Jackson Hole symposium could sap appetite for gold

Many analysts projected that Fed Chairman Powell will confirm that interest rates would continue to rise at the 2022 Jackson Hole Economic Symposium, which will take place from August 25–27. This can negatively affect gold prices the following week.

Next week's big catalyst will be the Federal Reserve Chair Jerome Powell's keynote at the Jackson Hole titled 'Economic Outlook,' which is scheduled for Friday.

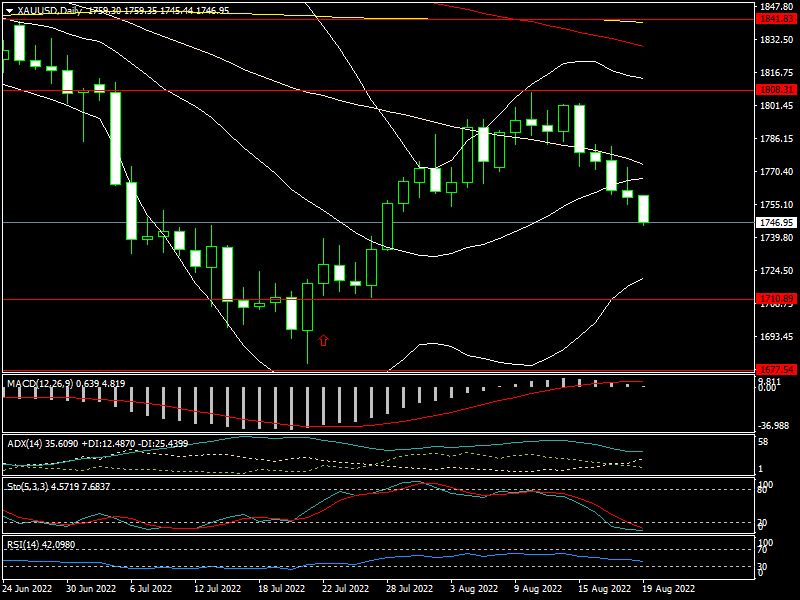

As anticipated, there has been significant selling pressure on the price of gold on the world market this week. As a result, the price of gold has steadily decreased from 1,801 USD/oz to 1,745 USD/oz before closing at 1,746 USD/oz.

The prices of SJC gold bars quoted by DOJI Group dropped from 67.55 million dong/tael to 66.85 million dong/tael on the Vietnamese gold market.

Although US inflation slowed down in July (July CPI climbed by 8.5% YoY, substantially lower than 9.1% in June), the market still anticipated that the FED will raise interest rates at its September meeting, which contributed to a dramatic bounce in the USD index from 106 points to above 108 points.

The minutes of the July FOMC meeting revealed that Fed policymakers concur that the tightening cycle must eventually slow down. However, they think the Fed should wait to assess how rate increases affect inflation.

Analysts opined that the aforementioned minutes were not a guarantee that the Fed's actions were correct. The FED Chairman will have a more defined opinion on rate hikes at the next Jackson Hole economic symposium.

The current state of the US economy demonstrates that, despite the fact that this nation's economy has grown negatively in the first two quarters of the year (-1.6 percent in Q1 and -0.9 percent in Q2), its labor market is stable, especially since the unemployment rate is only 3.5%, which is the lowest level in many years. While July's retail sales were unchanged from the same month last year. However, this number increased by 0.4% when auto sales were excluded. Significantly, online sales rose quickly. This demonstrates that despite high inflation, US consumers are still willing to "split their wallets."

It is impossible to determine whether the US economy has just entered a technical recession or a true recession because there are still data on the labor market, retail sales, CPI, PCE, and PPI... from August available until the FED's next meeting in September.

Given the current circumstances, many analysts predicted that the FED Chairman may still be upbeat about the US economic outlook and predict that inflation may have crested at the next Jackson Hole Conference. In the forthcoming meetings, he won't specify a rate hike but will reiterate that monetary tightening will keep inflation under control.

Gold prices may continue their downward trend next week

ING chief International economist James Knightley said: "We now support 50bp movements in September and November with a final 25bp hike in December. However, should payrolls rise significantly once more (350k) and inflation rise, then we would probably convert to a 75bp hike on September 21."

Gold prices may continue their downward trend the following week if the Fed Chairman indicates at the next Jackson Conference that interest rates will be raised further.

Prior to the Jackson Hole symposium, senior commodities broker at RJO Futures Bob Haberkorn also foresaw lower prices the next week, adding that the U.S. dollar would rise dramatically. In this atmosphere, he claimed, gold had a difficult time rallying. "Gold's support lies between $1,720 and $1,700. Below that point, there will be buying. Its $1,800 resistance level.