Prospects for the Vietnam steel sector in 2025

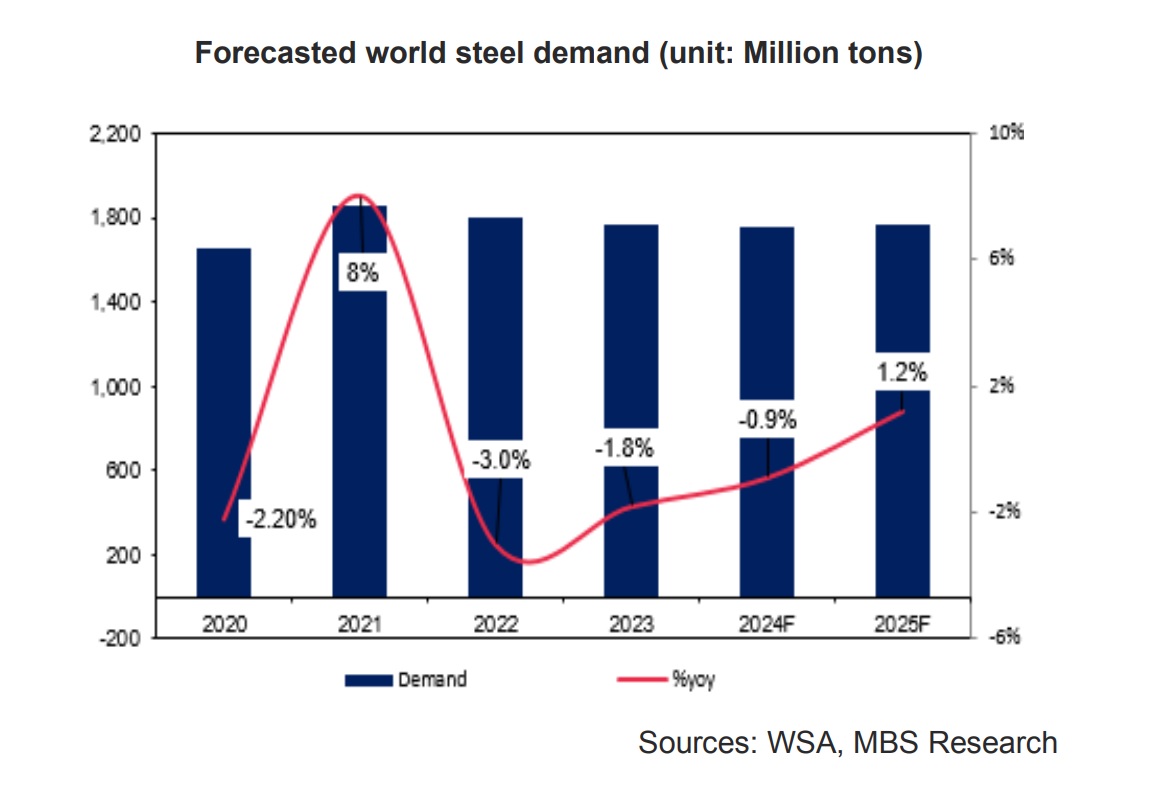

Many analysts expect world steel demand to recover 1.2% yoy in 2025 driven by the growth of India and EU while the supply remains stable due to cut down of China.

Global steel supply and demand

According to the World Steel Association, steel demand fell 0.9% year on year in 2024, owing primarily to a decline in China caused by the real estate crisis. China's consumption is expected to fall by 3% to 883 mt. Furthermore, other major countries, like the United States, Japan, and Korea, experienced negative growth due to the difficulty of the construction sector. India remains a bright area in global steel demand, increasing by 8% to 138 million metric tons.

In 2025, WSA expects that the Chinese real estate crisis will continue to have a negative influence on steel demand, which will fall 1% year on year. Others, such as Japan, Korea, and the United States, benefit from reduced interest rates. India and the EU are predicted to rise by 8% and 4.1%, respectively, mainly to stimulus in construction and manufacturing.

According to WSA, steel supply could remain steady in 2025, with India's production predicted to rise 7% year on year and some developed countries, such as Japan, Korea, and the United States, recovering 1%-2% year on year due to a positive signal in lower interest rates. In contrast, China's production continues to fall 1.5% year on year, as planned by the Chinese government, due to environmental concerns.

