Reducing the leverage ratio for stocks under selling pressure

Investors should hold stocks that are on a good growth trend in their portfolios, while considering reducing the leverage ratio for stocks that continue to be under strong selling pressure from the market.

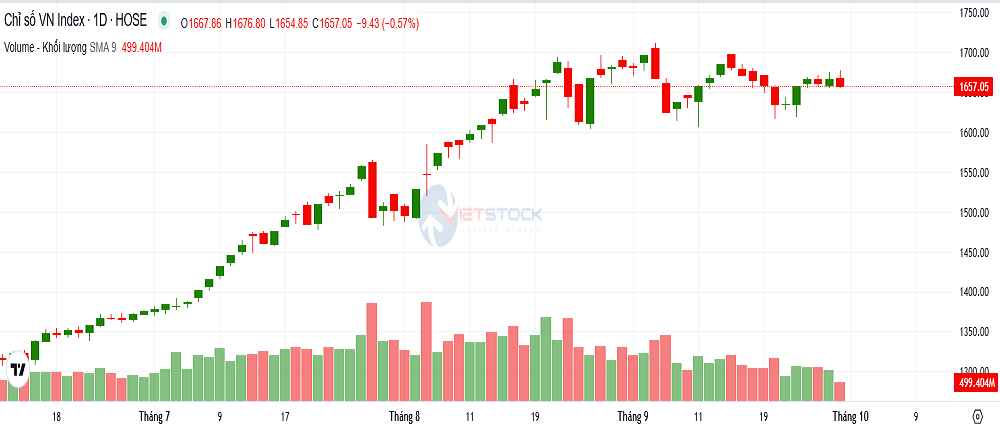

VN-Index fell 0.53% to 1,657,83 with many stocks in downtrend

In the yesterday’s session, the Vietnam’s stock market opened slightly lower than the reference due to continued selling pressure in banking and securities stocks. By mid-session, strong demand from Vingroup stocks helped the general index reverse and regain momentum. In the second half of the morning session, the index fluctuated within a narrow range around 1,660-1,670 points, with cash flow continuing to differentiate between industry groups. The public investment group continued to attract attention, notably VCG (2.71%) and HHV (0.60%).

However, red still dominated with 199 stocks decreasing and 94 stocks increasing. Liquidity increased slightly compared to the previous session, showing short-term profit-taking pressure. At the end of the morning session, VN-Index stopped at 1,668.76 points, up 8.06 points compared to the reference.

The afternoon session's developments were similar to the morning when VN-Index fluctuated within a narrow range around 1,665 points. The strong differentiation in the bluechip group continued to be a negative point, with quite a lot of selling pressure in some large-cap stocks such as FPT, MSN and MWG.

In contrast to the morning session, real estate and public investment stocks in the afternoon session were under strong selling pressure, causing most of them to narrow their gains, even some stocks decreased. The bright spot came from the livestock group with HAG (3.14%), DBC (2.78%) and BAF (1.0%). Foreign investors maintained strong net selling with a total value of VND 749 billion, focusing on SSI, DIG and VNM. At the end of the session, VN-Index closed at 1666.48 points, up 5.78 points (0.35%).

Investors should hold stocks that are on a good growth trend in their portfolios

In this morning, VN-Index fell 0.53% to 1,657,83 with many stocks in downtrend, such as ACB, AAA, ACC, BSI, BSR…

On the hourly chart, RSI and MACD were almost flat, indicating that VN-Index was in the phase of testing demand around the 1,660 point area. However, the CMF indicator was at 0.13 and was pointing down, reflecting that active money flow was still quite cautious in the current situation. The short-term support zone is currently around the MA20 line (equivalent to about 1,650- 1,660 points).

On the daily chart, the RSI indicator continued to point up, indicating that the index was still maintaining an uptrend. However, ADX was still below 25 and had not clearly agreed with the DI line, while active buying money flow was not strong enough to create conviction. Therefore, VN-Index is likely to need more time to accumulate for a more sustainable uptrend.

The Vietnam’s stock market continues to move in the 1,660-1,670 range with cash flow continuing to be strongly differentiated between stock market sectors. Before information about the business results of the third quarter appears in the coming time, VCBS recommends that investors continue to hold stocks that are on a good growth trend in their portfolios, while considering reducing the leverage ratio for stocks that continue to be under strong selling pressure from the market. Some industry groups that can be considered in the coming sessions are banking and agriculture.