Inflation pressure: Bigger risk from surging food prices

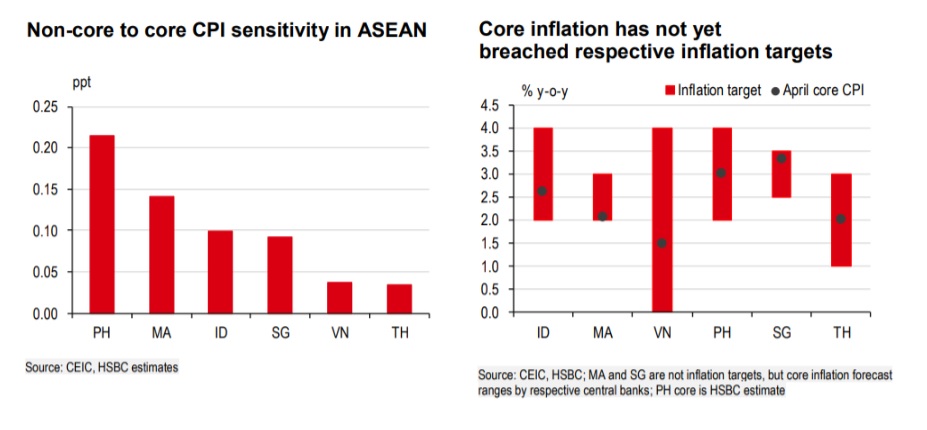

While rising energy prices were the main driver of inflation in most ASEAN markets in the first few months of 2022, the bigger risk now stems from surging prices for food on world markets.

All economies have seen a y-o-y tick-up in food prices, with food inflation in Thailand and Indonesia hitting 5% y-o-y.

There are clear echoes of the 2008 “food price scare” in Asia, when soaring energy costs further amplified the pressure on agricultural markets (for example through higher fertilizer and transportation costs). Moreover, like in 2008, the adoption of trade restrictions by major food exporters now raises the risk that prices could climb even further.

Nearly all global food price categories are ticking sharply higher since the start of 2022, particularly cooking oils. The surge in food prices is broad-based, in part due to severe disruptions to agriculture production in Eastern Europe, with the impact now amplified by export restrictions.

India, as the world’s second largest wheat producer, has imposed a wheat ban since mid-May, leading to an immediate 7% jump in wheat prices, and introduced some caps on sugar exports. Similarly, Indonesia, the biggest palm oil producer and exporter, also recently imposed a three-week export ban on palm oil exports, while Malaysia has restricted the export of chicken.

Fortunately, ASEAN’s main staple – rice – has only seen a moderate rise since the start of 2022, and remains below even its peak in 2021. This is good news for the region, with Indonesia, the Philippines and Malaysia being sizable net rice importers. In HSBC’s view, this is unlikely to offset the broad-based price rise for other food items, and with food comprising such a large share of CPI basket in many economies, notably in the Philippines and Vietnam, headline inflation is bound to rise further.

How bad is it? All economies have seen a y-o-y tick-up in food prices, with food inflation in Thailand and Indonesia hitting 5% y-o-y. In Thailand, meat prices also remain elevated, largely due to African Swine Fever-fuelled disruptions in local pork production, ultimately pushing up prices of alternative meat, such as chicken. Things are comparatively better in Vietnam, given relatively stable local production at the moment, but even here rising energy prices and higher global prices for food could ultimately push up local costs.

Similar to soaring energy prices, authorities are also seeking fiscal measures to offset high food prices. Malaysia has further allocated RM680m (USD155m) to stabilise prices for essential goods, including a RM40m (USD9.6m) subsidy package for general use flour. In the Philippines, the Duterte government plans to bring down prices by liberalising the importation of meat and corn. The MFN rates for pork, chicken, and corn currently range from 30-40%, and Duterte’s economic managers are looking into reducing these rates. Similar to the success of the Rice Tariffcation Law, liberalising these key commodities will be quick and effective, not only in tempering the increase in food prices, but in directly relieving household budgets as well.