Vietnam’s stock market outlook for 2025

For the 2025 stock market outlook, KBSV expected the VN-Index to reach 1,460 points, corresponding to a 16.7% EPS growth of listed companies (as discussed below).

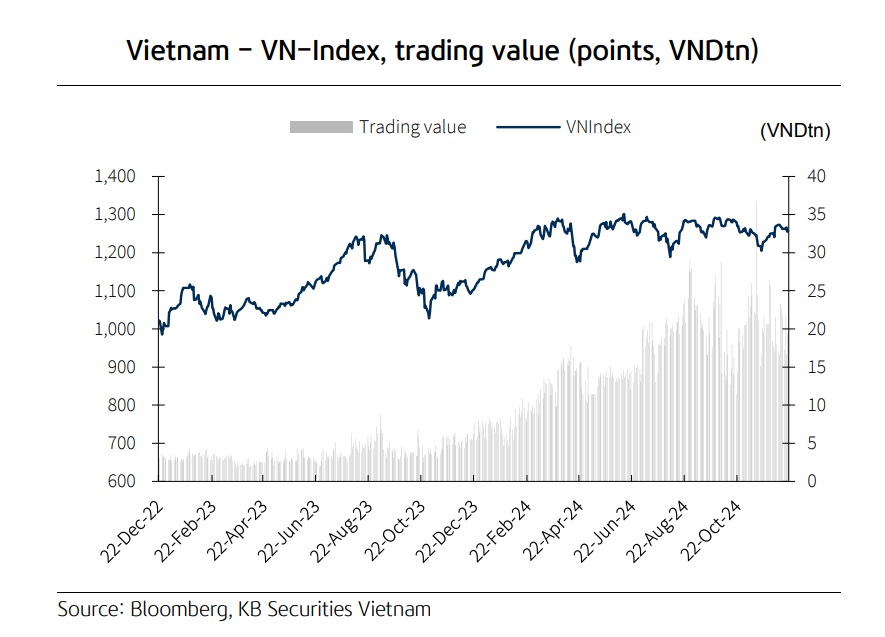

Vietnam's stock market experienced a recovery in 2024, with gains primarily concentrated in the first quarter as the VN-Index rose by 14%, supported by the continued recovery from late 2023. This was driven by low interest rates, favorable macroeconomic conditions, and positive corporate earnings growth. As of December 26, the VN-Index had increased by 12.5% in absolute terms, while trading value rose by 23% YoY.

For 2025 Vietnam’s stock market outlook, KBSV forecasted an average EPS growth of 16.7% for HSX-listed companies in 2025 compared to the previous year, driven by a favorable macroeconomic environment, iincluding: (i)(i) an easing monetary policy aimed at maintaining low interest rates to support businesses; (ii) a public investment plan and strategic infrastructure projects with a vision through 2030-2035; (iii) amendments to regulations designed to address difficulties and obstacles; and (iv) other factors such as trade expansion, FDI inflows, and increased investment in technology, data centers, and AI in Vietnam.

After a strong rise in 2024, the DXY is expected to see modest growth in 2025, ending the year at 108-110. This is anticipated to bolster domestic investor sentiment, encourage net foreign buying, and stabilize exchange rates. Factors contributing to the cooling of the DXY in 2025 include the Fed’s interest rate cuts, the worsening US budget deficit, the DXY lingering at high levels, and the US economy no longer outpacing the rest of the world as observed in 2024.

In 2025, KBSV forecasted relatively more stable macroeconomic conditions in the second half of the year, although the first half may still experience some disruptions. Specifically, for the year as a whole, exchange rate pressures are expected to be manageable, with the USD/VND up 1-2% compared to the end of 2024, while interest rates may rise slightly but remain low by historical standards. Deposit rates are expected to increase by 0.3%-0.5% among state-owned banks, with slightly higher increases in commercial banks. Overall, these conditions would lay the groundwork for capital flows to return to the stock market, potentially driving the P/E valuation of the VN-Index above its current level.

For the 2025 stock market outlook, KBSV expected the VN-Index to reach 1,460 points, corresponding to a 16.7% EPS growth of listed companies (as discussed below). This projection implies a target P/E ratio of 14.6x, approximating the level at the end of 2024 yet below the 10-year average of 16.6x.

On a positive note, factors that could drive the VN-Index’s P/E ratio in 2025 include: interest rates remaining low by historical standards (with deposit rates expected to rise slightly by 0.3%-0.5%, while lending rates remain stable or increase slightly), Vietnam’s stock market upgrade by FTSE Russell, and a favorable macroeconomic growth outlook.

However, KBSV said the 2025 landscape would also present numerous unpredictable risk factors, including the return of Donald Trump’ presidency, the weakening of the Chinese economy, and widespread geopolitical conflicts. As a result, it maintained its expected P/E ratio for 2025 at 14.6x, with updates to be provided in quarterly reports.