Outlook for the deposit rate by year-end

After nearly two months of stagnation, deposit rates of some commercial banks began rising again in November.

Interbank rates have cooled down

Amid mounting exchange rate pressures, the State Bank of Vietnam (SBV) implemented several flexible measures in the money market to stabilize and manage the liquidity of the Vietnam banking system. During November, the SBV issued nearly VND 21.4tn T-bills, with interest rates of 3.7% - 4% for 28-day tenors.

Along with that, the SBV also injected approximately VND 315tn through the OMO channel at an interest rate of 4% and tenors of 7 days in order to relieve liquidity pressures in the system caused by consecutive withdrawals since October. As a result, the SBV made a net injection of VND 87.1tn into the system in November.

The interbank rates fluctuated greatly in November. Starting at 3.6% at the beginning of the month, the overnight rate skyrocketed to a 19-month high of 5.5% on November 4, 2024. This increase is believed to have been driven by mounting pressure on the Vietnam banking system’s liquidity following the State Treasury’s withdrawal of VND 110tn from three major banks in 3Q24.

However, interbank rates have gradually declined, reaching 3.3% by the end of November, thanks to the substantial injection made by the SBV during the period. Meanwhile, for tenures ranging from one week to one month, interest rates span between 3.8% - 4.2%.

Deposit rates to inch up further

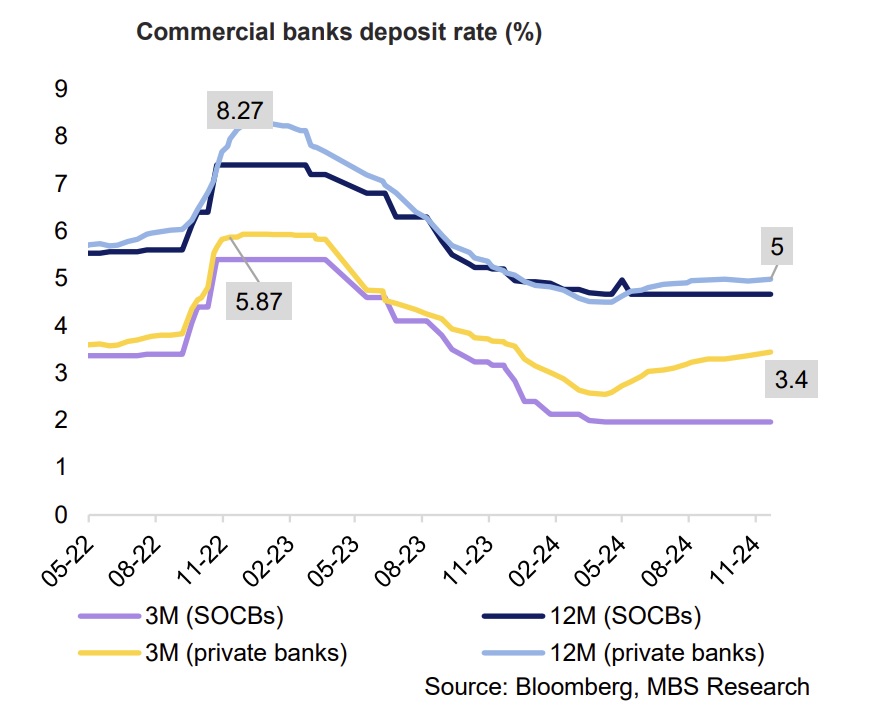

After nearly two months of stagnation, deposit rates began rising again in November, with 16 banks, including prominent ones such as Agribank, Techcombank, and MB, opting to increase their interest rates by 0.1% - 0.7%/year.

Since the beginning of December, 8 commercial banks have reduced deposit interest rates, including: ABBank, VIB, IVB, LPBank, Bac A Bank, KienLongBank, NCB and GPBank.

On the other hand, 11 other banks increased their deposit interest rates, including: ABBank, IVB, TPBank, GPBank, MSB, Dong A Bank, ABBank, OCB, VIB, Cake by VPBank and CB. Of which, ABBank increased interest rates twice in December.

This upturn in deposit rates is expected to continue toward year-end, as credit growth is expanding nearly twice as fast as capital mobilization.

According to the SBV, as of December 7, 2024, credit growth has increased by 12.5% compared to the end of 2023. Besides, the non-performing loan ratio of the Vietnam banking system at the end of September 2024 reached 4.55%, almost the same as at the end of 2023 and twice the level of 2% in 2022. Thus, this appeared to be another factor encouraging banks to bolster their reserve buffers to mitigate liquidity risk via attracting new deposits. By the end of November, the average 12-month deposit rate for commercial banks reached 5% (14 bps higher than that at the start of the year). Meanwhile, the rate for state-owned banks remained unchanged at 4.7%, which is 26 bps lower than that at the start of the year.

We observed a recovery in credit growth, coupled with robust production and investment growth, which may exert pressure on liquidity and potentially lead to an increase in deposit rates. As of December 7, 2024, credit growth had risen by 12.5%, higher than the 9% recorded in the same period last year.

However, on the downside, MBS expects subdued inflation and lower FED fund rates to create more room for easing monetary policy in Vietnam. Considering all these factors, this stock company anticipated that deposit rates would inch up by an additional 20 bps by year-end. Consequently, the average 12-month deposit rates of large commercial banks should range between 5.1% - 5.2% by the end of the year.