What outlook for bank stocks by year-end?

In 3Q25, the net profit of the covered listed banks is expected to increase 22% year over year, driven by steady loan growth.

Transactions at HDBank

The Vietnam banking system's credit outstanding increased 13.37% year-to-date in the first nine months of 2025 and is expected to reach 19–20% in 2025. Building on the robust credit growth in 1H25, it is anticipated that at the end of 3Q25, the total credit of listed banks covered by MBS Research will have increased by about 14.8% YTD, or 4.6% QoQ. The primary driver of loan expansion in 3Q25 continues to be the low interest rate environment.

With consumer and mortgage loan recovery, listed banks' retail loans are expected to outpace corporate ones in 2H25. Furthermore, it is expected that by the end of the third quarter of 2025, private joint-stock banks' credit growth would outpace that of state-owned banks, with 18% and 12% year-to-date increases, respectively. It is expected that banks such as VPB, HDB, LPB, and TCB, which saw significant growth in 1H25, would continue to do well in 3Q25.

NIM is forecast to remain steady or slightly improve over 1H25, as lending rates are expected to remain low and funding pressure is unlikely to emerge, despite deposit growth continuing to trail credit growth. Deposit growth in 1H25 reached 9.6% year-to-date, a notable increase from 4.7% in the same period last year. Banks are also taking steps to improve NIM by increasing medium- to long-term lending while also developing and optimizing CASA mobilization solutions to reduce financing costs.

MBS expects the net profit of listed banks under coverage to rise by about 21.5% YoY in 3Q25, above the 18.7% growth achieved in 2Q. HDB, TCB, BID, VPB, LPB, and CTG are among the banks with good net profit growth, the majority of which have seen rapid loan expansion. Covered banks' net profit is expected to increase by 15.6% year-on-year on September 25. Sector-wide asset quality is likely to improve somewhat by the end of 3Q25 compared to the end of 2Q25, with the NPL ratio falling below 2% and LLR remaining around 80%.

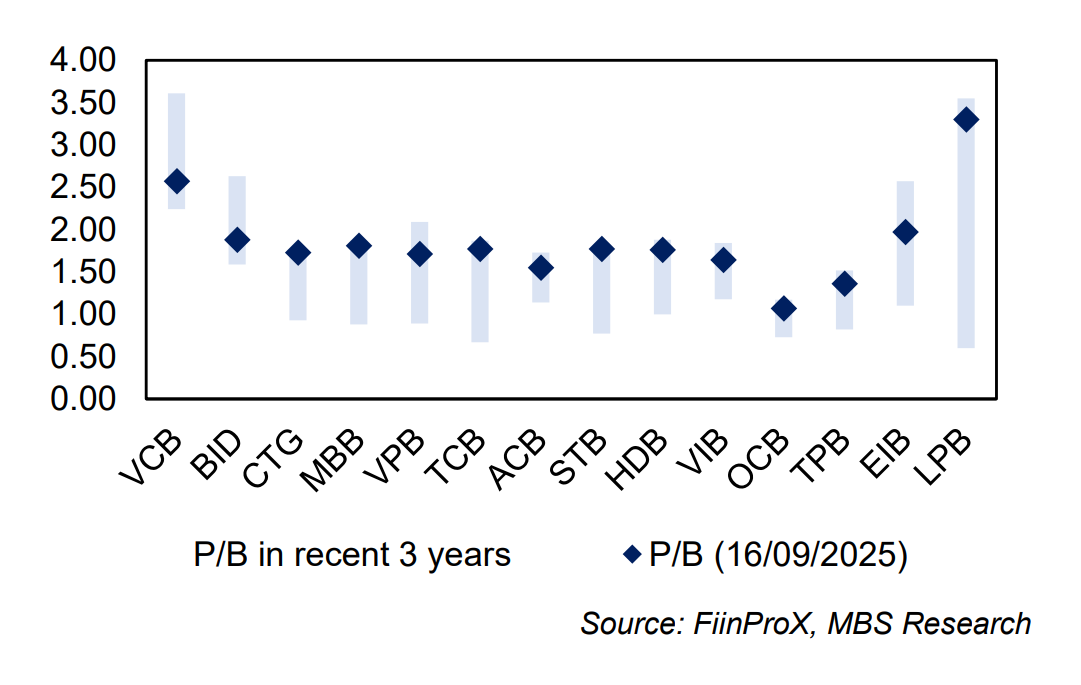

This stock firm retains a neutral rating in the banking industry since its current P/B ratio is somewhat higher than the three-year average, which is not especially appealing considering the 15% full-year profit growth projection for 2025. It recommends CTG, VCB, and HDB for 2H25 because (i) state-owned banks are expected to benefit more than private joint-stock banks from the strong public investment push in the rest of the year; (ii) superior asset quality compared to the sector average; and (iii) attractive current valuations relative to earnings growth potential.

Most banks are trading at their 3-year peak P/B levels except for VCB and BID

For CTG, its credit growth in 3Q25 is estimated to be over 5% quarter on quarter, bringing YTD growth to more than 15% by the end of September 2025. MBS anticipates CTG to get an extra 3% credit quota in 4Q25, with full-year credit growth of roughly 18%. NIM is expected to remain steady at 2.5%. Provisioning expenditures in 3Q25 are expected to be roughly VND 6.5 tn, down 29.8% year-on-year but tripling QoQ due to the low base in 2Q after high provisioning in 1Q. Provisioning in the third quarter is likely to continue strong, in keeping with the bank's full-year target of VND 20-25 trillion. Consequently, 3Q25 profit before tax (PBT) is forecast to reach approximately VND 9.5 tn (44.8% YoY), lifting 9M25 PBT to VND 28.4 tn (45.6% YoY), equivalent to about 75% of the full-year target.

As for VCB, its credit growth is forecast to reach 11% YoY by the end of 3Q25, up 82 basis points YoY, supported by robust public investment disbursement in 2H25 and economic growth momentum with a GDP goal of 8% or higher. NIM is expected to be 2.6% in 3Q25, which is generally consistent with 2Q25. The NPL ratio is predicted to drop to 0.97%. Total operational income for 3Q25 is expected to be VND 18.89 trillion (12.2% YoY). Credit risk provisioning expenditures are expected to skyrocket when the bank stops recording reversals on interbank loans. 3Q25 PBT is estimated at VND 11.88 tn (11% YoY), and 9M25 PBT is expected to fulfill 77% of the full-year target.

For HDB, its loan growth in 3Q25 is expected to be 8% QoQ, bringing 9M25 credit growth to about 25%, or 78% of the full-year objective. In the second half of 2025, NIM is predicted to remain around 5.1%. Provisioning expenditures in 3Q25 are expected to rise 70.3% YoY but fall 55.0% QoQ due to the previous quarter's high base, resulting in total 9M25 provisioning expenses tripling YoY. 9M25 PBT is expected to be around VND 15.7 trillion (24.0% YoY), accounting for 75% of the yearly target.