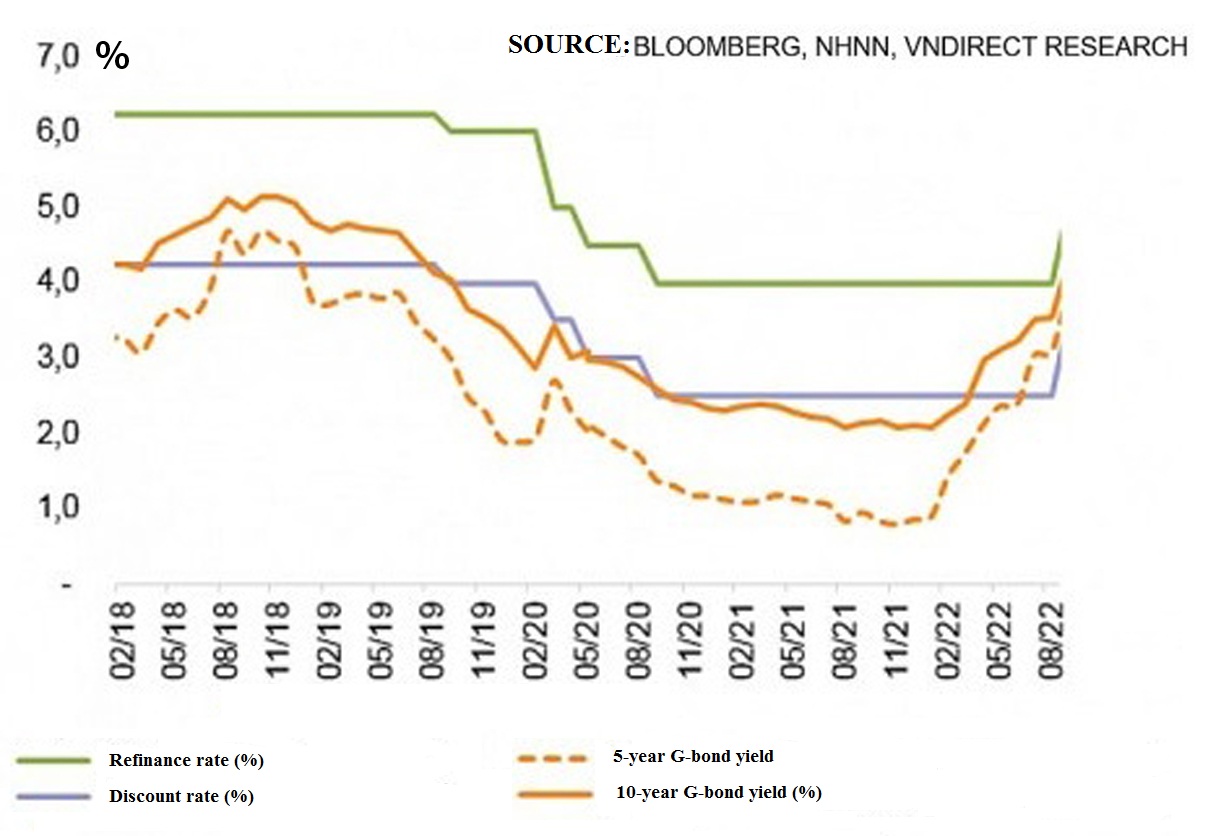

Policy rates under a big upward pressure

As a result of the FED's rate hike, many experts predict that the State Bank of Vietnam (SBV) may continue to increase the policy rates.

The SBV immediately adjusted up to 1% of the policy rates

>> Inflation pressure: The need for monetary tightening

The SBV immediately adjusted up to 1% of the policy rates following the Fed's 75 basis point increase in interest rates to 3-3.25%.

Significant challenges

The SBV's aforementioned action was shared by many experts. Because of the FED's sharp monetary tightening, the USD has appreciated significantly, putting significant pressure on the USD/VND rate. The reference rate has climbed by 335 VND/USD since the beginning of 2022, or 1.45%; even the selling price of USD at commercial banks has increased by 1,100 VND, or 4.8%.

Experts contend that Vietnam's economy is so open to the rest of the world, exchange rate stability is crucial because a sharp decline in the VND increases the risk of inflation from abroad.

Vietnam must maintain a steady exchange rate. This is the "Cau river line," Dr. Truong Van Phuoc, a former acting Chairman of the National Financial Supervisory Commission, stressed and adding If this line is destroyed, inflation would pour in.

>> Lending interest rates unlikely to keep stable

The FED is anticipated to keep raising rates in this tightening cycle to 5%, which is why many financial institutions predict that the SBV will also keep raising policy rates.

Time to raise policy rates

In order to defend itself against the FED's impending rate hike, the SBV recently increased the policy rate by one percentage point. As a result, VDSC’s view, the SBV's policy rate is currently the same as it was during the COVID-19 pandemic (March 2020), and given the rate of domestic inflation at the time, this rate is very secure. However, if the Fed keeps raising interest rates, VDSC predicts that the policy rates might rise by 0.5 to 1%.

A banking expert who shares this perspective notes that the SBV is currently tasked with managing inflation while also promoting economic growth. Therefore, the SBV continues to urge commercial banks to cut operating expenses in order to keep lending rates steady. Due to the fact that Vietnam's inflation is still at a manageable level, as well as the likelihood of a limit ed VND depreciation, it is expected that the SBV will maintain steady policy rates this year. However, this expert acknowledged that there would be significant pressure to boost policy rates in the upcoming year.