Stock market diverges as VCI, SSI and TCX emerge as potential picks

As Viet Nam’s main stock indices break all-time highs and liquidity surges, securities companies are reporting soaring earnings—yet growth is increasingly concentrated among industry giants.

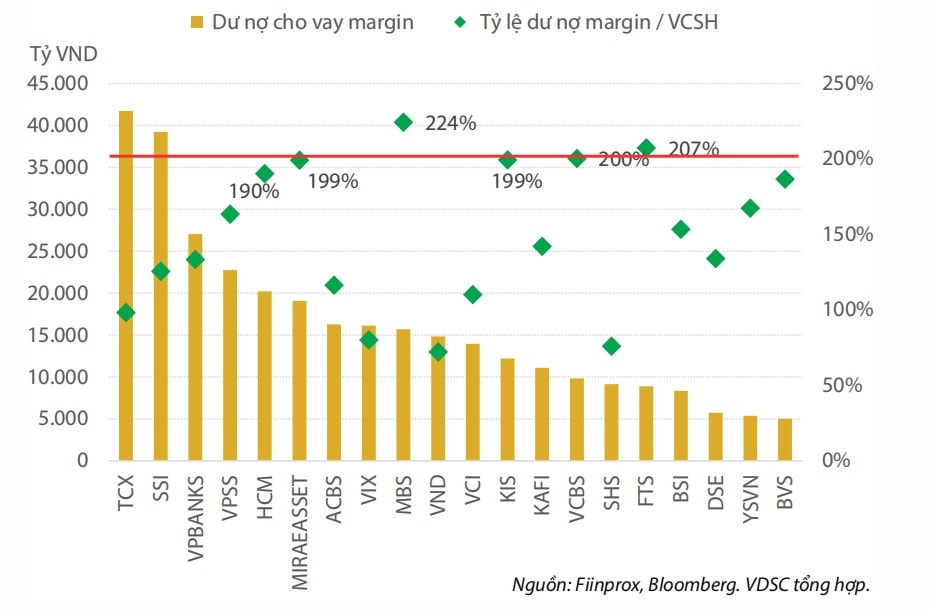

Top 20 firms by margin loans, Q3/2025

Dominant Contribution From Large Firms

With VN-Index rising sharply in Q3 2025, the sector’s pre-tax profit recorded its highest increase in two years—up 169% YoY—as all core business segments of securities companies expanded. The main driver was the VN-Index rally, with the benchmark climbing to around 1,600–1,700 (a historic high), compared with 1,100–1,200 a year earlier, alongside a 40% jump in liquidity.

Riding the market’s uptrend, securities stocks have also delivered notable returns since the beginning of the year: VIX (up more than 150% YTD), SHS (up more than 100%), VND (up more than 50%)… At some points VIX even surged over 300% YTD before retreating as the market met resistance around 1,700, according to VDSC.

Market movements translated directly into business results. By the end of Q3, financial statements show that proprietary trading contributed more than half of the sector’s aggregate earnings growth.

The industry’s growth, however, is far from uniform. The four firms with the highest pre-tax profit accounted for roughly 50% of the sector’s total pre-tax earnings and contributed up to 56% of overall growth. Expanding to the top 20 firms, both ratios rise to around 91%. This pattern—where a few large players contribute the majority of profits—has been a consistent feature of Viet Nam’s securities sector; ten years ago, the figures were also above 90%.

Nevertheless, this does not mean smaller firms are stagnant. VDSC estimates that if the top 20 profit-generating firms are excluded, the remaining companies collectively still posted a 171% YoY increase in pre-tax profit.

“This shows the stock market still offers plenty of room for smaller companies to grow, as client demand continues to rise each year alongside Viet Nam’s economic progress. As household incomes improve, investment demand also grows—and large firms may not be able to serve all of these needs,” VDSC analysts commented.

Individual growth depends heavily on each company’s investment strategy. For VIX, most profits came from listed equity holdings such as GEX, EIB, GEE. VPBANKS and TCX (TCBS) generated most gains from unlisted bonds, while SSI’s growth came from listed equities and derivatives trading.

Meanwhile, the influx of new investors has driven margin lending demand sharply higher. Newcomers have made the margin market more active, pushing total trading value up 40% YoY. Margin loans across the sector surged to new all-time highs since the downturn of Q4 2022, raising the Margin Loan / Equity ratio—but still within regulatory limits, as securities firms have been racing to increase capital to meet rising demand.

