"Golden opportunity" for property investment

There are always opportunities for intelligent and bold investors during times of crises. And now is an ideal time to invest in real estate.

>> Rental prices for industrial real estate continue to rise

Positive macroenvironmental indications from bank loans and legislative frameworks, as recently released by Resolution 33 and Decree 08/2023, show that the time of "local turmoil" has passed.

For both property developers and investors, the market is entering a period of screening and categorization. Many devs were forced to depart the game and reorganize earlier this year. However, many developers may still "survive" due to strong management and implementation skills.

The period of "local turmoil" has passed

Individual investors can take advantage of this possibility instead of placing money in a bank for 2 - 3 years, with the amount merely equaling the amount in a developer's marketing program. They may purchase a decent product at a reasonable price and generate rapid cash flow.

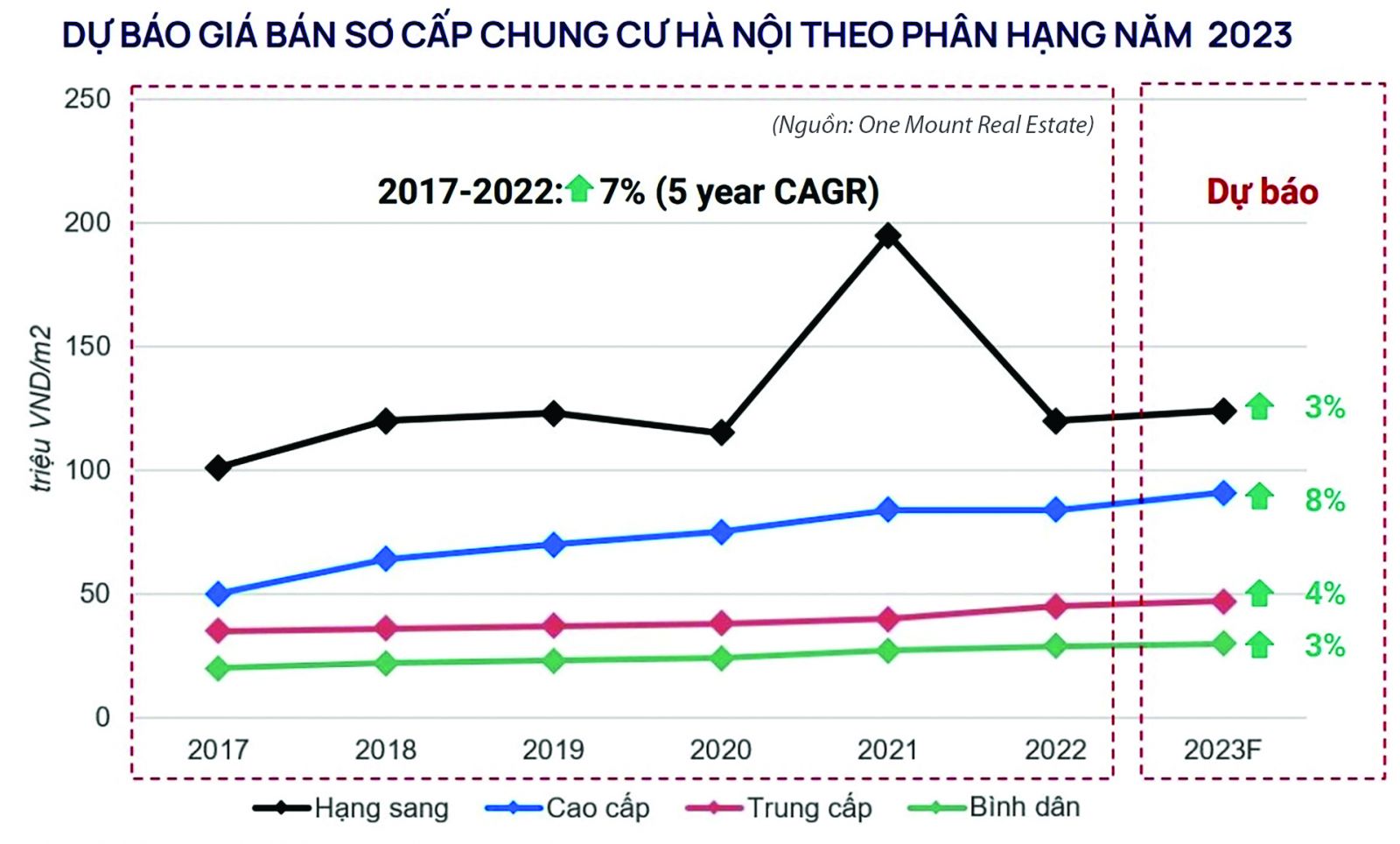

According to an in-depth analysis of the real estate industry conducted by OneHousing's Market Research and Customer Insights Center, capital is still flooding into the sector, but investors are becoming more cautious and focused on real estate types that can provide cash flow. Demand will rise in the next months, but not evenly across segments:

Those who need to transform their house from where they are now want to discover a more contemporary and sufficient location to live. Others have money in the bank and wish to utilize some of it to buy or invest in real estate."

The timing to buy a house

People who used to invest and speculate are now rearranging their financial portfolios and looking for goods that offer instant cash flow. Many investors are increasingly migrating away from houses and land plots and toward flats in order to maximize rental revenues.

.

Those who purchase properties for their children's future (after graduation, marriage, etc.) seek to build assets while simultaneously earning rental income. Developers are currently building excellent support programs. This is why, because they demand a huge number of money, many clients are no longer interested in land items or products that are not backed by interest rates. They solely concentrate on items that are now backed by low-interest rates from reputable developers and powerful institutions. Anyone planning to buy a property should have at least 20-30% of their own money. When the interest rate assistance program expires, their cash flow will be 50% more stable.

>> Efforts to "break the ice", when will the real estate market warm up?

The market also offers many excellent financial solutions to reduce the burden of interest payments for homebuyers. This is the right time for buyers to choose the best project with the best price range and choose the appropriate financial leverage.

Many individuals continue to anticipate the "bottom" of the real estate market. However, the apartment market will not reach a bottom as long as primary prices continue to grow, supply is limit ed, and input costs rise. This section can also create rapid cash flow to fulfill genuine housing demand. When purchasers can choose legally compliant items, create quick cash flow, and select the optimal financial leverage, they are in the best pricing range.

The investing community believes that if there is a profit, they will invest. Products that satisfy society's true requirements while also meeting the wants of the middle class will have a lot of promise at this point. Singapore, Thailand, Hong Kong, and Japan have all shown comparable tendencies to Vietnam.

Positive signals

In terms of the market recovery component, the government has been and continues to be an active participant: Decree 08, Resolution 33 of the Government has established a massive premise in order to "prevent" the domino effect of the market collapse, therefore allowing investors and investors to move forward. Furthermore, policies create a solid basis in terms of institutional and legal structure, as well as capital flow, legal lanes for private investors, price and associated legislation... These are critical aspects in achieving long-term growth.

The finest real estate is the one purchased first.

Currently, the State Bank of Vietnam has cut its policy rates, which is a first step in lowering deposit and lending interest rates. Lowering deposit interest rates implies lower lending interest rates. The interest rate peak is when we find indicators of the real estate crisis. Interest rates are currently "falling," implying that the crisis is already on the other side of the cliff. The market's unfavorable and challenging aspects have passed.

The choice to invest or not should be based on the customer's financial status and whether or not they receive the best assistance from the bank's lending policy. The finest real estate is the one purchased first.

.