How will a Trump comeback affect the US dollar?

History shows that Republican presidents are more likely to preside over a falling US dollar, but Trump’s first term was a little better than his predecessors.

Mr. Donald Trump has a clear lead over Nikki Haley in the next Republican primary as pressure builds on his only remaining challenger.

>> What will drive the pound in 2024?

The US is one of many countries that will hold elections this year, with the Presidential election on November 5th. In the UK November 5th is bonfire night, when the country ‘celebrates’ Guy Fawkes trying to blow up parliament in 1605. The irony might not be lost on many American voters, should former President Trump’s name be on the ballot.

In the Standard Bank’s assessment, Mr. Trump will win a second term. National opinion polls are of limit ed use given the electoral college system for choosing a president, but betting odds might be more helpful, in our view and, right now they are not looking good for Biden. However, just before the 2020 election, the implied betting odds from RealClearPolitics put the probability of a Biden win at just 35%, while Trump had an implied probability of victory of close to 65%. Hence, it is not always the case that those prepared to put their money at stake are likely to be correct.

The irony of Biden’s plight is that the US economy is doing well and those parts of the economy that consumers care about the most, like household wealth and employment, are very robust. Indeed, it is their very robustness that pushed the economy to an annual growth rate last year that’s likely to be in the region of 2.5%. Not bad, when most forecasts at the start of last year were for a recession. Growth is expected to slow this year as the lagged effect of the Fed’s aggressive rate hike cycle continues to work its way through the economy.

As this happens, there are still some sectors that could prove vulnerable and put pressure on the wider economy, such as commercial real estate. But Standard Bank’s assumption is that the much-lauded soft-landing scenario is most likely to play out, even though it doubts it will come to Biden’s rescue in the election.

The Fed should start to provide interest rate relief this year and may also scale back, or end, its quantitative tightening. The market is currently priced for the Fed to start cutting rates at either the March or May meeting. Standard Bank suspects it might take a little longer but, importantly, do not think that delay imperils US assets, such as stocks and treasuries, and nor do we think it will lift the dollar. In its view, rate cuts are most likely to start in Q3 but, while we see a late start compared to market pricing, we do think that the Fed will be quite rapid with rate cuts when it gets going, producing 100 bps of cuts in 2024, which is one 25 bps cut less than the market is currently priced for.

>> Two factors to impact US dollar in 2024

The backdrop of easing Fed policy should be the most important factor for longer-term treasury yields this year, and Standard Bank expects 10-year notes to fall into a 3-3.5% range later in the year. But this is not to say that other issues are unimportant, such as hefty auctions, the associated surge in debt, Congress’s poor fiscal management, the November election, and more. It all suggests that yields won’t come down in a straight line, even if the Fed’s rate reductions occur in a smooth fashion.

Falling US policy rates may create modest weakening of the US dollar this year, not via any significant changes in interest rate differentials, but because lower US rates will ease the global financial cycle and encourage risk-taking, an environment that most often sees the US dollar giving ground. However, downward pressure on the dollar from lower rates will likely be balanced by upward pressure from continued US ‘exceptionalism’, even if it is not quite on a par with 2023.

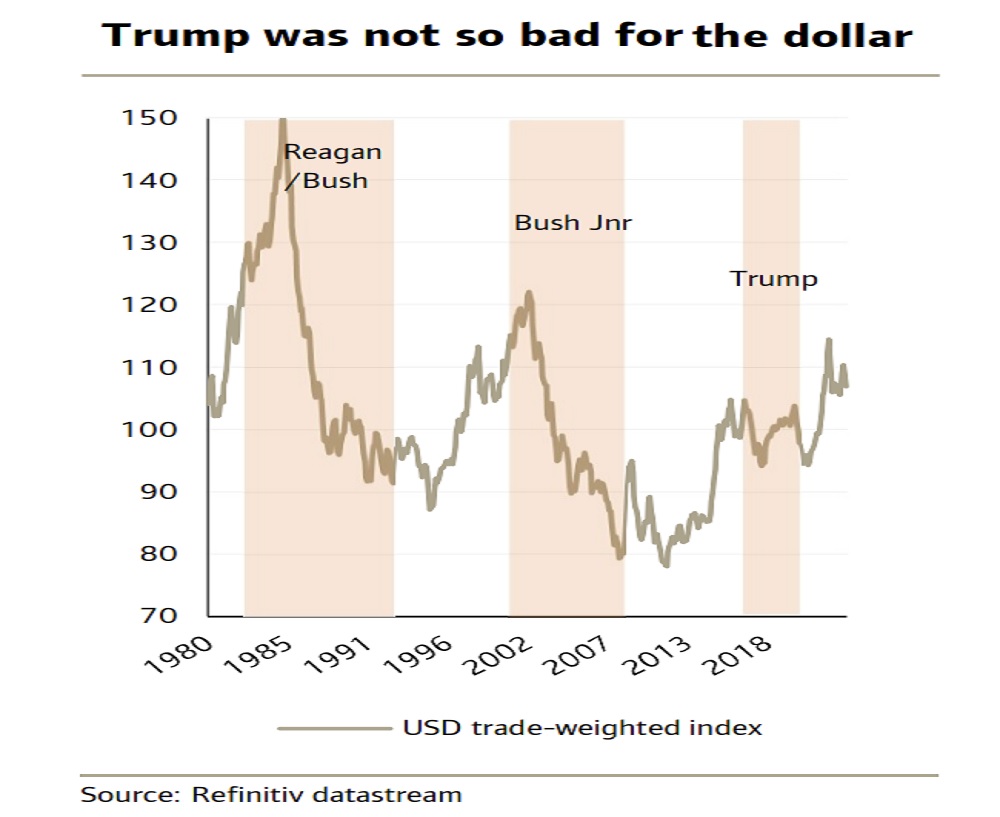

Politics could be a factor later in the year. But while the prospect of a second term for Trump could raise the hackles of many with thoughts of more protectionism, weaker support for NATO, and weakened climate-change action, it is not at all clear that this is negative for the dollar. History shows that Republican presidents are more likely to preside over a falling dollar, but Trump’s first term was a little better than his predecessors.

“Our view, that the dollar will slide a modest 5% or so this year, is largely dependent on rate cuts and firmer asset prices, not any particular outcome from November’s election”, said Standard Bank.