Picking stocks with signs of recovery

Investors should select stocks that show signs of recovery after adjusting to a strong support zone at attractive discounted prices and have had notable cash flow participation recently to disburse/open positions next week.

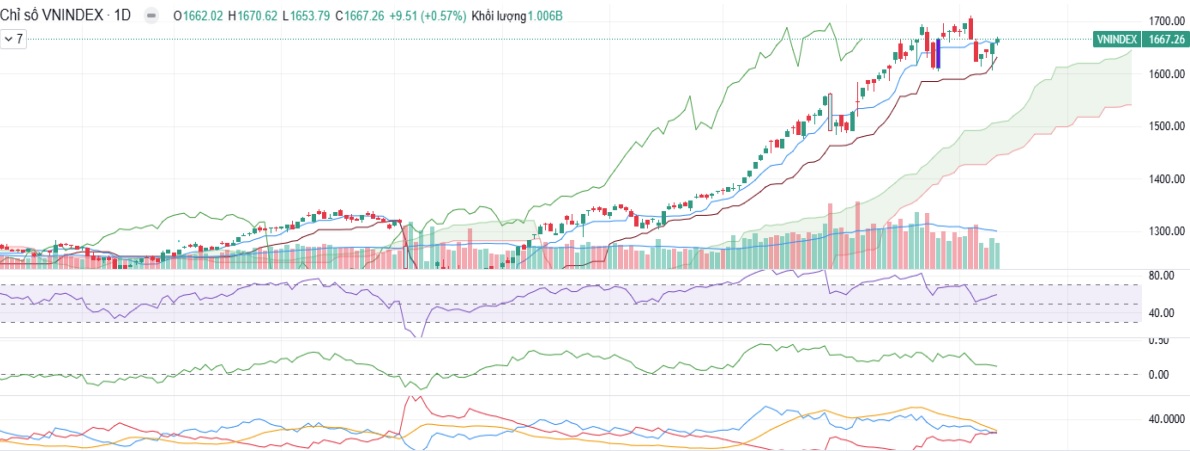

In the week of September 8 - September 12, VN-Index recorded a recovery after adjusting to the 1,620 zone in the first session of the week. Large-cap stocks were the main driving force to help the index balance, with some codes making outstanding contributions during the week such as VIC, HPG, MWG, and HVN. In addition, midcap stocks, after adjusting to the discounted price zone also attracted increased demand again, typically in the Construction, Public Investment, Steel, and Oil and Gas groups.

Liquidity in the recovery sessions (September 9-12) remained lower than the 20-session average, showing that cautious sentiment still exists in the market. Foreign investors increased net selling throughout the week and focused on selling mainly in HPG, MWG, and MBB.

In the last session of the week, September 12, VN-Index continued the recovery momentum from the previous sessions and opened in green with a slight increase. Except for some fluctuations around the reference level, the general index mainly fluctuated within a narrow range above this level throughout the morning session. Blue-chip stocks still played a major role in supporting the index with bright spots in VNM, HPG, HVN and BSR. In the afternoon session, the general index gradually widened its increase range to the 1,670 level and then fluctuated within the 1,660-1,670 range.

The highlight of the afternoon session was still the blue-chip stocks that maintained good growth momentum from the morning session such as: MSN, HPG, VNM, and HVN. Although green dominated with 252 green codes and 84 red codes, liquidity was still lower than the 20- session average and the divergence in the large-cap group somewhat slowed down the upward momentum of the VN Index. Foreign investors were net sellers with a total net value of VND 1,133.2 billion, focusing on selling HPG, SSI, and FPT.

At the end of the session, VN Index closed at 1667.26, up 9.51 points, equivalent to 0.57%. At the end of the week, VN Index increased slightly by 0.29 points (0.02%) compared to the previous week.

This morning, VN-Index rose by 0.42% to 1,674 with many stocks in uptrend, such as BCM, BID, ACB, HPG, MBB, STB…

VN-Index ended the weekend session with a green candlestick increasing points and moving towards the 1,670 mark in the upward recovery inertia after two sessions of adjustment to the 1,620 zone at the beginning of the week.

On the daily chart, the general index surpassed the 1,660 mark, at the same time as the Tenkan line and the MA20 line, showing that the momentum of VN-Index continues to be consolidated. The RSI indicator in an upward trend and the CMF indicator almost flat above the 0 mark show that the active buying money flow is moving well in the market, however, the /-DI line moves intertwined above the 25 mark, so the tug-of-war situation will still appear in the process of moving up to conquer the old points.

On the hourly chart, the RSI and MACD indicators are still in an upward trend and the general index has crossed the Senkouspan B cloud, contributing to strengthening the upward momentum of the VN-Index. The VN-Index is moving closely along the upper border of the Bollinger band and the DI and ADX lines have not yet reached a consensus, so it is necessary to pay attention to the possibility of a tug-of-war in the upward momentum as stated above.

VN-Index started the first session of the week down more than 40 points, however, in the remaining sessions of the week, the index recovered and regained the adjusted points, moving towards the 1,670 zone. The large-cap group is the main driving force for the index's recovery. Although the green color has gradually spread from the blue-chip group to the small and medium-cap stocks, the liquidity has been maintained at a level lower than the 20-session average, showing the differentiation between the recovery and increase levels between industry groups and stocks on the market.

Given the current situation, VCBS recommends investors select stocks that show signs of recovery after adjusting to a strong support zone at attractive discounted prices and have had notable cash flow participation recently to disburse/open positions next week. Some notable groups include Retail, Steel, Banking, and Securities.