for the third time this year. Fed policymakers will be forced to make choices based on inadequate information in the absence of the October nonfarm payrolls (NFP) data and the most current CPI, particularly because the Federal Open Market Committee (FOMC) is more split than it has been in previous years. As a result, any shocks might cause the price of gold to fluctuate further next week. The price of gold may start to rise toward 4,300 USD/oz if it surpasses 4,265 USD/oz next week. On the other hand, gold prices might drop much more if they drop below $4,160/oz next week.

The next week's gold prices may rise on the FED's rate cuts

A substantial quantity of money will need to be circulated due to the US's vast public debt and budget imbalance, in addition to the need to lower interest rates. This puts the US economy in particular and the world economy in general at danger of instability in addition to raising inflation. Regardless of the present price, gold is becoming more expensive because of this. "The price of gold has dropped significantly, so now is the time to look for investment opportunities in gold," advises Mr. Eric Strand, the founder of AuAg Funds, a precious metals firm.

Ultimately, whether the Fed continues to loosen monetary policy or whether macroeconomic factors like slower growth or heightened geopolitical threats materialize will determine how gold prices go further. The Fed's further rate reduction, the USD's further depreciation, rising demand for gold as a safe haven, and—most importantly—central banks' sustained aggressive gold purchases will all be necessary for the price of gold to hit an all-time high.

The Reserve Bank of Australia, the Bank of Canada, and the Swiss National Bank will all make their interest rate decisions public in addition to the FED's monetary policy meeting. All three central banks are expected by the market to maintain stable interest rates.