Stock investment strategy: What sectors to invest in?

VCBS recommends that investors select stocks that have successfully consolidated their price base and record an increase in active buying liquidity to increase their proportion or open positions in the coming sessions.

US stocks set a record for the 3rd consecutive session. At the close of trading on September 10, the S&P 500 index increased by 0.85% to 6,587.47 points. This is the third consecutive session that this index has set a new record. The Nasdaq Composite also inched up 0.72% to 22,043 points, marking the fourth session reaching an all-time high. The DJIA index rose by 1.36% to 46,108 points.

Meanwhile, Vietnam’s export in the past 8 months has recorded important achievements, but the real challenges lie in the last months of the year when global economic growth slows down and the new US tariff policy takes effect. Faced with this challenge, the Government, associations and the business community are simultaneously implementing solutions to maintain growth momentum, towards the set target. So, Vietnam’s export is expected to gain positive growth by year-end.

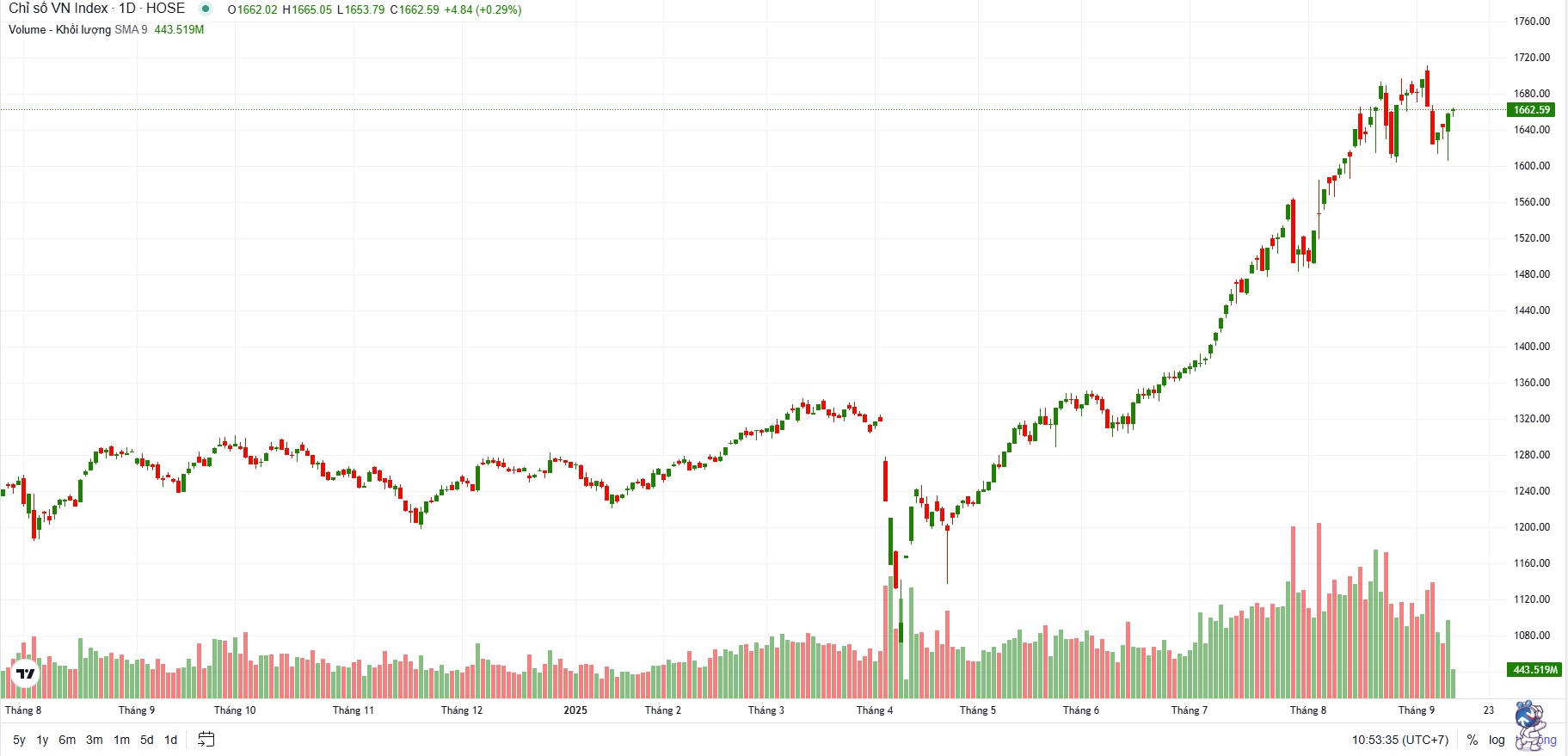

On Vietnam’s stock market, the supply force dominated at the beginning of yesterday’s session, causing the VN-Index to open in red and continuously widen the decline, with the deepest decline near the 1,600 mark. The correction occurred widely with 261 red codes and 74 green codes, and liquidity increased by nearly 43% compared to the previous trading day, showing that cautious sentiment spread across the market. Near the end of the session, the demand force increased again along with green efforts in some large-cap stocks such as VIC, VHM, LPB, and MWG, helping the general index narrow the decline and close the session near the 1630 mark.

In the afternoon session, the selling pressure continued to cool down along with positive demand in Vingroup stocks, the Retail group, and some Banking stocks, creating momentum to help the VN Index reverse and increase points. The recovery in the large-cap group gradually spread to other industry groups in the market with many mid- and small-cap stocks not only narrowing the decline but even increasing impressively such as NKG, VDS, CII, HDG.

Foreign investors are still in a strong net selling trend with a total net value of VND 1,063.36 billion, focusing on selling SSI, MSB, and MWG.

At the end of yesterday's session, VN-Index closed at 1,657.75, up 14.49 points, equivalent to 0.88%.

In today's trading session, VN-Index rose by 0.24% to 1,661, with many shares in uptrend, such as BID, ACB, GAS, MSN, MBB…

Regarding the technical analysis, VN-Index closed yesterday's session close to the session's highest level, showing the support efforts of large-cap stocks. On the daily chart, the general index recorded a recovery after touching the Kijun line, equivalent to the support zone around 1,610, showing that this is an important support zone of the market. The RSI indicator is pointing up and the Kijun line is also pointing up again, reinforcing the upward recovery of the VN-Index.

On the hourly chart, the general index crossed the MA20 line and moved up from the low zone in the RSI and MACD indicators, helping to strengthen the market momentum. In addition, the DI line continued to anchor above the 25 mark, and although there was no consensus with the ADX line, with the -DI line gradually lowering, it can be seen that the VN-Index maintained its recovery trend in the next sessions.

The VN-Index recorded a fluctuating session with an amplitude of more than 50 points along with an impressive recovery accompanied by improved liquidity, led by the recovery momentum of large-cap stocks in the afternoon session. Although the cash flow continued to differentiate—reflected in the different recovery strengths between stock groups in the market—there was also a spread from the large-cap group to many mid- and small-cap stocks. Accordingly, VCBS recommends that investors select stocks that have successfully consolidated their price base and record an increase in active buying liquidity to increase their proportion or open positions in the coming sessions. Some notable sectors include Banking, Retail and Steel.