Next week's gold price: Impacts from US inflation

The release of US inflation data next week will have a direct impact on gold prices.

In the Vietnamese gold market, the price of an SJC gold bar reported by DOJI varied between VND 74 and VND 77 million per teal

>> Will the gold price surpass its all-time high in 2024?

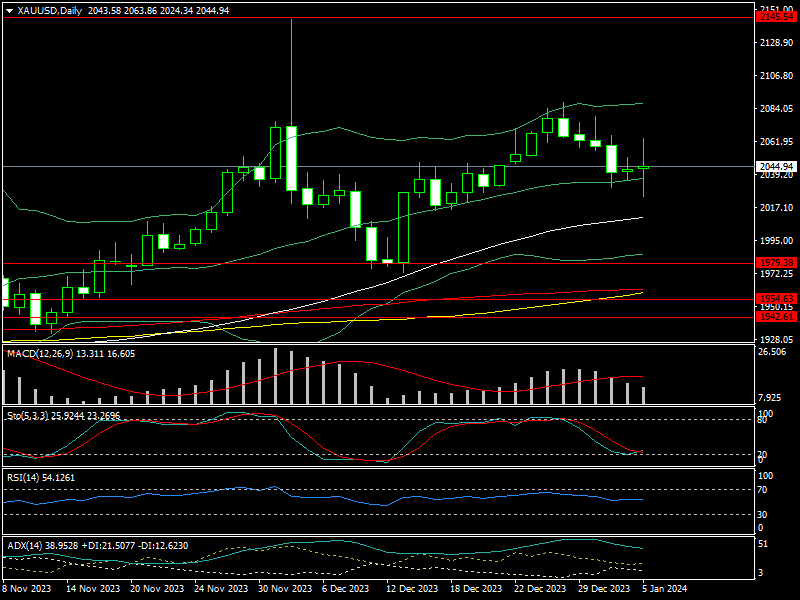

This week, after the first two days of the week, gold has been heavily sold off following the release of the December report of the FOMC meeting. This suggests that the Fed may be hesitant to lower interest rates. Then, the December NFP employment data from the United States, which was announced at 216,000 jobs, above the projection of 170,000 jobs, pushed the gold price to its session low of $2,025/oz. However, the service PMI was lower than predicted, causing the gold price to rise to $2,063, before falling to $2,044/oz.

In the Vietnamese gold market, the price of an SJC gold bar reported by DOJI varied between VND 74 and VND 77 million per teal.

The jobs data in the United States shifted market expectations for a March interest-rate decrease, which FedWatch now anticipates would be about 56%.

However, Philip Streible, Chief Market Strategy Officer at Blue Line Futures, stated that the Fed's expectations for interest-rate reduction remained strong, despite the fact that some experts felt the recent US jobs report indicated the emergence of cracks in the labor market. He observed that the enormous number of jobs reported in the government's December report appeared to mislead the data.

Meanwhile, in the last FOMC meeting, three interest rate decreases were anticipated for 2023. Furthermore, the Fed Chairman's statement following the most recent FOMC meeting, as well as the Dot Plot chart projections, demonstrate this. Thus, despite deferring interest-rate reduction until 2Q24, many analysts believe the Fed will lower rates at least three times in 2024.

The December US Consumer Price Index data will be significant next week. The December CPI is expected to grow by 3.2% over the same month last year, according to forecasts. If the CPI falls more dramatically than predicted, the Fed is expected to raise interest rates in March, bolstering gold prices next week. On the contrary, the gold price will be under pressure next week.

>> What are the prospects for gold prices in 2024?

Although the CPI in the United States has fallen from its peak in 2022, some analysts believe it will remain around 3% in the future. While core CPI is likely to continue around 4%, that is more than double the Fed's aim. As a result, the Fed still has work to do to reduce inflation to the 2% objective.

Gold prices may swing around $2,000/oz next week

Although US inflation is far higher than the Fed's objective, Mr. Colin, an independent foreign exchange expert, believes the Fed cannot continue to postpone interest-rate reduction indefinitely. If the Fed does not lower rates at its March meeting, it will do so at the following meeting. Because America's manufacturing, services, and labor market continue to confront problems. There is a risk of a recession in the United States if interest rates remain too high for an extended period of time. However, the Red Sea issue is threatening to spike inflation again, which the Fed may weigh in its monetary policy approach.

According to technical analysis, the gold price will find important support next week near $2,010/oz (MA50). If it remains above this level, it is expected to test the $2,075 to $2,100/oz zone. In contrast, it may drop to $1,985/oz.

While the short-term gold price is expected to swing, many analysts anticipate the medium and long-term gold price will climb.