Strong wave of importing low price steel products: Challenged situation and urgent solutions

The wave of low price steel imports, especially from China and Japan, has been causing domestic steel enterprises to face numerous risks. This import trend not only devalues but also suffocates the market, pushing key industries into serious difficulties.

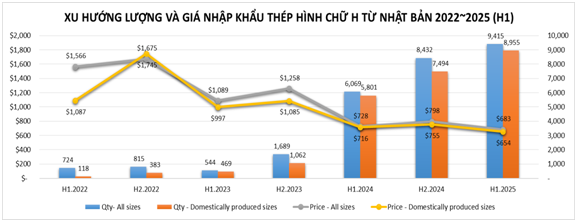

H-shaped steel imported from japan: a nightmare for the domestic steel industry

Currently, the trend of importing H-shaped steel from Japan is increasing rapidly. This situation has caused extremely heavy losses for domestic steel manufacturing and trading enterprises when sales continuously decrease, profits are directly affected, thereby the ability to maintain production of the domestic steel industry is on the brink. In the long run, the domestic market will certainly weaken, thereby collapsing the efforts to maintain the competitiveness of Vietnamese enterprises.

Data shows that from just over a thousand tons in 20222023, the number has skyrocketed to over 6 thousand tons in the first half of 2024, then over 8 thousand tons and reached nearly 9.5 thousand tons in just the first 6 months of 2025 (13 times higher than the same period in 2022). More notably, the imported quantity of domestically produced sizes accounts for 90%95%. In contrast to the sharp increase in quantity, the import price of these steel products has dropped sharply from $1,566/mt on average in the first half of 2022 to $683/mt on average in the first half of 2025 (down 56% as compared to the same period in 2022). Particularly for domestically produced sizes, the import price in the first 6 months of 2025 was also recorded to go down significantly from $1,087/mt to only $654/mt, a decrease of 40% as compared to the same period in 2022.

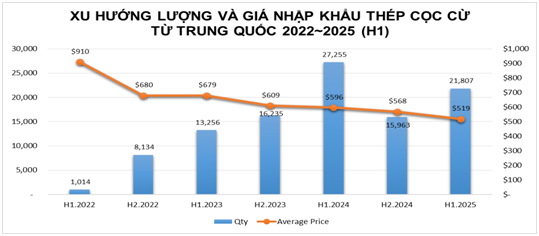

Sheetpiles imported from china: “suffocate” domestic market

In addition to H-shaped steel imported from Japan, sheetpile products imported from China are another major threat that the domestic steel industry is facing. While the domestic production is fully capable of meeting the market demand, the large import of low price Chinese sheetpiles is suffocating the domestic market, causing a decrease in sales, selling prices and profits for the entire industry.

The import volume of sheet piles from this country increased significantly from the second half of 2022 and peaked in the first half of 2024 with more than 27 thousand tons at a sharp price drop to $596/mt. Although the quantity decreased in the second half of the year, it remained high. In the first 6 months of 2025, this figure skyrocketed to more than 21 thousand tons, at an unusually low price of only $519/mt (meaning a 13 times increase in volume but a 43% decrease in price as compared to the same period in 2022).

Facing this situation, steel traders gradually switched to foreign goods, increasing the inventory of domestically produced steel products. While market demand remains gloomy, domestic enterprises are facing heavy losses as the competitive environment gradually becomes unhealthy.

In Vietnam, the domestic steel industry needs more protection measures to avoid being "swallowed up" by low price imports. In particular, strengthening and tightening Trade remedy measures is one of the most urgent solutions. Specifically, 1) Initiating a new investigation into sheetpiles imported from China 2) Maintaining reasonable tariff barriers, not allowing imported steel to put too much pressure on the domestic industry. Trade remedy measures need to be implemented urgently with high determination than ever before to protect the key industries, ensure the strength of the national economy as well as Vietnam's position in the global value chain.

Representative of the domestic steel industry, Posco Yamato Vina Steel JSC affirmed: “The domestic steel industry is facing the risk of being wiped out by the proliferation of low price imported steels. We urgently suggest the Government to take immediate actions, adjust tariff policies and apply more drastic measures to protect domestic production in a healthy competitive environment. This is not only about businesses, but also about the future of the economy and the country's autonomy!”

Facing the dangers from the flow of imported goods, what has the representative of the domestic manufacturing industry - Posco Yamato Vina Steel Joint Stock Company been doing to maintain production? (To be continued)