Pressure on the USD/VND will ease following Fed’s rate cut

MBS expects the USD/VND exchange rate to fluctuate in the range of 26,230 – 26,420 VND/USD by year-end, representing a year-to-date increase of 3% - 3.8%.

MBS expects the USD/VND exchange rate to fluctuate in the range of 26,230 – 26,420 VND/USD by year-end

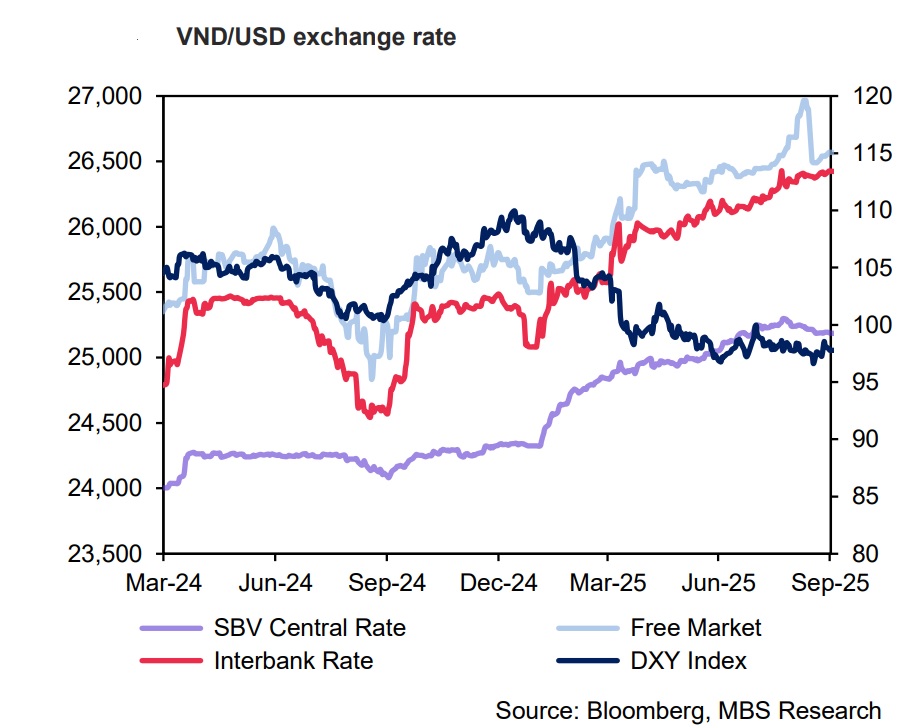

Starting this month at 97.8, the DXY experienced a steady decline, and even hitting a four-year low of 96.6 on Sept. 16 as investors anticipated a rate cut at the September meeting, driven by softening labor market data. As expected, the Fed implemented a 25 bps interest rate cut for the first time in 9 months. The dot plot suggests most policymakers expect interest rates to reach 3.5% - 3.75% by the end of 2025, with two potential additional cuts by Dec. However, the DXY has swiftly recovered to 98.5 on Sep 25 amid robust economic data.

Specifically, the economy achieved the fastest growth in nearly two years, with Q2 GDP revised upward to 3.8% amid strong consumer spending and a sharp trade deficit contraction. Thus, this weakens the case for rate-cut advocates, as sustained economic growth may prompt the Fed to adopt a less dovish stance to curb inflation (Aug PCE rose 2.7% yoy, while core PCE rose 2.9% - still above the Fed’s target). Nevertheless, the market is still betting on two more rate cuts this year, thereby clouding the DXY’s outlook toward the year-end. By the month-end, the greenback hovered at 97.9 (-10.5% ytd).

USD/VND pressure eased in September amid a weakening USD in the first half of the month and growing expectations of two additional rate cuts this year, which may further weaken the USD. Additionally, the domestic currency was partly supported as the VND-USD interest rate gap narrowed greatly from -2.7% at the end of August to 0.6% by the end of Sep thanks to the Fed’s rate cuts.

Subsequently, the interbank exchange rate ended the month at 26,426 VND/USD (0.3% mom, 3.8% ytd). In contrast, the free-market rate dropped 0.4% over the month, ending the month at 26,570 VND/USD (3.2% ytd). Likewise, the central exchange rate decreased by 0.2% mom, currently stays at 25,187 VND/USD (3.5% ytd).

The Fed’s decision to begin cutting interest rates in September, with expectations of an additional 50 bps reduction in Q4, bringing the total reduction this year to 75 bps, will help ease exchange rate pressure toward year-end. At the same time, it will also create more room for the SBV to maintain a low interest rate environment to promote economic growth.

However, MBS believes there are still downside risks to the USD/VND rate, including: (1) Trade surplus is projected to narrow to USD 16.3 - 20.4bn this year as exports is expected to slow down in Q4 as front-loading unwinds, while Vietnam still needs to ramp up imports from the US to avoid tariff risks. (2) Domestic-global gold price gap amid rising gold prices. (3) The Fed could adopt a less dovish stance to curb inflation if there is no clear evidence showing that the labor market or economy is weakening.

Balancing the above factors, MBS expects the interbank exchange rate to fluctuate in the range of 26,230 – 26,420 VND/USD by the end of the year, representing a year-to-date increase of 3% - 3.8%.