Lower interest rates to support margin lending activities

The interest rates have dropped strongly over the past few months. This fact will provide support for margin lending activities.

Transactions at BSC

To investigate margin yield trending, VNDirect decided to look at the spread margin, which is the difference between lending yield and the cost of debt. Its observation showed the sector’s spread margin normally falls between 4.0 and 7.0%, depending on the market’s condition. It discovered a negative relationship between margin yield and interest rates, suggesting a lower interest rate environment could promote better yields for brokerage firms. This could be explained by the fact that lowering deposit rates leads to a more attractive securities market, impelling investors to trade and lever their assets in order to capture investment opportunities.

During 2Q23, aggregated spread enhanced to 5.6% from the 4.2% level in 1Q23, mainly driven by a decrease in interest rates as 12M average deposit rates reduced from 8.0% in 1Q23 to 7.3%. In 2H23F, sector spread margin could improve meaningfully from the 5.6% level during 2Q23 as interest rates kept increasing since the SBV cut its policy rates four times during the end of 2Q23. Top brokerage firms with a higher margin spread than peers in 1H23 include: AGR, MBS, BSI, SSI, and SHS.

Ms. Nguyen Thanh Phuong, analyst at VNDirect, expects a strong bounce in the sector’s total margin loans thanks to the recovery of the stock market and lower margin rates. The average trading value during 2Q23 on three main exchanges improved impressively by 48.4% QoQ to VND16.5trn. Besides, at end-2Q23, the aggregated sector’s total margin loans/shareholder’s equity reached only 0.77x, leaving ample room for margin loan growth as the regulated threshold is 2.0x.

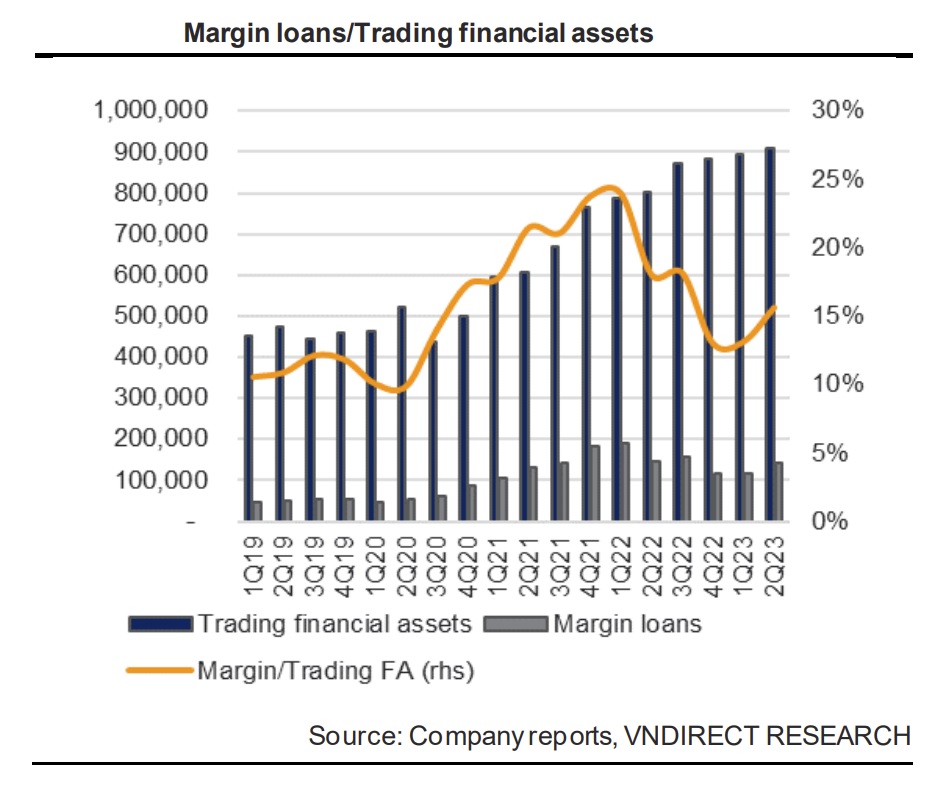

To find the optimal number for the sector’s margin loan, VNDirect decided to take a bottom-up approach based on the total value of traded financial assets and its linear correlation with sector margin loans. VNDirect expects VN-Index to reach 1,300 pts in 2H23, representing an upside of 16% from the 1,120 pts level at the end of 2Q23. Thus, it is projected that the total value of financial assets trading at the Vietnam Securities Depository (VSD) will grow at the same momentum (16%) to around VND910 trillion from VND784 trillion at the end of FY23 (data collected from the top 30 listed brokerage firms in terms of asset size).

Incorporating the range of sector margin loans into the total value of listed assets in the recent 3 years, which was around 17% to 20%, VNDirect expects total margin loans for the whole market could reach VND155–180 trillion during 2H23, implying an increase of 10–30% from the VND140 trillion level at the end of 2Q23. With total shareholders’ equity (SE) of 30 brokerage firms reaching VND183tr at end-2Q23, this infers a potential ratio of sector margin/SE of 0.85–1.0x for the period.

“We believe those with low-margin loans or SE and a high margin spread, together with a strategy not focusing on expanding their investment books, could be able to catch the new margin lending wave, which includes SHS, AGR, SSI, BSI, and MBS”, said Ms. Nguyen Thanh Phuong.