Outlook for 2024 real estate market

As stated by the Fiin Group's expert team in the research 'Positioning Growth Drivers and Risks for Vietnam's Economy in 2024,' the real estate market prospects in 2024 are strongly dependent on managing bond debt difficulties.

Due to uncertain or low-growth economic expectations, private investments by domestic firms are projected to remain problematic in 2024, according to the expert panel. Meanwhile, when interest rates increase again, long-term capital remains a substantial concern.

The outlook for 2024 is still uncertain

The report estimates a significant demand in the real estate market but underlines supply-side problems. Legal difficulties influencing project completion and finance restructuring capabilities continue to be key roadblocks. As a result, Fiin Group considers the prospects for 2024 to be uncertain, relying mainly on attempts to address corporate bond defaults, particularly real estate-related debt. This will become obvious in 2024-2025, when the extended and delayed obligations are reviewed.

According to the expert team, banks are just now beginning to deal with poor real estate bond debt, as evidenced by a high percentage of corporate bond default breaches (approximately 14.6% based on total outstanding value) and a rising rate of non-performing loan generation.

Expectations for Circular 02/2023/TT-NHNN adjustments (credit restructuring requirements) and Decree 08/2023/NĐ-CP amendments (extension, deferral of corporate bonds) have a major cross-impact on bank lending, particularly for banks with inadequate capital buffers or bad debt coverage.

While business real estate credit has returned (21.86% growth in the first nine months of the year), it remains insignificant in contrast to demand. Long-term deposit interest rates have yet to decline, but short-term deposit interest rates have.

In the expert group's view, Vietnam has leeway to selectively ease fiscal and monetary policy, such as loan growth based on risk stratification or credit rating organization levels, at the moment.

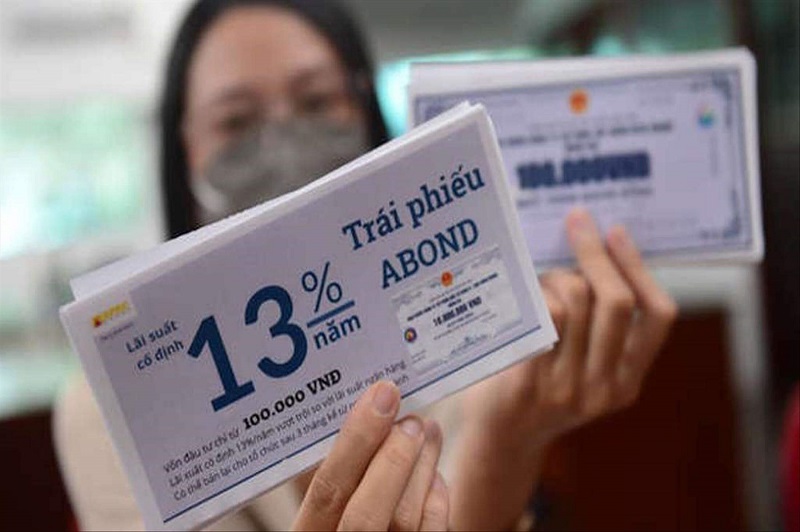

Increasing pressure to repay bond debt

Meanwhile, assessments from other market research groups point to a slow market picture, with bond maturity exerting growing pressure.

According to the Hanoi Stock Exchange (HNX), around 69 firms were on the list of postponed obligations to pay interest or principal on corporate bonds as of October 3, 2023, with a total debt of approximately VND 176.1 trillion. The majority of these are real estate firms.

Negotiations for an extension have been ongoing since April 2023, with largely positive outcomes. As of October 3, more than 50 issuing entities had agreed to extend the terms of bonds worth more than VND 95.2 trillion. The maturity extension is primarily for two years, increasing the debt repayment burden to the years 2025-2026. Experts, however, warn that debt extension does not imply debt eradication. Difficulties will continue to exist in the future.

The Ho Chi Minh City Real Estate Association (HoREA) recently released figures suggesting that the entire amount of corporate bonds due in 2024 would be VND 329.5 trillion, the highest sum in the previous three years.

VNDIRECT Securities Company, in particular, forecasted that the pressure of bond maturity would grow dramatically in the second quarter of 2024. At its height, the unit anticipated that there would be roughly VND 114 trillion in corporate bonds due in the fourth quarter of 2024.

Businesses must take advantage of this opportunity to restructure their loans. They must contemplate selling assets and even accept capital injections or losses in order to produce cash flow for debt payments and finish projects that can be promptly sold in the market.

This phase also gives investors a "quiet" time to halt, examine conditions, and strategize for more sustainable and successful participation.