Rice export prices might rise in 2023

In the first 10 months of 2022, the average price of rice exported was 484 USD per tonne, a decrease of 8.3% from the same period in 2017. However, for a few reasons, it might increase in 2023.

In the first 10 months of 2022, the average price of rice exported was 484 USD per tonne, a decrease of 8.3% from the same period in 2017.

>> Vietnamese rice export showing impressively positive signs

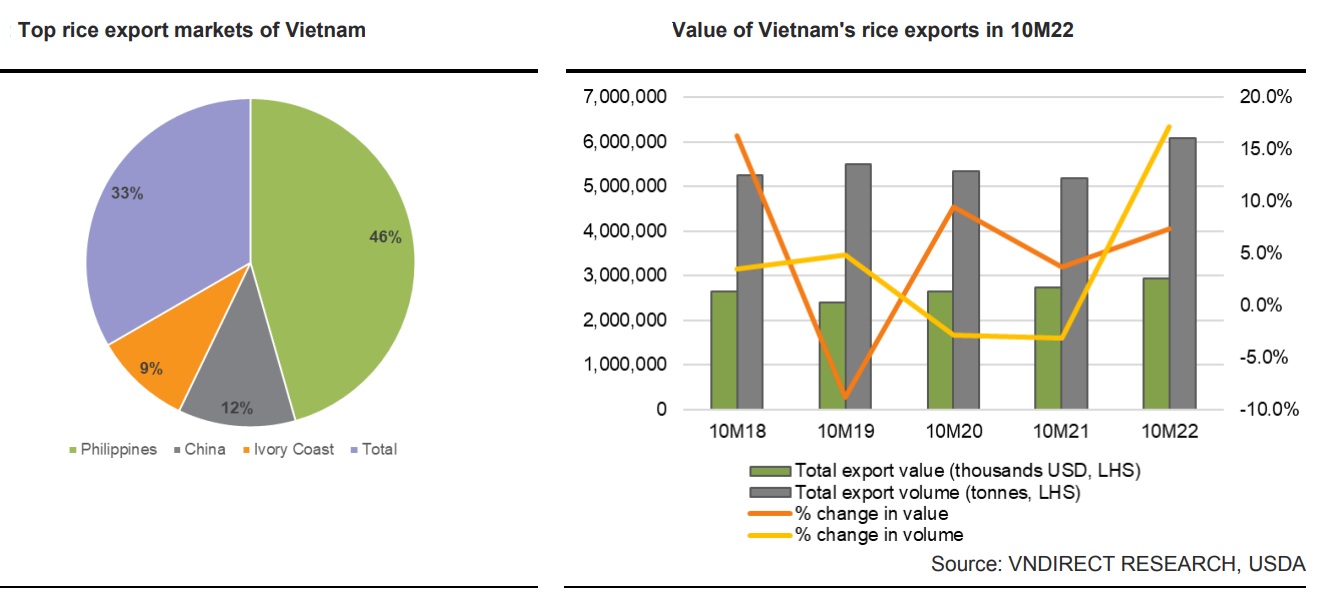

According to the Ministry of Agriculture and Rural Development, 6.07 million tonnes of rice worth 2.94 billion USD were exported in the first ten months of 2022, an increase of 17.2% in volume and 7.4% in value year over year.

With 43.9% of all exports between January and September, the Philippines was the largest importer. It spent 1.14 billion USD on 2.47 million tonnes of Vietnamese rice, an increase of 35.3% and 22.2% from the previous year. Over 71% more export money went to Ivory Coast than at any other time in the previous nine months. The MARD reported that shipments to Ghana saw the biggest decline, falling by over 33%.

Approximately 700,000 tonnes of rice were exported in only the month of October, bringing in 334 million USD. Export prices were the highest since November 2021, ranging between 425 and 430 USD per tonne.

Due to rising rice prices and India's restrictions on rice exports, VNDirect anticipates 2023 to be a good year for the rice industry. Furthermore, due to bad weather in Vietnam's primary export markets, demand for rice imports keeps rising. Philippines is currently Vietnam's top rice client. Due to insufficient inventories for 2023F and a projected decline in rice output as a result of Typhoon Noru's crop damage, their domestic supply is at a low level.

Worldwide rice supplies are in danger as severe weather affects major exporters. The production outlook in 2022–2023 is likely to be affected by the recent bad weather in Asia's top rice exporting nations (such as Patchy rains in India, drought in China, and flood in Bangladesh).

On the other hand, demand for rice is increasing. According to the USDA, China is anticipated to increase rice imports to a record 6 million tonnes in 2022–2023 as a result of production losses. In addition, protectionism is increasing as a result of recent geopolitical conflicts in an effort to maintain food security. In 2023F, the price of rice will continue to rise both globally and in Vietnam due to stable demand and a shrinking supply.

>> Rice prices under upward pressure

According to VNDirect, Vietnam's rice exporters are in a good position to benefit from the upward trend in rice prices. After Thailand and India, Vietnam is the third largest rice exporter in the world. Due to higher duties, Indian rice prices will no longer be competitive, which may cause customers to switch to Thailand and Vietnam.

“Given that LTG is one of the rice distributors for both of the major markets, Europe and China, we think the company will directly profit from rice exports. TAR will profit from China's decreased output and India's export limit ations as a result of the drought. The primary line of business for TAR is rice trading, with exports making up nearly 15% of total revenue. In which China accounts for up to 27% of this company's export revenue and is its primary market for rice.”, said Ms. Ha Thu Hien, analyst at VNDirect.

However, there may be certain risks for Vietnam's rice industry. First off, the lifting of the rice export embargo by India will increase competition for Vietnamese rice and drive down export prices. Second, a higher likelihood of a Neutral phase in 2023F may cause a minor drop in the supply of rice in Vietnam compared to 2022. (less rainfall than La Nina).