Meat producers recorded a mixed performance

Based on VNDirect’s statistics, aggregated revenue of listed meat production companies plunged 39.7% yoy in 1Q22, and net profit also declined 37.4% yoy.

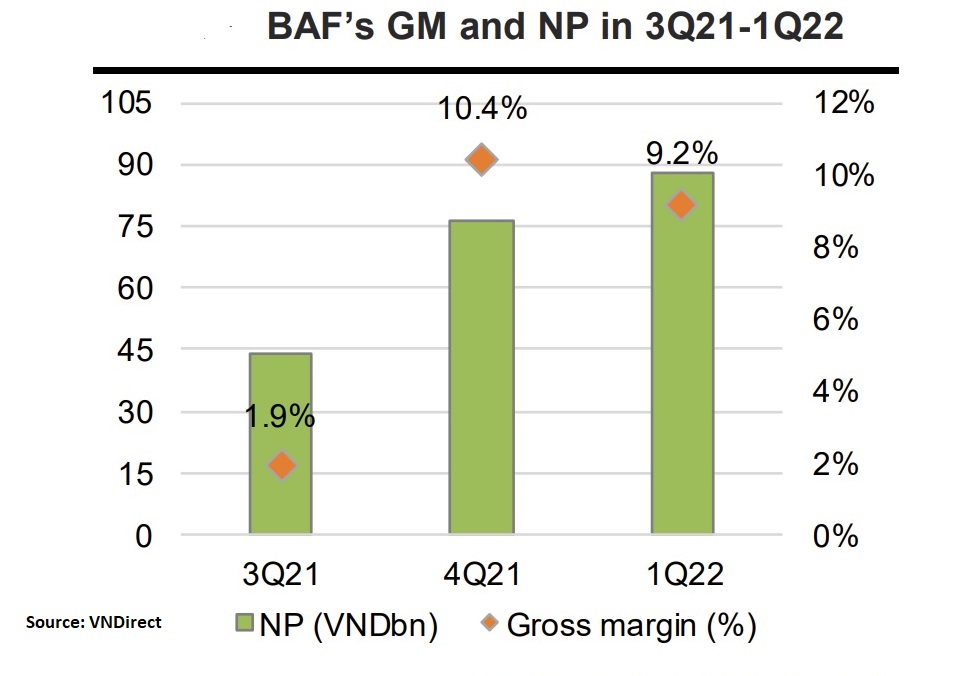

BAF Vietnam Agricultural JSC (BAF VN, HOSE) reported negative revenue growth in 1Q22 of 36.9% year on year

Top meat production companies recorded negative earnings growth in 1Q22, including DBC (-97.6% yoy) and BAF (-7.8% yoy). In VNDirect’s view, aggregated revenue declined mainly due to a sharp 30.7% drop in live hog prices in 1Q22. Besides, BAF actively cut revenue from the agricultural trading segment and MML no longer recorded revenue from the animal feed segment, which also contributed to the decline in aggregated revenue.

Meanwhile, the total gross margin of meat producers declined significantly by 13.2% yoy in 1Q22 due to higher input material prices for animal feed and lower output prices. Based on VNDirect’s estimate, wheat, corn, and soybean meal increased strongly by 46.9%, 24.8%, and 6.5% yoy in 1Q22.

BAF Vietnam Agricultural JSC (BAF VN, HOSE) reported negative revenue growth of 36.9% year on year as the company actively reduced agricultural product sales volume to focus resources on 3F business. However, the company's GM expanded by 3.8% pts yoy in 1Q22. In which, the GM of the Farm & Food segment improved by 2.3% yoy in 1Q22.

Ms. Ha Thu Hien, analyst at VNDirect, said BAF has an advantage in input materials compared to its competitors. In which, raw materials for BAF's animal feed production are imported from Tan Long Group at a price 10-15% lower than peers. Hoang Anh Gia Lai JSC (HAG VN, HOSE) also recorded a 16.4% point increase in GM, in which the pork segment rose 9.0% points, mainly thanks to lower material costs than other competitors.

According to BAF’s Board of Directors, this company has taken advantage of the waste bananas from the fruit business as an input material for animal feed production. Therefore, the company was not affected by higher global agricultural prices in 1Q22.

Dabaco Group (DBC VN, HOSE) recorded a sharp drop in core business gross margin of 16.5% pts due to higher raw material prices for animal feed production. As a result, DBC's net profit fell 97.6%, much lower than our projection.

Ms. Ha Thu Hien estimated the gross margin of the pork segment to drop significantly from 18.1% in 1Q21 to 12.1% in 1Q22, while the branded chicken business brought in a negative gross margin of 1.8% in 1Q22, up 8.7% against the negative 10.5% of 1Q21.

"We believe the weak results were due to the spike in feed ingredients prices and a 30.7% yoy decline in live hog prices in 1Q22. In our view, live hog prices cannot increase sharply following input material prices as meat consumption demand has not fully recovered compared to pre-COVID-19 levels. Meanwhile, the pork supply remains stable and is on the way to recovering after the ASF epidemic", said Ms. Ha Thu Hien.

Many analysts forecasted that meat production companies would continue to face many difficulties and challenges in the months to come.