Steel price outlook

The main cause of China's steel price decline is oversupply and insufficient demand. The rebar and HRC prices fell to 5-year lows, dropping 24% and 21% YTD, respectively. In terms of demand, the real estate recession has gotten worse despite the government's many stimulus policies. In October 2024, China's home-price downturn deepens to a record 9-year low, falling 5% (more than 4.5% in September).

Le Hai Thanh, analyst at MBS, predicted that the real estate market will be in crisis until the end of 2024 and that the potential for steel prices would be determined by supply when steel mills participated in output cuts. In 2025, the China price could be maintained by lower supply, as the Chinese government plans to stop new coal blast furnaces beginning in Q4/24, reducing the overstock issue.

Unlike China, the potential of VN steel has been recognized due to the positive outlook for real estate. The increase in housing supply and governmental investment has fueled the recovery of rebar. "VN rebar would show good growth from Q4/24, when China's pressure was reduced. As a result of the strong pressure on China steel in 1H24, we estimate that the rebar price will reach an average of 551 USD/ton (-2% year on year). We anticipate that rebar prices will climb by 7% and 8% between 2025 and 2026, reaching 590 USD and 637 USD/ton, respectively," Thanh stated.

Export volume slightly to grow

In 10M24, export volume was 7.1 mt (6% yoy) due to growth in rebar (20% yoy) and HDG (44% yoy), while HRC volume was 2.1 mt (-26% yoy). Despite the increasing volume, the export price fell 17% year on year to 650 USD/ton due to fierce rivalry with China's export product. Furthermore, EU demand has declined significantly in 2024 due to important sectors such as construction (30%) and automation (17%) reporting minus 3% and 4.5% year on year, respectively. Furthermore, the heavy competition from China's exports has had a detrimental influence on export volume.

Thanh predicted that steel export volume would increase moderately in 2025. However, he notes that this could be reduced by the AD tax on HRC products from the EU. According to the European Steel Association (Eurofer), construction and automation are major drivers of demand growth. In more detail, the industry may record a 4% to 3% year-on-year increase due to reduced interest rates that encourage demand. Due to both positive and negative effects on the export market, total sales volume could increase by 8%/5% in 2024-2025. For each segment, HDG is expected to expand the most (35% year on year) in 2024, reaching 3.2 million metric tons.

Despite a minor increase in demand in the EU as a result of the AD tax, VN's export volume may rise from a low basis in 2024 but will not return to the high base of 2021-2022.

Investment approach

MBS prefers top companies, including HPG, HSG, and NKG.

First, HPG benefits from the recovery cycle, which is fueled by robust demand for rebar and HRC. The expansion phase is predicted to begin in 2025, with a good signal from the construction sector. The rise in housing supply and governmental investment would have a positive influence on rebar sales. In terms of HRC volume, MBS anticipated that thanks to the AD tax and the Dung Quat 2 Complex, the volume would increase by 40% year on year to 4.4 million tons.

Rebar and HRC prices are expected to recover 7%/6% in 2025 as a result of decreasing pressure from China exports and strong domestic demand. The gross profit margin (GPM) is expected to increase by 1% to 15.2% as prices rise faster than input materials. So, the net profit (NP) may be 17,995 billion VND (39% year on year). HPG is valued at a lower than average multiple. The forward PB and PE are currently 1.6 and 10.2, respectively (lower than the average in two cycles of 2.2 and 12.5).

Second, HSG benefits from the recovery cycle, which is being driven by strong domestic demand. Domestic growth and the AD tax might boost sales volume by 6% year on year to 2.1 mt. Because of lesser pressure from China exports and robust local demand, HDG prices are expected to rebound 6% year on year in 2025, reaching 984 USD/ton. Gross profit margin (GPM) is expected to increase by 0.4% to 11.2% as prices rise faster than input materials. So, the net profit (NP) may be 869 billion VND (70% year on year). HSG is valued at a lower-than-average multiple. The forward PB and PE are currently at 0.9 and 10.5 (lower than the average across two cycles of 1.2 and 12.0).

Third, NKG benefits from the recovery cycle, which is being driven by strong domestic demand. Domestic growth and the AD tax might boost sales volume by 6% year on year to 2.1 mt. Because of lesser pressure from China exports and robust local demand, HDG prices are expected to rebound 6% year on year in 2025, reaching 984 USD/ton. Gross profit margin (GPM) is expected to increase by 0.4% to 11.2% as prices rise faster than input materials. So, the net profit (NP) may be 869 billion VND (70% year on year). NKG is valued lower than average multiple: The forward PB and PE are currently at 0.9 and 10.5 (lower than the average across two cycles of 1.2 and 12.0).