Removing obstacles in the corporate bond market

Vietnam corporate bond market remains slow, necessitating more aggressive approaches to 'break the ice' in this market.

The major corporate bond market is less active, as shown by the absence of new issuances from April through the end of May.

Issuances are "frozen"

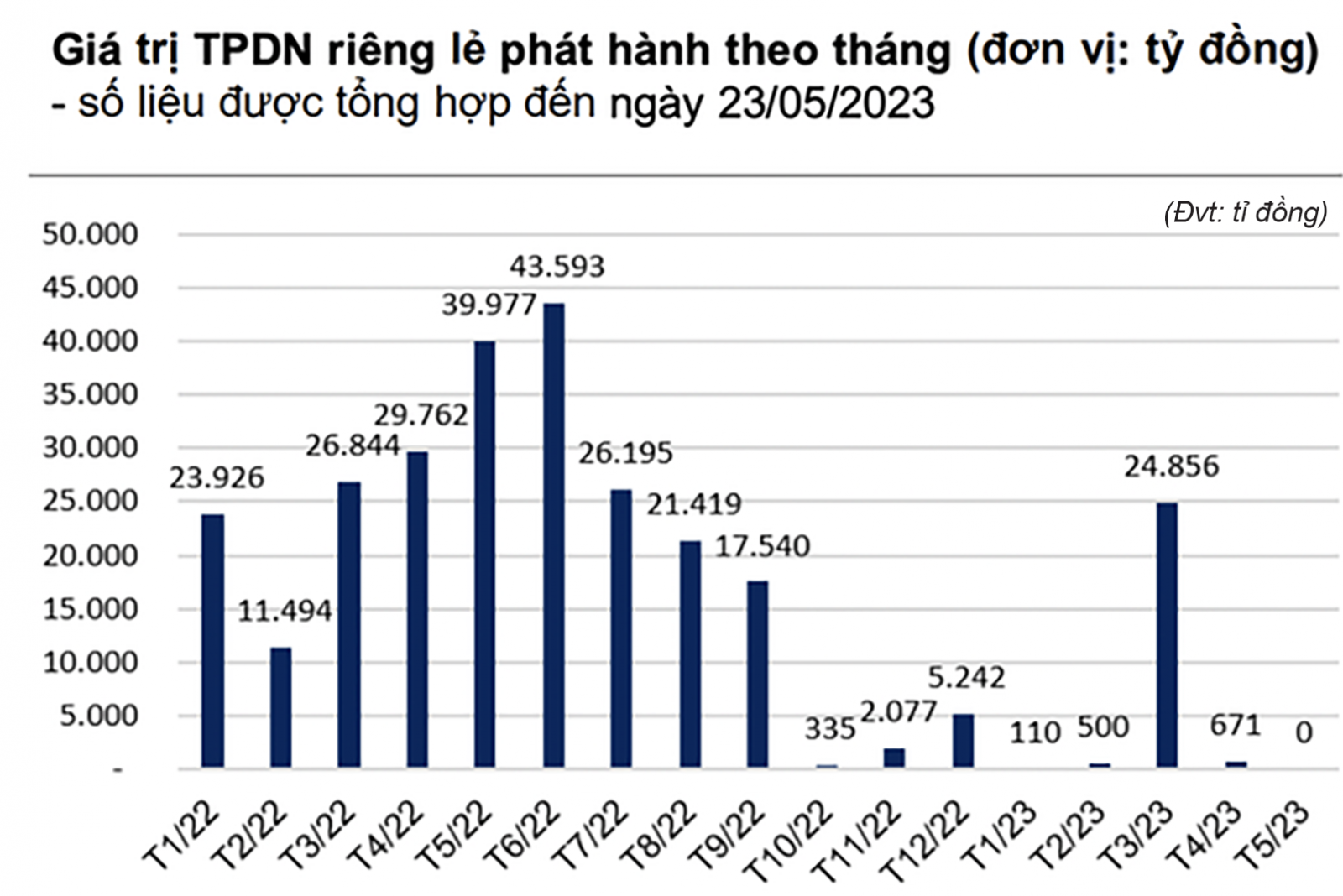

According to information collated by the Vietnam Bond Market Association (VBMA) from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC), no corporate bond issuances were registered in May 2023 as of May 26, 2023. In April, there was one private offering and one public issuance totaling VND 2.671 trillion (equal to 10% of the previous month's total issuance volume).

