Price increases for rubber latex benefit TRC

Tay Ninh Rubber Joint Stock Company (HoSE: TRC)'s largest profit in more than a decade has been largely attributed to the skyrocketing average selling price of rubber latex.

The soaring average selling price of rubber latex has significantly contributed to TRC's highest profit in over 10 years

TRC reported sales of around VND 296 billion in the recently issued Q4/2024 consolidated financial report, which represents a roughly 38% growth over the same time the previous year. The rubber industry enterprise's gross profit increased by around 103% year over year to reach over VND 148 billion, largely due to the cost of goods supplied only slightly increasing over the same period.

Furthermore, financial expenses, including interest expenses, also decreased sharply compared to the same period, from over VND 4.3 billion to more than VND 1.5 billion, a reduction of over 65%. The profit/loss from joint ventures and associates also declined from a loss of over VND 2.5 billion in the same period to a loss of more than VND 1.3 billion. Meanwhile, the company's other expenses showed insignificant fluctuations.

Consequently, TRC reported a net profit of more than VND 120 billion after subtracting expenses, which is more than 155% more than it made during the same period last year. This is the rubber company's biggest profit in over ten years.

In comparison to the same period last year, the parent company, Tay Ninh Rubber JSC, and its subsidiary, Tay Ninh Siem Reap Rubber Development Company (Kingdom of Cambodia), have seen an increase in the average selling price of rubber latex. This, according to company executives, is the reason for the higher profits from rubber latex business activities.

For the entire year of 2024, TRC achieved more than VND 752 billion in net revenue, an increase of nearly 34% year-on-year. Net profit recorded was over VND 221 billion, a sharp increase of nearly 230% compared to 2023.

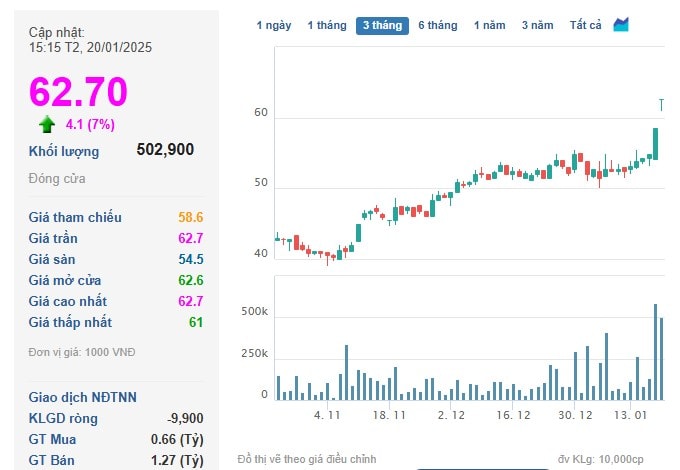

Immediately after the company announced its strong business growth plans for Q4 and the whole of 2024, TRC shares on the stock market responded positively, hitting the ceiling price for two consecutive trading sessions on January 17 and 20. As a result, TRC's stock price set a new level at VND 62,700 per share. Trading liquidity also surged, with more than 500,000 shares changing hands per session.

TRC shares hit the ceiling price for two consecutive sessions right after the company announced strong business growth results.

The natural rubber industry's recovery cycle is reflected in TRC's robust business growth. Vietnam exported more than 2 million tons of rubber in 2024, a modest 6.2% decline from 2023, but the high prices caused the total export value to rise 18.2% year over year to $3.4 billion (General Department of Customs data).

In comparison to 2023, the average rubber export price increased by $351 per ton to $1,701 per ton in 2024. A worldwide shortage of supplies and unfavorable weather in the main producing nations were the main causes of this price increase.

China remains the largest market for Vietnamese rubber. In 2024, rubber exports to China reached nearly 1.5 million tons, valued at $2.4 billion, down 8.5% in volume but up nearly 11% in value compared to 2023. China accounted for 72% of Vietnam's rubber export volume and 71% of export value in 2024.

The Vietnam Rubber Association (VRA) stated that the $3.4 billion export value announced by the General Department of Customs only includes raw rubber (fresh and semi-processed). In fact, the total export value of the entire rubber industry in 2024 reached $10.2 billion, marking an all-time high. Of this, exports of processed rubber products (such as automobile tires, rubber gloves, and other products) reached $4.5 billion, and rubber wood exports were estimated at $2.3 billion.

Regarding the outlook for 2025, Vietnam's rubber exports are expected to continue growing due to signs of recovery in demand from China, while global supply is expected to remain tight.

Key Southeast Asian producing nations have seen a decline in rubber production in recent years, according to data from the Association of Natural Rubber Producing Countries (ANRPC). Thailand produced 4.7 million tons of natural rubber in 2024, down from 4.85 million tons in 2019. Malaysia's production decreased from 640,000 to 340,000 tons within the same time period, while Indonesia's fell from 3.3 million tons to 2.5 million tons. The global supply constraint may worsen as a result of this production loss, driving up prices in the upcoming years.

Experts believe that domestic and international rubber prices in early 2025 will heavily depend on China's economic policies. China's automotive industry, one of the largest consumers of rubber, is expected to continue growing in 2025 due to domestic and export demand.

The VRA also forecasts that 2025 will continue to be a successful year for Vietnam's rubber industry, with total export turnover expected to reach $11-11.2 billion, growing by 10% compared to 2024. This forecast is based on the industry's continuous pursuit of sustainable growth opportunities, especially as export value trends upward due to global economic factors and Vietnam's internal policies.