Promoting early credit disbursement

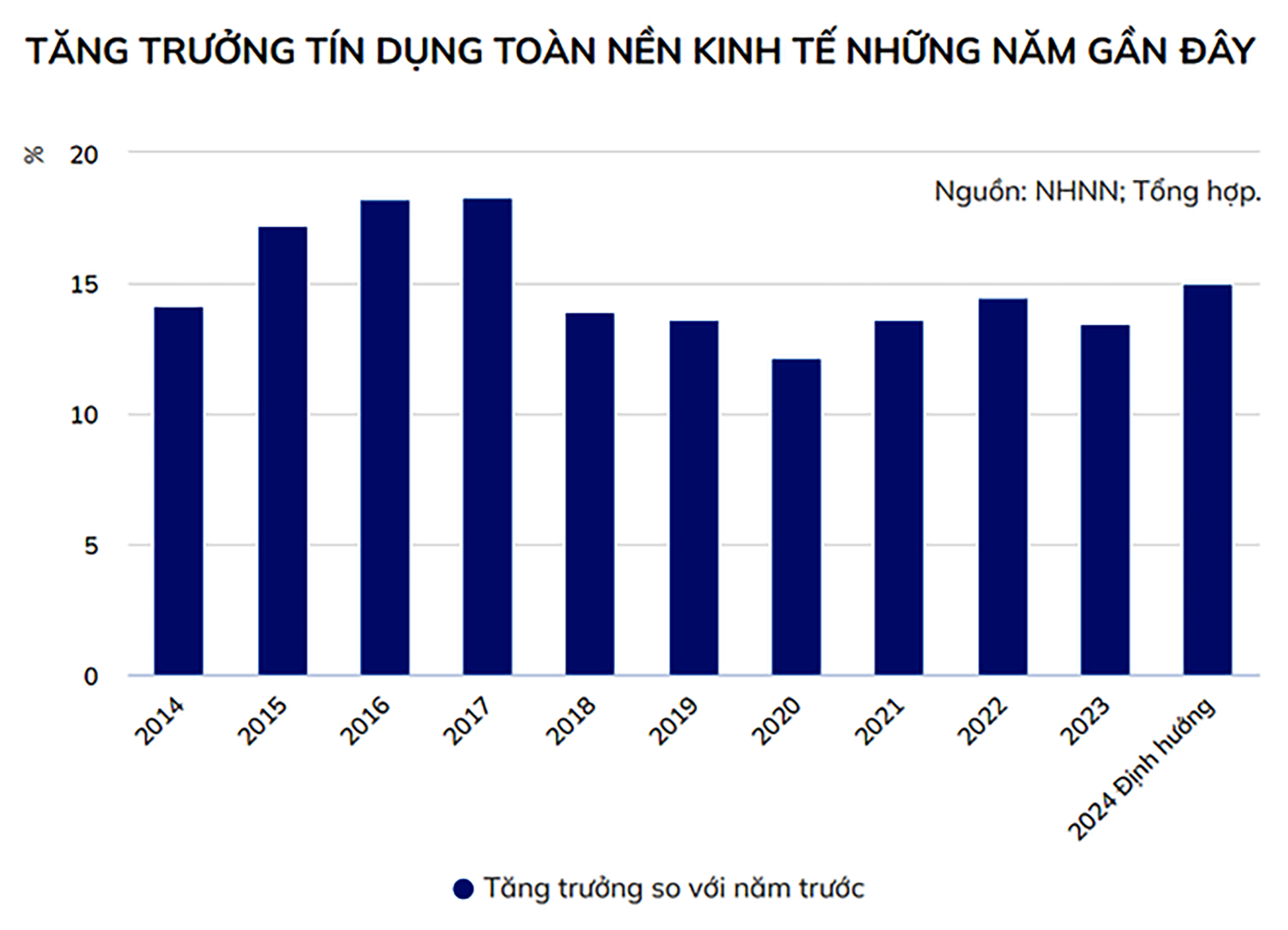

Banks have been assigned an overall credit growth goal for 2024, and they are aggressively addressing the conditions that favor early disbursement. However, access to credit remains a substantial obstacle to businesses.

From the Banking Perspective

To answer these concerns, Mr. Nguyen Dinh Tung, CEO of Orient Commercial Joint Stock Bank (OCB), shared the bank's experience in 2023, a particularly difficult year for credit disbursement. The bank focuses on making things easier for consumers in its strategic division.

"We've classified our customers. For individuals who are still performing well, we are prepared to implement support programs such as interest rate reductions, cost reductions, and even the prompt settlement of additional credit demands. For the struggling client category, the bank continues to restructure old and new debts so that customers may implement new business strategies and repay new loans while still managing existing obligations," Mr. Tung stated.

The bank also uses more flexible options, such as examining credit limit hikes for each bank, resolving loan-to-collateral value ratios if clients have a business plan, and strictly monitoring income streams. Even for customers without collateral, the bank considers alleviating issues through unsecured loans.

Towards General Solutions

Dr. Do Thien Anh Tuan, a lecturer at Fulbright University Vietnam, believes that the economy must constantly rely on four pillars of aggregate demand: household consumption, private investment, government expenditure, and net exports. When these four variables align, the economy may prosper.

Dr. Do Thien Anh Tuan stressed fiscal policy, arguing that increasing family spending is critical. This involves evaluating tax policy. For the private sector, initiatives that improve access to lending capital are particularly important.

Starting January 1, 2024, a 2% VAT reduction strategy will assist raise spending and encourage credit demand, adding to credit growth in 2024.

Furthermore, the anticipation of bespoke packaging would fuel the manufacturing industry. Dao Minh Tu, Deputy Governor of the State Bank of Vietnam (SBV), stated that support packages such as the 15,000 billion VND credit package for aquaculture had been successfully issued. "Business groups believe this is an effective bundle. As a result, if completely distributed, the SBV is prepared to continue assisting," Mr. Tu stated.

In HCM City, Nguyen Duc Lenh, Deputy Director of the SBV's HCMC branch, stated that even in a stable market with low interest rates, providing preferential loan packages is still vital and significant for the bank-business connection program. As a result, this continues and will continue to be a key solution for promoting successful loan disbursement in the banking industry in the area through 2024.