Vietnam stock market: Is a year-end rally still possible?

Vietnam stock market has entered a phase of correction and consolidation, yet analysts see multiple catalysts that could support a rebound toward the end of the year.

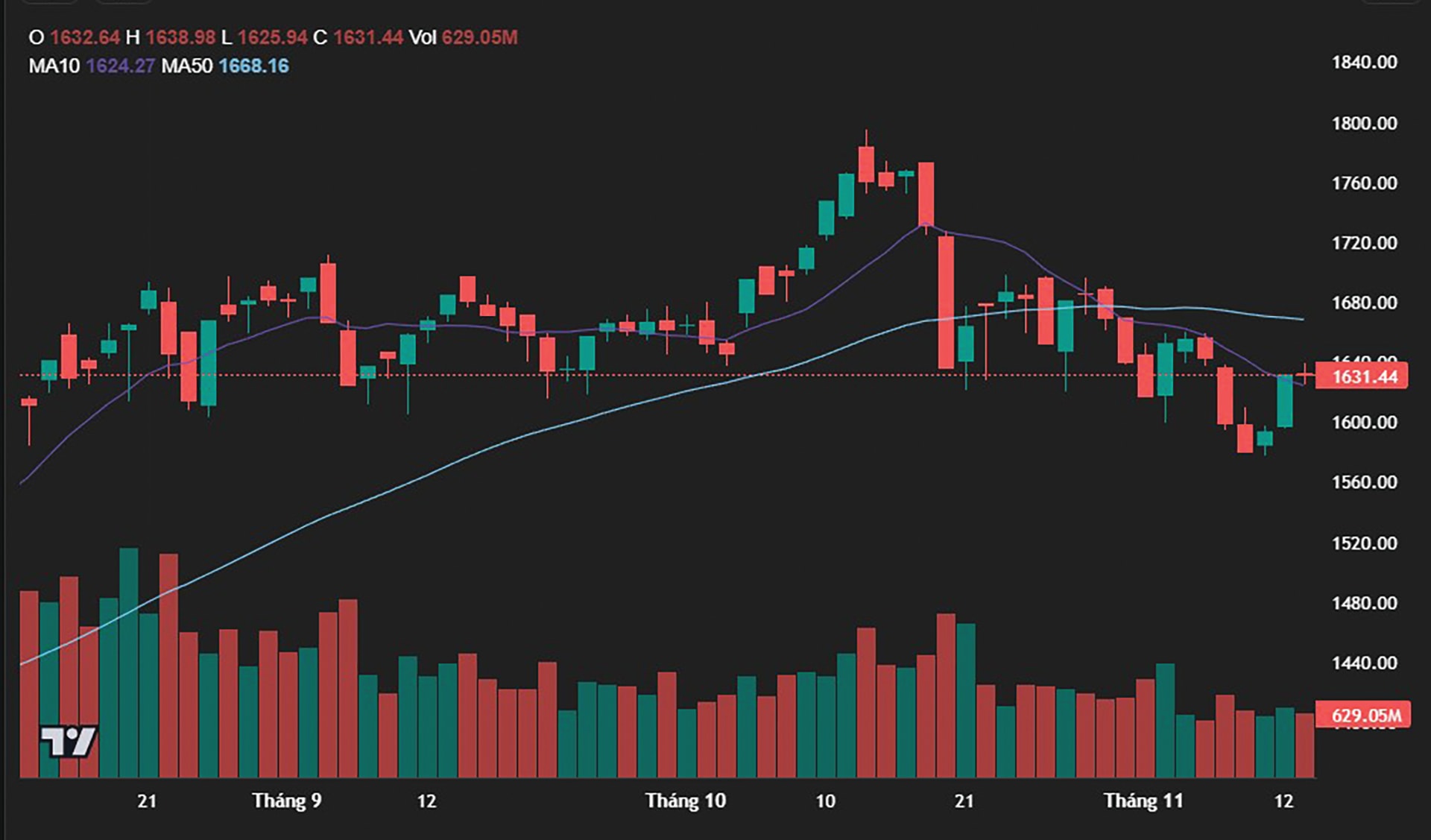

The VN-Index’s current correction may be only temporary before the market resumes its upward trend toward the end of the year.