Large companies accounted for the overwhelming share of sector-wide growth, though smaller firms still retain significant room to expand.

Advantage for Securities Firms Backed by Banks

According to VDSC, bank-affiliated securities companies are gaining ground. Their market share has expanded quickly from under 40% five years ago to nearly 60% today—mostly at the expense of foreign-owned firms.

Among the 20 companies with the largest margin loan balances, 11 have bank support—a clear sign of banks increasingly expanding into the securities segment compared to 5–10 years ago.

Seventeen of these 20 firms have a Margin Loan / Equity ratio below the regulatory ceiling of 2x, with only MBS, VCBS, and FTS hitting or exceeding the limit. Some firms—including HCM, KIS, and Mirae Asset—are approaching the threshold and will need to raise equity if they want to extend more loans. Only MBS is currently raising charter capital (from VND 5,471 billion to VND 5,728 billion), though this still may not bring its ratio back below the 200% legal limit.

However, momentum from new investors alone is not enough for profits to surpass the 2021 peak. Brokerage revenue has surged, lifting gross margins, but still falls short of late-2021/early-2022 levels—even though trading value is 83% higher—because of the “zero-fee” trend among major firms, which is spreading across the market. With many new investors entering, firms with strong brands and large brokerage forces such as VPS and SSI hold a competitive advantage. Both firms have noticeably expanded market share compared to last year.

High-Potential Securities Firms

Within an overall positive but uneven landscape, VDSC identifies three promising securities companies: VCI, SSI, and TCX.

In the short term, VCI (Vietcap) is expected to meet its 2025 business targets thanks to strong performance in proprietary trading and margin lending. After the first nine months of the year, VCI had achieved 76.5 percent of its pre-tax profit target and 80 percent of its operating revenue target, driven by a surge in third-quarter results.

VDSC believes VCI may be re-rated by the market, lifting its current price-to-book ratio of two times toward its five-year average of 2.2 times. Analysts also believe that with continued technological development and support from VietCapital Bank, VCI will remain one of Viet Nam’s leading securities firms over the next five years. Based on the market price of VND 34,400 on 26 November 2025, VCI’s target price is VND 41,300, implying an upside of 20 percent. However, the firm’s strong performance in 2025 will be difficult to replicate in 2026 as the VN-Index has cooled after touching 1,700.

SSI is also on track to exceed its ambitious 2025 targets. After nine months, the firm had achieved 96.2 percent of its revenue target and 95.9 percent of its pre-tax profit target. With conservative estimates, VDSC believes SSI may beat its full-year target by around 15 percent, potentially reaching the highest revenue and profit levels in its history. This could support a re-rating of SSI’s price-to-book ratio toward 2.8 times, near its historical peak.

In the long term, despite intensifying competition from bank-backed companies, SSI is expected to remain resilient due to its large, experienced brokerage team, strong brand, and accumulated capital base. Based on the 26 November 2025 market price of VND 33,950, SSI’s target price is VND 41,300, representing an upside of 21.6 percent. Nonetheless, SSI’s current price-to-book ratio of 2.3 times is high relative to its five-year average of two times, meaning one or two weaker quarters could trigger a significant price correction in 2026.

TCX (TCBS), which listed on HOSE on 21 October 2025 with a reference price of VND 46,800, has attracted strong attention as investors look for benchmarks related to future securities IPOs. Still, each company’s core advantages and growth drivers differ.

In the short term, TCX is expected to exceed its 2025 business plan thanks to strong gains in bond proprietary trading and margin lending. After nine months, TCX had achieved 84.2 percent of its revenue target and 88 percent of its pre-tax profit target. Conservative estimates place its likely outperformance at around 10 percent. If realised, this would result in year-on-year increases of 34.7 percent in operating revenue and 31.8 percent in net profit. VDSC believes TCX could be re-rated toward VND 51,500, equivalent to a forecast price-to-book ratio of 2.8 times.

In the long term, TCX is expected to remain a top-tier securities firm thanks to three competitive advantages: capital strength supported by Techcombank, early adoption of fintech in brokerage operations, and its integrated banking–investment–insurance ecosystem. Based on the 26 November 2025 market price of VND 46,000, TCX’s target price is VND 51,500, representing an upside of 11.9 percent. Risks include potential post-IPO price volatility and the likelihood that record-high 2025 earnings will be difficult to repeat as the market shows signs of slowing.