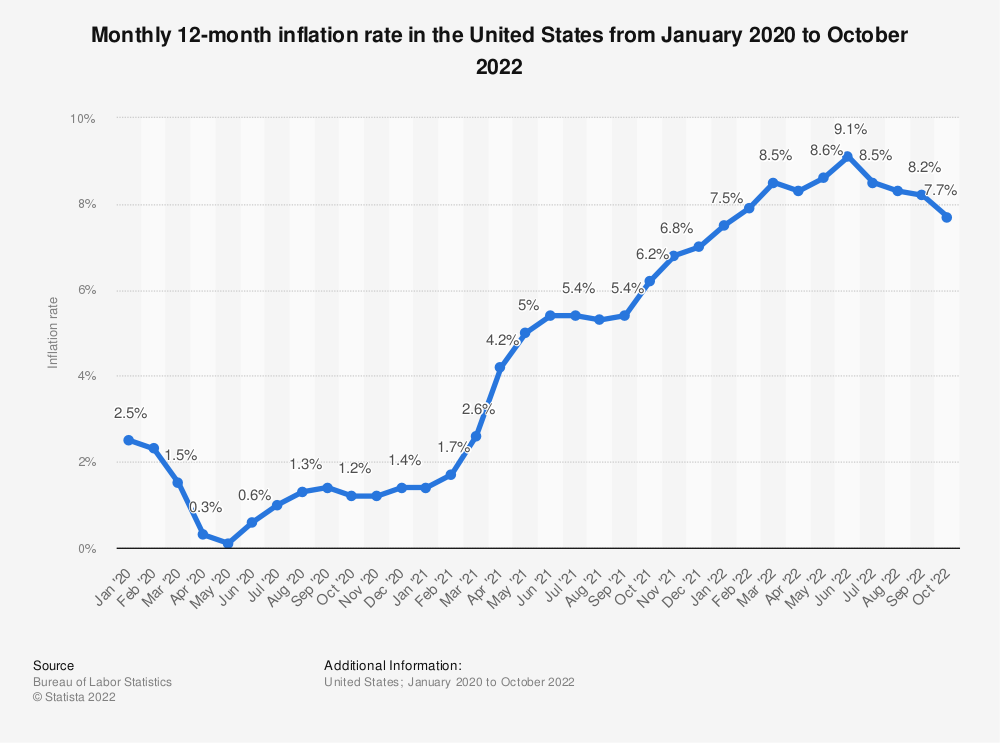

Is the "pain” in the US economy sufficient to bring inflation back to target?

They say that if there’s no pain then there’s no gain and we can arguably put the Fed and other central banks in this category. They need to create pain in order to extinguish rampant inflation but, as far as we can see, there’s still far too little pain in the US.

Last Friday’s payroll data from the US showed another very healthy monthly rise of 263k in November and the unemployment rate of 3.7% is still just a whisker above the record low.

>> How strong is the U.S economy?

Last Friday’s payroll data from the US showed another very healthy monthly rise of 263k in November and the unemployment rate of 3.7% is still just a whisker above the record low. It is another in a long line of data that suggests the “pain” in the US economy is not sufficient to bring inflation back to target. There’s still over 10.3 million job vacancies in the US; well in excess of the 6 million unemployed. This ratio of vacancies-to-unemployed has come down from the peak of around 2 but, at just over 1.7 right now, it is still historically very elevated indeed and clearly not indicative of too much pain within the labour market.

Of course, we can point out that there might be a lot of people in work, and a lot of job vacancies, but wages have slipped far behind inflation. Surely this represents significant “pain” for the working population? It does, but we have to look at household wealth in the round, not just the wages component. It is important to do this right now because households still have very large amounts of “excess” savings built up from the pandemic; both from their inactivity at the time (being unable to go to restaurants etc) and the considerable handouts from the government.

The Federal Reserve estimates that “excess” savings (which compute the level of savings above and beyond the levels households would have accumulated based on pre-pandemic trends) were a huge USD2.3 trillion at their peak in Q3 2021 and were still standing at USD1.7 trillion in the middle of 2022. This is a very unusual situation borne, of course, of a very unusual shock– the pandemic. It does not imply that households are pain free, but what it does suggest to us is that the pain might still not be sufficient to force behaviour to change in the way the Fed needs in order to squeeze a sufficient amount of inflation out of the economy.

What about firms? Mr. Steve Barrow, Head of Standard Bank G10 Strategy said it does not look to us that the pain is sufficient. The best way to see this is to look at profits and particularly profit margins. If firms were experiencing real pain, we’d expect profit margins to be squeezed hard, but that’s not happening, at least not yet. In fact, it is quite the reverse with margins at 15.5% in Q2; the highest since 1950. Profit levels too are at very lofty levels suggesting that, increases in costs have been more than matched by increases in prices. Unsurprisingly, there’s expectations that margins and profit levels will fall.

>> Will the US economy enjoy a soft or hard landing?

“We don’t doubt that this will happen in time but it does not take anything away from our view that the pain being felt in the corporate sector is very limit ed right now and probably won’t become sufficient to bear down on inflation in the way the Fed needs in the future”, said Mr. Steve Barrow.

The upshot of all this is that, although consumer and business sentiment is pretty pessimistic, and although the economy looks as if it is heading for a recession, the pain may still not be sufficient to bring inflation back to target on a sustainable basis. Right now, we seem to have an economic downturn with no rise in unemployment, consumers with healthy balance sheets, and firms that are still racking up large profits. “These things will change in time but whether they change enough to bear down on inflation is questionable in our view. If we are right, the Fed could go much harder than we all expect but, more likely, the bank will accept higher inflation than it did before”, emphasized Mr. Steve Barrow.