According to Dr. Le Duc Khanh, Director of Market Strategy at VPS, domestic liquidity, global monetary easing, and the country’s new emerging-market classification could set the stage for another upward leg once the current pullback stabilizes.

Recent months have seen strong participation from domestic investors, with trading values frequently reaching VND 70–80 trillion per session. This liquidity has allowed the stock market to record several notable advances despite short-term volatility. For investors, Khanh argues, the priority is to take advantage of corrective phases to accumulate quality stocks with remaining upside potential.

A Short-Term Correction Amid Global Optimism

The global backdrop has been broadly supportive. Major central banks have shifted toward monetary easing, including a 0.25% rate cut by the U.S. Federal Reserve in October and another one expected in December. U.S. and Asian indices such as the Dow Jones, Nasdaq 100, and Nikkei 225 have repeatedly notched new highs despite geopolitical and macroeconomic uncertainty.

Vietnam, however, has diverged from this global uptrend. The VN-Index and key sectors—including banking, securities, and real estate—have experienced consecutive sessions of decline. After approaching the historical resistance zone of 1,795–1,800 points, the VN-Index retreated below 1,650 points and continues to flash signals of further near-term adjustment in both the VN-Index and VN30 baskets.

In Khanh's opinion, this corrective move appears to be temporary. The VN-Index is likely to find a short-term bottom before regaining momentum toward the end of the year.

Clear Market Divergence

One of the defining features of the current pullback is pronounced sectoral divergence. While large-cap banking, brokerage, and property stocks have weakened, other sectors—such as seafood, chemicals, seaports, construction, and materials—have shown positive trading activity. Certain leading stocks that rallied strongly earlier in the year are now cooling off, while some blue-chip names in the VN30 have begun to move counter to the broader trend. Meanwhile, mid- and small-cap stocks have posted gains, adding to the market’s contrasting movements.

Technology, telecommunications, utilities, and energy have also exhibited constructive price action, unlike other sectors that are still trending downward. This pattern, Khanh notes, is characteristic of short-term corrections. Such pullbacks may last from one to two weeks, or even one to two months, before a new market-wide uptrend emerges. After four consecutive months of gains, followed by two months of adjustment and consolidation, the setup for another upswing is forming.

Vietnam’s market has recently been elevated to “emerging market” status by FTSE Russell—a milestone expected to draw increased interest from foreign institutional investors and global funds

Which Stocks Could Lead the Next Rally?

The Vietnam stock market has recently been elevated to “emerging market” status by FTSE Russell—a milestone expected to draw increased interest from foreign institutional investors and global funds. Domestic investors alone have generated sizable liquidity, but renewed foreign inflows could significantly amplify the market’s upside potential.

Global monetary easing also plays a crucial role. Multiple central banks have lowered benchmark interest rates, and Vietnamese commercial banks have also reduced lending rates, improving market sentiment. With the Fed potentially cutting rates again in December 2025 and through the first half of 2026, global risk appetite could strengthen further, supporting both international and Vietnamese equities.

A new upward phase for the Vietnam stock market could unfold after the current correction, potentially beginning as early as November and December 2025. The VN-Index remains within its medium-term uptrend channel and may attempt another move toward the 1,700–1,800 level in the coming one to two months.

Khanh expects sectors such as financials, seaports, seafood, energy, construction, and materials to continue attracting capital toward the year’s end. Leading companies within each sector—and especially those delivering superior earnings results—will likely become focal points for both retail and institutional investors. He highlights several stocks that merit attention in the final months of the year, including CTD, HAH, BMP, ANV, VTP, FPT, and CTR.

While short-term volatility has tested investor sentiment, Khanh maintains that the broader market structure remains intact. As global financial conditions ease, foreign inflows potentially strengthen, and domestic liquidity stays robust, Vietnam’s equity market could find the support needed for a late-year recovery. The divergence across sectors also presents selective opportunities for investors willing to position early ahead of a potential new rally.