Vietnam’s stock market upgrade: Deepening integration into global finance

Viet Nam’s elevation from a Frontier to a Secondary Emerging Market under FTSE Russell is a landmark move that deepens its integration into global finance, said Tran Hoang Son, Market Strategy Director at VPBank Securities.

Viet Nam’s stock market has officially been upgraded from Frontier Market to Secondary Emerging Market, with effect from September 21, 2025.

Viet Nam’s stock market upgrade from a Frontier Market to a Secondary Emerging Market under the FTSE Russell classification marks a historic milestone — one that brings the country closer to full integration into the global financial system.

According to FTSE Russell’s announcement, Viet Nam’s stock market has officially been upgraded from Frontier Market to Secondary Emerging Market, with effect from September 21, 2025.

Opening the Door to Major Investment Inflows

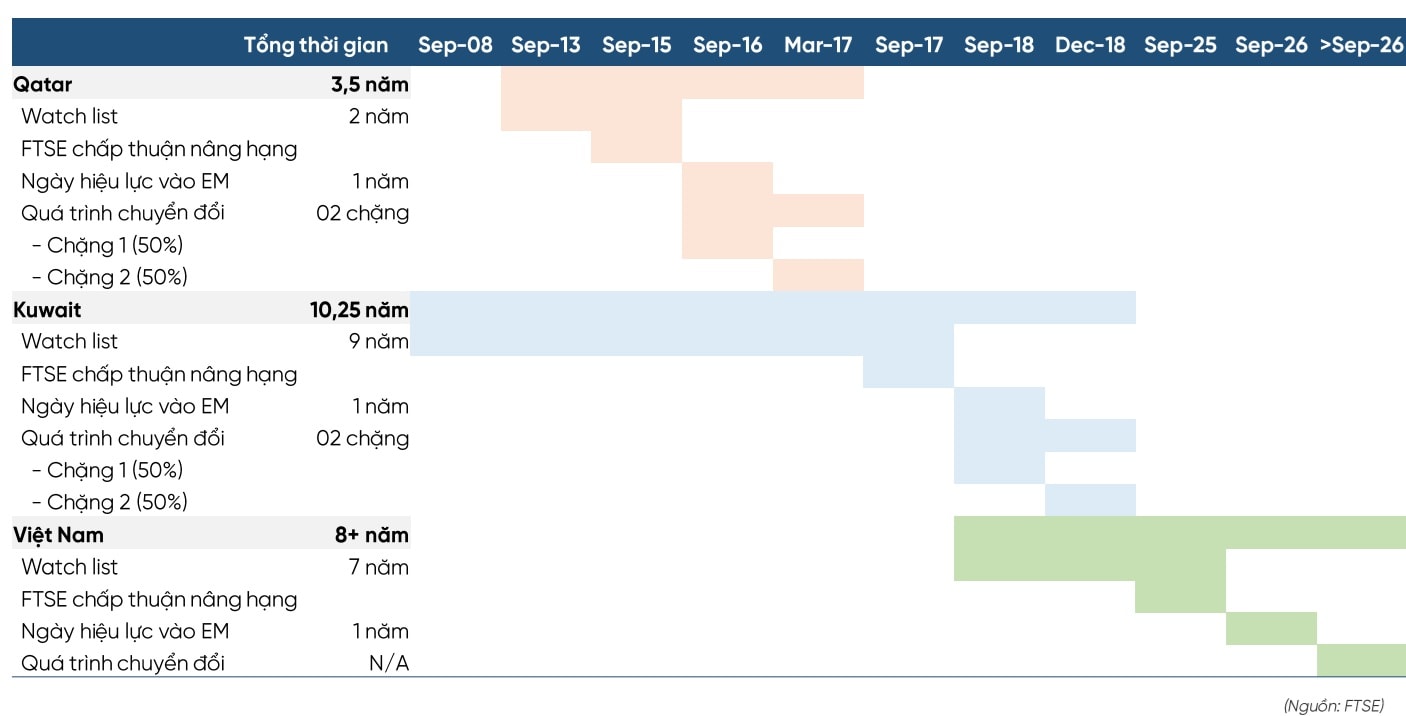

Viet Nam was first added to FTSE Russell’s Watch List in September 2018. Since then, significant progress has been made — such as the introduction of no pre-funding (NFP) for trades and a new failed trade settlement process in November 2024 — improving both transaction efficiency and foreign investor accessibility.

FTSE Russell’s decision followed an Official Benchmark Review (OBR) based on the FTSE Equity Country Classification Framework. The review emphasized resolving global brokers’ access barriers to strengthen investor confidence and reduce market risk.

The upgrade takes effect from September 21, 2026, subject to an interim review in March 2026. The implementation will be phased, following stakeholder consultations. FTSE Russell will continue monitoring and is expected to release detailed plans in March 2026.

This reclassification is a transformative step that aligns Viet Nam more deeply with global financial markets. Drawing from the experiences of Saudi Arabia and Kuwait, several positive impacts are anticipated.

