NKG faces narrower export opportunities

As a coated steel sheet producer with a high export ratio, Nam Kim Steel JSC (HoSE: NKG) has been affected as many countries step up trade protection measures.

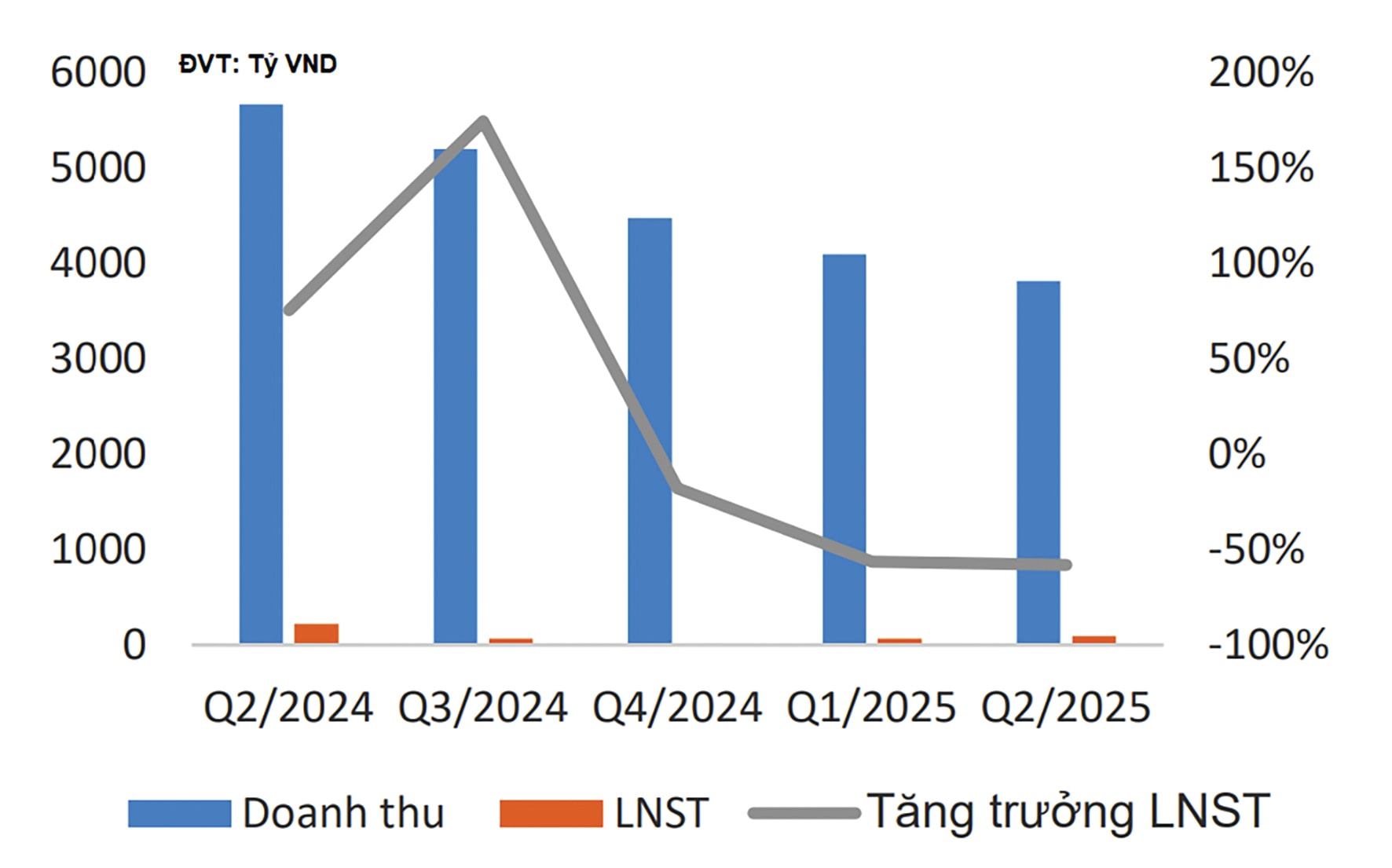

NKG’s revenue and profit over the years.

In Q2 2025, NKG’s export revenue plunged 50.6% as countries tightened trade protection policies.

Sharp Profit Decline

According to its Q2 2025 consolidated financial report, NKG recorded revenue of VND 3.808 trillion, down 33%, and after-tax profit of only VND 91.5 billion, a 58% drop from the same period last year. For the first six months of 2025, the company posted revenue of VND 7.899 trillion, down 28%, and after-tax profit of VND 156.9 billion, also down 58% year-on-year.

For 2025, NKG targets total revenue of VND 23 trillion, up 11%, and pre-tax profit of VND 440 billion, down 21% from last year. After the first half, the company has achieved only 34% of its annual revenue target and 44% of its profit goal.

As of June 30, 2025, NKG’s total assets rose 21.9% from the start of the year to VND 16.479 trillion. This includes VND 6.127 trillion in inventories (37.2% of total assets), VND 3.010 trillion in long-term work-in-progress (18.3%), VND 1.870 trillion in fixed assets (11.4%), VND 1.628 trillion in cash and short-term financial investments (9.9%), and VND 1.620 trillion in short-term receivables (9.8%).

On the liabilities side, total short- and long-term borrowings increased 8.6% from the start of the year to VND 6.856 trillion, equivalent to 90.5% of total equity. Short-term loans made up the majority, at VND 5.468 trillion.

Export Markets Stalled

Vietnam’s steel exports are facing significant headwinds due to trade defense cases. According to the Trade Remedies Authority of Vietnam, the country’s exports have faced 252 trade remedy investigations from 24 markets, with the steel industry alone involved in more than 70 cases.

Agriseco reported that NKG’s Q2 2025 business results were hit hard as export markets “stalled.” In the quarter, the company’s export revenue slumped 50.6% as countries increased trade protection.

With a high export revenue ratio and a focus on markets such as the EU and North America, NKG has been negatively impacted by trade defense measures. Currently, NKG faces two types of duties when exporting to the US: a preliminary anti-dumping duty of up to 49.42%, effective from April 4, 2025; and a basic import tariff on steel products raised from 25% to 50% from June 4, 2025. In addition, the company faces the risk of countervailing duties due to the US Department of Commerce’s subsidy investigation.

Domestic Market as a “Lifeline”

Domestic demand is expected to recover thanks to growth in the construction sector and the acceleration of public investment projects in the latter part of the year. The anticipated imposition of anti-dumping duties on coated steel sheets (AD-19 case), possibly as early as August or September 2025, will also support domestic consumption for NKG in particular and steel producers in general.

To sustain its domestic market presence, NKG is investing in a roofing steel sheet plant and expanding production lines for electrical steel used in electric motors, automobiles, and transformers, aiming to serve the high-end supporting industries segment, where price competition is less intense than in coated steel products. This strategy will help NKG strengthen its market position, create a foundation for long-term growth, and reduce reliance on exports.

NKG has raised investment capital for the Nam Kim Phu My Roofing Steel Sheet Plant project for the second time to diversify its product portfolio. The total investment for the project has been increased by VND 400 billion to VND 6.2 trillion, implemented in two phases until 2027. The capital increase is intended to finance production lines, technology, and electrical steel for use in electric motors, automobiles, and transformers.

Earlier, in April 2025, NKG had already adjusted the project’s investment capital from VND 4.5 trillion to VND 5.8 trillion. Notably, in January 2025, the company completed a rights issue of 131.6 million shares to existing shareholders, raising VND 1.58 trillion for the project.