USD/VND remains stable ahead of FED’s september meeting

Given the State Bank of Vietnam's (SBV) intervention and the approaching month of September, when the Fed is generally expected to announce a rate cut, the USD/VND exchange rate is predicted to stay steady this week.

The SBV has demonstrated flexibility in managing the USD/VND amid mounting international market pressures.

On Monday, August 25, the central exchange rate cooled, with the SBV setting it at 25,291–25,298 VND/USD, down 7 VND from the previous session’s close. This followed a sharp 49 VND increase in the central rate during the prior week.

Last week, the USD/VND came under pressure from both the strengthening DXY and rising short-term USD demand in the domestic market. The SBV raised the central rate to a record high of 25,298 on August 22, while commercial banks’ selling rates frequently touched the SBV’s upper limit.

According to Yuanta Securities Vietnam, the central exchange rate rose 0.19% week-on-week, while Vietcombank’s buying and selling rates climbed 0.27% and 0.26% respectively. The unofficial market rate also increased 0.23% WoW.

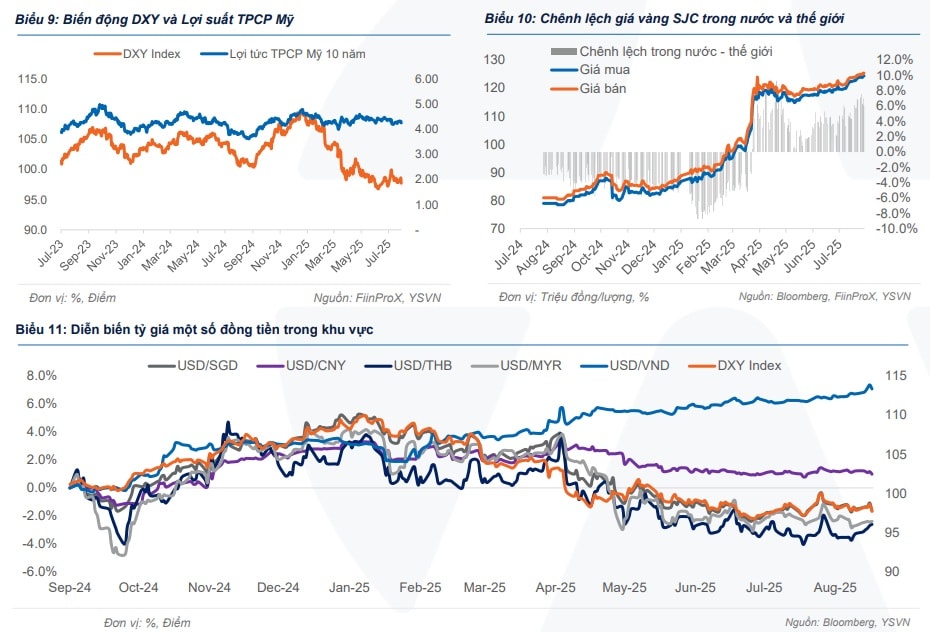

The upward momentum came after minutes from the Fed’s July FOMC meeting showed most officials remained hawkish, still viewing inflation risks as the main concern. This boosted the DXY in most sessions despite higher-than-expected jobless claims.

However, at the Jackson Hole Symposium on August 22, Fed Chair Jerome Powell signaled the possibility of monetary easing, while stressing the need to await further labor and inflation data due next week. This drove the DXY down 0.9% on Friday.

For the week, the DXY fell 0.14% WoW, despite gains in nearly all sessions except Friday. Year-to-date, the USD has dropped 9.9%, while the VND has depreciated 3.6% against the dollar.

Despite the DXY pullback and growing expectations of a Fed rate cut in September, short-term pressures prompted the SBV to announce plans to sell foreign currency through revocable 180-day forward contracts on August 22, applicable on August 25–26. Nguyen The Minh, Head of Analysis at Yuanta Securities Vietnam, said this move eased market sentiment, projecting that the USD/VND will stabilize this week alongside a likely 25 basis-point Fed rate cut in September.

On August 25, the SBV executed these revocable forward sales. Transactions were limited to credit institutions with negative foreign exchange positions, with each bank allowed to purchase enough to bring its FX position back into balance. For contracts worth 100 million USD or more, banks may revoke up to three times; for those under 100 million USD, the maximum is twice.

Analysts noted that the SBV’s provision of revocable FX forwards was intended to set a hard cap on interbank rates around 26,550 VND, while quelling market expectations of further upward adjustments to the trading band, thereby easing short-term exchange rate pressures.

Previously, by supporting liquidity and tolerating a weaker dong near or beyond the band, monetary authorities had signaled a willingness to allow moderate VND depreciation in order to maintain interest rate targets and support economic growth.

Movement of exchange rates

Commenting on the SBV’s intervention, independent analyst Huynh Hoang Phuong observed that the central bank is making strong efforts to maintain an accommodative monetary policy, with continuous net injections via the open market operation (OMO). He emphasized that the 180-day revocable forward sales mainly aim to stabilize sentiment and curb speculation within the banking system—“a light-touch measure” that avoids major disruptions to money supply. For investors, he warned that outright spot USD sales tend to weigh more heavily on system liquidity and the VN-Index, which was evident in the August 25 session.

“The SBV’s intervention is necessary and relatively mild given that the VND has depreciated about 3.x% against the USD. In 2025, the central bank may allow greater depreciation, with a projected ±5% band, so there is still room for the VND to weaken further if needed. However, it will be important to monitor whether the dollar’s rise loses momentum. If depreciation approaches 4.x%, the SBV will likely act more forcefully to manage dong liquidity,” Phuong said.

Overall, in his view, the intervention does not significantly alter system liquidity and the SBV still prioritizes an accommodative policy stance to support growth. He stressed, however, the need to watch whether these light interventions prove effective.

Nguyen Huu Huan, Associate Professor at the University of Economics Ho Chi Minh City (UEH), agreed that the SBV’s move would bolster confidence in FX supply stability. He added that the combination of SBV intervention and dovish signals from the Fed should ease pressure on the exchange rate, giving Vietnam more room to maintain loose monetary policy in support of economic growth.