First, a surge in foreign capital inflows: The upgrade opens the door to billions of dollars in both passive and active investments. Assuming all FTSE Viet Nam constituents are included in the FTSE Emerging Market index series, it is estimated that total inflows could reach USD 3–7 billion, of which about USD 1.5 billion may come from passive funds, if Viet Nam captures 0.5% of the emerging market index weight. According to FTSE, assets managed by active funds are roughly five times larger than those of ETFs.

Second, improved market liquidity and efficiency: The elimination of the pre-funding requirement encourages institutional participation, potentially raising daily trading value to USD 2–3 billion, making the market more liquid, stable, and less volatile.

Third, enhanced economic image and regional positioning: As one of ASEAN’s more mature and rapidly growing economies, Viet Nam’s upgraded status increases its appeal to major investors — including pension and ETF funds — while reinforcing its leverage in international trade negotiations and its ability to attract higher-quality FDI.

Fourth, stronger corporate and economic growth: Larger capital inflows will boost IPO activity, expand market capitalization, and turn the stock market into a more effective capital mobilization channel. This supports Viet Nam’s ambition for GDP growth above 8% in 2025, and double-digit rates between 2026–2030. The upgrade also incentivizes corporate reforms, higher governance standards, and greater transparency.

Overall, the reclassification brings not only financial gains but also structural reform momentum, moving Viet Nam closer to its 2045 high-income vision.

The Road Ahead: Sustaining the Emerging Market Status Beyond 2026

To meet the stricter standards of MSCI and maintain emerging-market classification, the Prime Minister issued Decision No. 2014/QĐ-TTg in September 2025, approving the National Roadmap for Stock Market Upgrade, structured into four phases through 2030.

Short term (2025–2026): Viet Nam is finalizing its FTSE upgrade while ensuring long-term sustainability. The key focus is resolving the “pre-funding bottleneck,” a major obstacle before the Central Counterparty Clearing (CCP) system is operational.

Critical measures include:

- Simplifying foreign investor account procedures and improving coordination between custodian banks and securities firms through the launch of the Omnibus Trading Account (OTA) system.

- Deploying a modern IT trading infrastructure by May 5, 2025, enhancing support for foreign funds and CCP functionality.

- Stabilizing the foreign exchange market and upgrading clearing and settlement infrastructure for security and efficiency.

To attract more foreign capital, the Government issued Decree No. 245/2025/NĐ-CP, aimed at “opening” the capital market. The reforms include:

- Shortening IPO and listing timelines to 3–6 months.

- Liberalizing the Foreign Ownership Limit (FOL) by removing mandatory minimum thresholds.

- Granting electronic trading codes instantly to foreign investors for immediate access.

Establishing a robust legal framework for CCP to ensure safe and efficient settlements.

Combined with the requirement for large-cap companies to publish information in English, these reforms position Viet Nam to enter the MSCI Watch List by June 2026, with the goal of achieving MSCI Emerging Market status by June 2027. This strategic alignment enhances legal, liquidity, and accessibility frameworks — fulfilling MSCI’s key evaluation criteria and paving the way for a potential surge in global capital inflows.

Medium term (2027–2028): The full MSCI Emerging Market upgrade is targeted for June 2027. During this phase, Viet Nam plans to fully implement the CCP system, migrate all listed stocks from HNX to HOSE, and achieve IFRS compliance for 80% of listed companies.

Long term (2029–2030): The goal is to advance to FTSE Advanced Emerging Market status. Viet Nam aims to develop derivative products, diversify indices (including ESG), achieve Investment Grade credit ratings, and strengthen cooperation with the London Stock Exchange (LSE) and FTSE for ongoing supervision and benchmarking.

This roadmap ensures sustainable progress through international collaboration and regulatory oversight, securing Viet Nam’s stable position among regional emerging markets.

Target: Market Capitalization Reaching 120% of GDP by 2030

Under the Stock Market Development Strategy to 2030, Viet Nam’s market capitalization is projected to reach 100% of GDP by 2025 and 120% by 2030, up from the current 70–100% (roughly USD 300 billion in 2025). This will be supported by annual GDP growth of 6.5–8% and expanded capital mobilization through IPOs and SOE equitization.

Liquidity is also expected to rise significantly following the upgrade and ongoing reforms.

- 2025–2026: Average daily trading value is projected to grow from USD 860 million to USD 1.5–2 billion, fueled by USD 3–5 billion in foreign inflows from the FTSE and KRX upgrades.

- 2027–2030: Daily trading may reach USD 3–5 billion, with the number of trading accounts rising to 15–20 million. Growth drivers include more listed firms (from 1,600 to 2,000), new financial products (derivatives, ETFs), and foreign investment in green technology and logistics.

Higher liquidity will make the stock market a key financing channel for sustainable growth. However, robust capital flow monitoring mechanisms will be essential to mitigate potential risks amid global volatility.