Port enterprises: Divergent profits in 1H2025

Amid strong growth in Vietnam’s import-export turnover in the first half of the year, the business performance of many port industry enterprises remained mixed.

Divergent Q2/2025 results among port enterprises – illustrative image.

Among the port companies that have released their Q2 financial statements and H1 2025 results, Nghe Tinh Port Joint Stock Company (HNX: NAP) recorded the most positive performance, with revenue reaching nearly VND 66.4 billion, up 31% year-on-year. This is also the highest revenue level in the past two years for the company. Net profit after tax surged 170% compared to the same period in 2024, reaching over VND 10 billion.

For the first six months of 2025, NAP’s revenue increased by more than 8.6% year-on-year, and its net profit after tax reached nearly VND 14.4 billion, up almost 38.5% from the same period last year.

The company stated that in Q2/2025, cargo volume through the port increased, boosting revenue from goods and service provision by 170% year-on-year. Additionally, financial income rose nearly 65%. Meanwhile, various costs declined significantly, leading to a strong increase in profit for both Q2 and the first half of the year.

Similarly, Dong Nai Port Joint Stock Company (HoSE: PDN) reported strong Q2 growth in both revenue and profit. Specifically, in Q2, PDN posted revenue of VND 392 billion, up 22% year-on-year. Net profit after tax reached VND 125.5 billion, a 47% increase over the same period.

For H1/2025, PDN reported VND 746 billion in revenue, up 17% year-on-year, and nearly VND 225 billion in net profit, up 32% compared to the first half of 2024. This marks the fifth consecutive year PDN has achieved revenue growth and the third consecutive year of record-breaking mid-year profits.

According to company leadership, the increase in Q2/2025 revenue from operations was due to higher volumes of rolled steel, iron and steel billets, etc., leading to increased cargo transport and handling. Moreover, alumin and cargo from yard tenants at Go Dau Port remained stable.

Dong Nai Port has also focused on investing in infrastructure, container-handling facilities, and specialized loading equipment to promptly address congestion, accommodate rising cargo volumes, and enhance customer satisfaction. These efforts led to higher volumes in both container and general cargo segments, resulting in higher sales and service revenue compared to the same period.

In contrast to the above companies, Dinh Vu Port Investment & Development JSC (HoSE: DVP) recorded declines in both revenue and profit. In Q2/2025, DVP’s revenue dropped 22% year-on-year to VND 148 billion, and profit fell 21% to VND 67.4 billion. The primary reason was a decline in cargo volume through the port.

For H1/2025, DVP reported nearly VND 307 billion in revenue, down more than 10.2%, and a net profit of nearly VND 132 billion, down almost 10% year-on-year. With these results, the company has only achieved 32% of its full-year revenue target and 35% of its profit goal.

Similarly, Quy Nhon Port JSC (HoSE: QNP) also posted a 16% drop in net revenue to under VND 280 billion, due to a decline in port cargo volume. Profit also fell 10% to VND 39.4 billion.

For the first half of the year, both revenue and profit at QNP dropped 13% year-on-year, reaching VND 531 billion and over VND 65 billion, respectively. As of mid-year, the company had fulfilled only 38% of its revenue target and 42% of its profit goal for the year.

Divergent performance across port enterprises amid strong double-digit export-import growth in H1/2025.

According to MBS Securities, Vietnam's export turnover in H1/2025 reached USD 219.83 billion, up 14.4% year-on-year. The U.S. remained Vietnam’s largest export market at USD 70.9 billion, up 28.2%. Exports to the EU also rose 10%, while exports to China increased slightly by 4.2%. Exports to Japan reached USD 12.8 billion, an 11.8% rise.

Meanwhile, imports surged by 17.9% in H1/2025 as businesses increased stockpiling of raw materials amid tariff uncertainties. This also partially reflects Vietnam’s effort to reduce its trade surplus with the U.S., as imports from the U.S. rose 22.3% to USD 8.9 billion — the highest six-month level between 2020 and 2025.

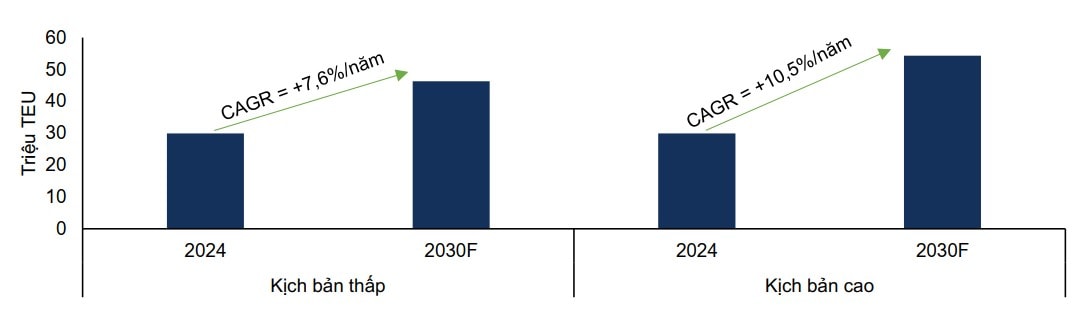

Regarding growth potential in the port sector, FPTS Securities projects that container cargo volume through seaports is expected to continue rising thanks to recovering consumer demand and the ongoing shift in global supply chains.

Image: Projected container throughput at Vietnamese seaports – Source: Ministry of Construction, Vietnam Maritime Administration

In the short term, FPTS forecasts that Vietnam's import-export activities will continue growing due to rising consumer demand in multiple countries. Fitch Solutions estimates that Vietnam's trade turnover will rise over 20% in 2025 as improved demand from trade partners helps ease inflationary pressures.

However, FPTS also notes that actual trade growth may fall short of forecasts if orders decline, especially in light of retaliatory tariffs imposed by the U.S. (Vietnam’s largest export market), which could dampen U.S. consumer spending.

In the medium to long term, FPTS sees a less optimistic outlook for Vietnam’s trade turnover due to higher U.S. export tariffs. Nevertheless, they remain positive that investment incentives, infrastructure development, and tariff advantages from various free trade agreements will help maintain positive growth.

FPTS maintains a neutral recommendation for Vietnam's port sector in the short term (under 12 months), anticipating slower growth in trade turnover due to mild demand recovery among partners and reduced orders caused by U.S. tariff policies. The main growth drivers are expected to come from deep-water ports like Lach Huyen and Cai Mep – Thi Vai, which can accommodate larger vessels. Meanwhile, feeder ports are projected to grow more slowly due to increasing competition.

FPTS also highlights several investment risks in the port industry, including: overcapacity due to continued port construction, and supply chain shifts away from Vietnam as a result of high U.S. tariffs driven by the prolonged trade surplus.