According to VBMA, the total value of corporate bond issuances recorded from the start of the year until May 26 is VND 31.658 trillion, with seven public issuances valued at VND 5.521 trillion (17% of total issuance value) and 15 private issuances valued at VND 26.137 trillion (83% of total). As a result, with the immediate impact of Decree 08/2023, the majority of new issuances occurred in the second half of March.

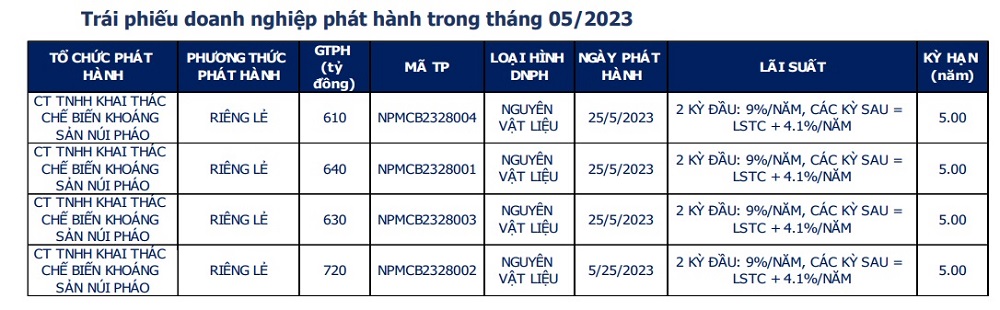

According to the most recent comprehensive report, VBMA has registered four new corporate bond issuances in May 2023, totaling VND 2.600 trillion.

Nui Phao Mining and Processing Company Limited (Masan Hightech Materials) issued all four issuances. The bond tranches have a 5-year duration and an annual interest rate of 9%.

With these four issuances, the total value of corporate bond issuances recorded from the beginning of the year until the end of May 2023 is nearly VND 34.3 trillion, with seven public issuances worth VND 5.521 trillion (16% of total issuance value) and 19 private issuances worth VND 28.737 trillion (84%).

Notably, the four issuances by Nui Phao Mining and Processing firm, a subsidiary of Masan Group, are from a firm recognized for its excellent fundraising capabilities and continuously good ratings by international investors for its payment capacity, allowing it to successfully raise huge amounts of cash.

As a result, especially for large, respectable enterprises or groupings of companies inside an ecosystem partnership, the market has not totally escaped the "ice block" of primary issuance closure.

What are we waiting for?

Nguyen Le Ngoc Hoan, a financial analyst, feels that the major corporate bond market has been "frozen" for the previous two months for the following reasons:

First, an examination of the entire market reveals that the capital absorption capacity of enterprises in general is now poor due to a fall in orders and sluggish consumer demand.

Second, although the manufacturing and business groups require money primarily for operations and short-term capital turnover, project-based industries such as real estate, energy, and infrastructure have enormous and long-term demands.

Except for banks, real estate, energy, and infrastructure corporations have significant capital requirements, particularly for current projects. However, due to this group's low debt repayment capabilities, many bond tranches are delayed in payment, there is no new cash flow, and new projects become "stuck." As a result, corporations are increasingly limit ed in their ability to use existing assets/projects as the foundation for new issuances.

Meanwhile, the market remains cautious, with non-professional investors unprepared for fresh issuances, despite the suspension of the law that "only professional investors can buy bonds."

"In general, difficulties in new issuances and delayed repayment of old debts will worsen and focus on the non-banking group." As a result, the market may have to wait for banks to aggressively restructure their loans, which will move gradually to the capital market. Furthermore, as banks develop frameworks and procedures for determining credit ratings for enterprises, they will be confident in repurchasing bonds," the expert stated.