Luxury items could be less risky

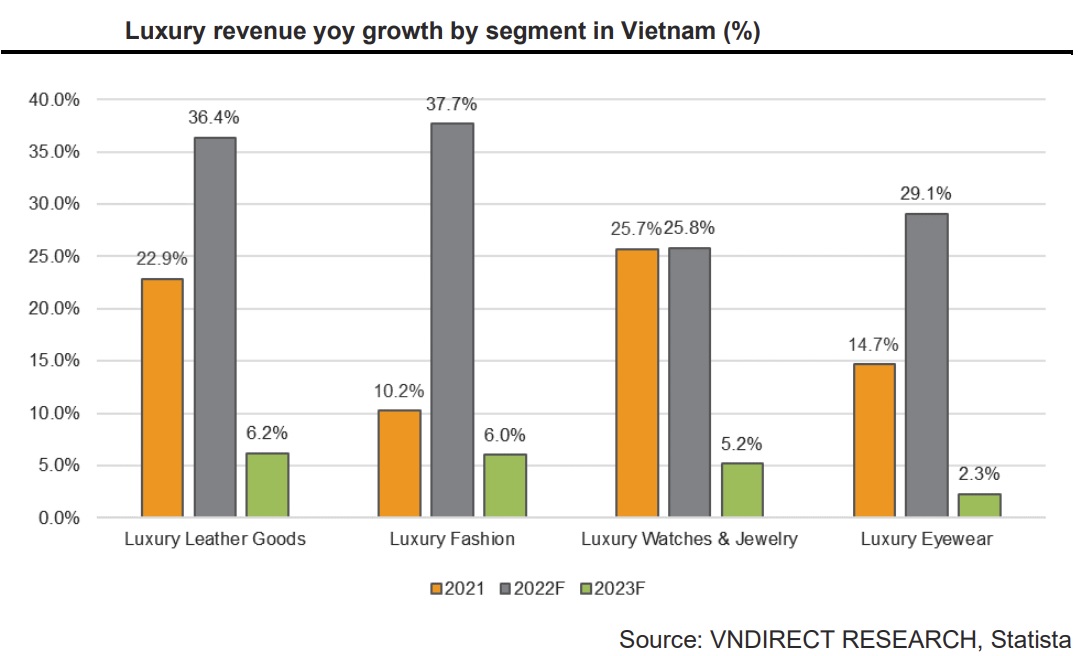

Vietnam's market for luxury personal items, which reached US$976 million in 2021, is predicted to rise 6.7% annually to US$1 billion in 2025F, according to Statista.

PNJ's jewelry market share increased from from 25% in 2017 to over 60% in 10M22.

>> Consumer spending may face a pullback

The wealthy are frequently the last to experience the consequences of inflation because of the cushion that their excessive wealth offers, even when spending among lower-income consumers is being squeezed. According to a Knight Frank estimate, there would be approximately 72,135 people in Vietnam in 2021 with liquid assets worth more than $1 million USD.

Vietnam's luxury market, albeit still in its infancy, is predicted to expand dramatically over the coming years as a result of the development of high-net-worth individuals, who have an expanding hunger for luxury goods and services (luxury travel, jewelry, cars, high-end digital devices, etc.). Despite the current challenges, wealthy consumers will likely grow more picky, but we think brands and businesses with significant exposure to luxury items may be less at risk from this slump in consumer purchasing.

According to Statista, the market for fine jewelry and watches is expected to grow at a faster rate than the market for luxury personal products in Vietnam, with a CAGR of 8.5% expected between 2021 and 2026F. PNJ is therefore anticipated to profit from this growth momentum given its dominant market share in the jewelry business, strong brand recognition, and extensive range of items in the luxury jewelry and watches area.

With consumers favoring better branded products, PNJ's jewelry market share increased from from 25% in 2017 to over 60% in 10M22. Revenue and net profit for PNJ reached VND2,961 billion and VND147 billion in Oct. 22, respectively, gaining 42.4% year over year and 21.5% year over year.

In order to maintain its market position in the mid-high-end jewelry items with more sophistication and fashion style, PNJ is anticipated to construct a new factory with higher technology than the current one in the near future.

>> Enterprises minimize costs to support consumers amid price hikes

With a retail price of between VND25m and VND47m, or 3.7x and 7.0x the average monthly pay in Vietnam, the iPhone 14 might be categorized as a luxury item. By the end of 2Q22, the iPhone held a 15.4% (8.3 pts% yoy) market share among the top 5 selling smartphones in Vietnam. Reiterating the high demand for Apple products, Apple Vietnam disclosed that the volume of iPhone 14 shipments to Vietnam has doubled compared to iPhone 13 shipments.

However, there are currently shortages of Apple products because Foxconn, which manufactures 70% of China's iPhones, has cut back on production because of the Covid-19 lockdown. Therefore, Mr. Phan Nhu Bach, an analyst at VNDirect believes the influence of iPhone 14 series debut may turn favorable since 1Q23F, later than early forecast in 4Q22. He anticipates that DGW, FRT, and MWG, which each receive a sizeable portion of their revenue from Apple products-roughly 30%, 20%, and 14%, respectively- will benefit from this development.

Statista predicts that in FY23F, sales of high-end clothing and leather items in Vietnam would be US$550 million (up 6.1% year over year). As a result, major international brands like Chanel, Kering, Louis Vuitton, etc. are the dominant participants in this sector in Vietnam, accounting for more than 50% of the fashion market share and 80% of the leather goods market share. Major international brands must retain storefronts in city centers and malls, maintain a high level of foot traffic, and be able to create a sustained demand for shopping in these areas if they want to continue growing and dominating the market.