ShopeeFood, GrabFood hold sway in Vietnam’s food delivery market

The survey results highlight evolving consumer preferences, increasing platform specialization, and the expanding role of technology in dining behaviors.

ShopeeFood and GrabFood together control over 90% of Vietnam’s online food delivery market, according to separate surveys by NielsenIQ and Decision Lab.

Food delivery services in Vietnam are on the rise. Photo: Khanh Ly/The Hanoi Times

Based on order volume during a seven-day consumer survey in April, NielsenIQ reported that ShopeeFood holds the largest market share at 56%, followed by GrabFood with 36%. BeFood, the delivery arm of Be Group, trails in third place with a tiny share.

A similar Decision Lab survey across Hanoi, Ho Chi Minh City, and Da nang confirmed these findings. In Hanoi, ShopeeFood leads with a 56% market share, while GrabFood tops Ho Chi Minh City with a 50% share.

Together, the two platforms command nearly all orders in Danang. BeFood has a stronger presence in Ho Chi Minh City (11%) than in Hanoi (9%).

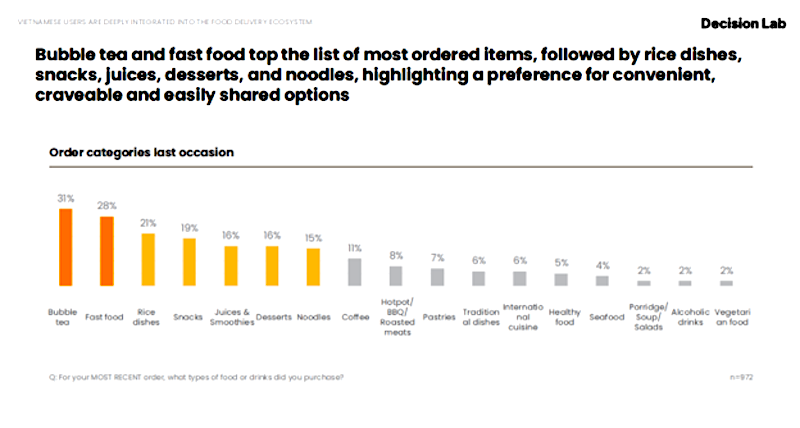

Consumer preferences also vary by platform. ShopeeFood attracts younger users (ages 16-24) with offerings such as bubble tea, snacks, and fast food. GrabFood appeals more to users aged 35 and older, who prefer full meals, seafood, healthy dishes, juices, and coffee.

Screenshot from Decision Lab's survey

"Food delivery has become a habitual service for most Vietnamese consumers, particularly in major urban centers," noted Decision Lab.

Over the past three years, the market has seen intense competition.

In 2023, six platforms were active, including ShopeeFood, GrabFood, BeFood, GoFood, Baemin, and Loship. However, Baemin exited the market in December 2023, followed by GoFood in September 2024. Local player Loship also ceased operations late last year.

Market dynamics may shift again with the arrival of Xanh SM, which launched its food delivery service Xanh SM Ngon in June, partners with over 2,000 vetted restaurants in Hanoi, plans to expand nationwide, and prioritizes food safety by ensuring certified partners deliver meals matching their menu photos.

Meanwhile, ShopeeFood and GrabFood are turning to artificial intelligence (AI) to optimize services for restaurant partners and users.

Grabfood has introduced group ordering, solo dining options, and in-store dining vouchers. ShopeeFood is leveraging AI-powered affiliate marketing and livestreaming features to boost demand.

Nguyen Hoai Anh of ShopeeFood said that the market holds both opportunities and challenges, requiring platforms to constantly innovate, from expanding partnerships to upgrading the customer experience.

"We are accelerating AI adoption to better understand and respond to users' daily food preferences," she added.

According to the 2024 e-Conomy report by Google, Temasek, and Bain & Company, Vietnam’s ride-hailing and food delivery sector reached $4 billion in 2024, up 12% from 2023. It is projected to reach $9 billion by 2030.

Meanwhile, Statista estimates that Vietnam’s food delivery market will reach nearly $2.8 billion this year, growing at an average rate of 9.3% annually to reach $4.4 billion by the end of the decade.