Major currencies remain stuck

Euro/US dollar has rarely strayed from a 1.05-1.10 range all year while, more recently, US dollar/yen has become stuck at a single level – which is 150.

The other major currency that is stuck at the moment is euro/dollar, as the 1.05-1.10 range has captured just about all of the activity so far this year.

>> Which currencies stand to gain from geopolitical conflict?

There’s a clear sense that G10 currency markets are stuck. The reason for the statis is pretty clear when it comes to dollar/yen. It has happened because Bank of Japan policy is geared to maintain a fixed trading band for 10-year JGBs; the top of which is set at 1%.

The Standard Bank said maintaining this band in the face of surging global yields, particularly treasuries, means that the BoJ has to allow yen weakness. But it does not want to do this or, at least, it does not seem to want the yen to weaken much more than the 150 level against the dollar given its intervention in this region just over a year ago. For the moment, the FX market seems to be respecting the BoJ’s wishes on both fronts: 10-year JGB yields are below 1%, at around 0.87%, and dollar/yen is a fraction below 150. But in our view this statis is untenable.

In short, the Bank of Japan and the government has to choose whether it wants to stabilise 10-year JGB yields or the yen; it cannot do both. Unsurprisingly, the rise in JGB yields towards the top of the permitted range and the rise in dollar/yen to 150 has provoked speculation that the BoJ will tweak policy as soon as next week’s meeting. In the past the BoJ has been forced to widen the JGB range to avoid excessive yen weakness but this has had limit ed success.

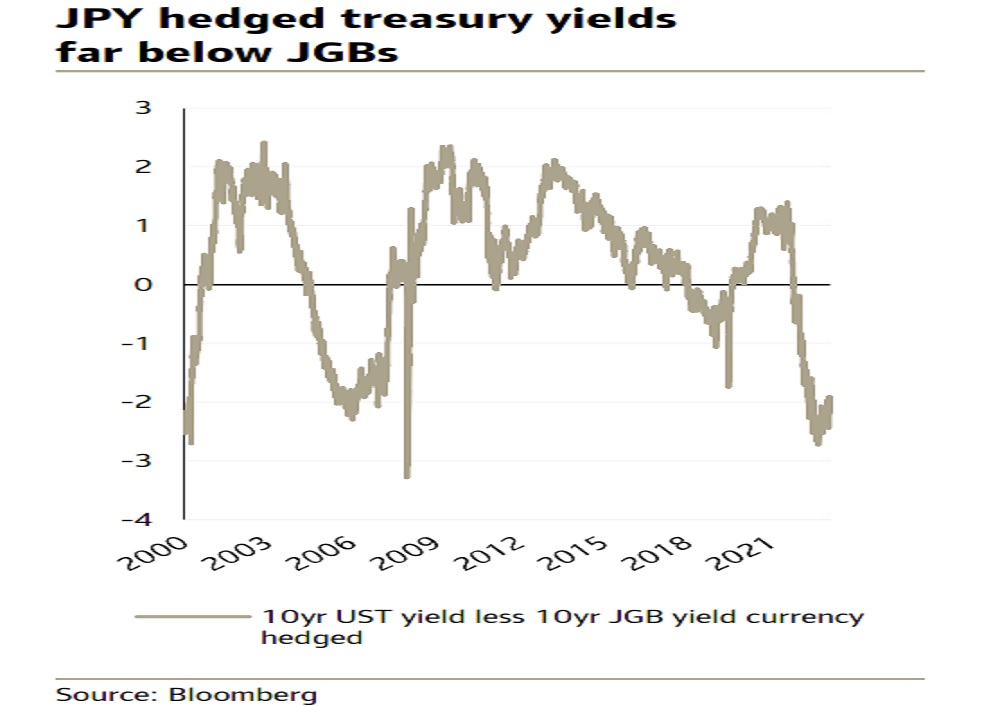

Another widening now might take some of the pressure off the yen but, in reality, if it really wanted to take the strain off the yen it would need to abandon the JGB band altogether and let yields settle at market -clearing levels. The Standard Bank also believes that it needs to lift short-term rates in order to reduce the high funding costs for hedged positions in US treasuries. For these high funding costs appear to have forced Japanese investors to err towards unhedged treasury purchases from hedged transactions and that inevitably lifts the dollar against the yen as unhedged trades take place in the spot or forward market, not the swaps market. But will the BoJ lift short-term policy rates and the JGB target at the same time?

>> Debt woes for the US dollar

It seems unlikely, in the Standard Bank’s view. If this proves correct, the scope for dollar/yen to stay below 150 would seem limit ed even if the market gives the BoJ the benefit of the doubt ahead of the October 31st meeting. But while a short-term, and possibly modest rise above 150 seems likely for dollar/yen, the longer-term outlook seems to be one of yen recovery as the BoJ tightens policy and, eventually removes the 10-year JGB target range. At the same time the Fed should start to ease policy and that should help push previously unhedged Japanese treasury holders back into hedged positions; so relieving the upward pressure on dollar/yen. Hence, in the long haul it’s possible to see dollar/yen slipping back to the 120-130 range in our view but clearly any dollar/yen bears are going to have to play the long game on this one.

The other major currency that is stuck at the moment is euro/dollar, as the 1.05-1.10 range has captured just about all of the activity so far this year. It might not be as easy to see the causes of this as it is in dollar/yen. The Standard Bank’s view is that there’s a fundamental juxtaposition at the moment, particularly within the US. On one side, high US rates and what’s been termed US ‘exceptionalism’ seem to be lifting the dollar. This ‘exceptionalism’ will likely be shown again this week with a third quarter GDP print in the US that’s north of 4% in annualised terms. But this outperformance seems unable to generate much more dollar strength, at least against the euro because there is a growing sense here that the steps the US has taken, and is taking, to maintain this outperformance are jeopardising the long-term health of the economy and hence the dollar.

The US is able to take financial liberties by virtue of its dominant global position, particularly when it comes to the dollar. Debt dynamics, for instance are very poor and US governance leaves a lot to be desired as well. The rest of the world is on the hook for a lot of US debt and there is this underlying concern that the US might be stretching foreign pockets. For now, high US rates and general risk aversion may be papering over these cracks but, in time, as the cracks widen, we expect euro/dollar to be able to rally to 1.30 and beyond.